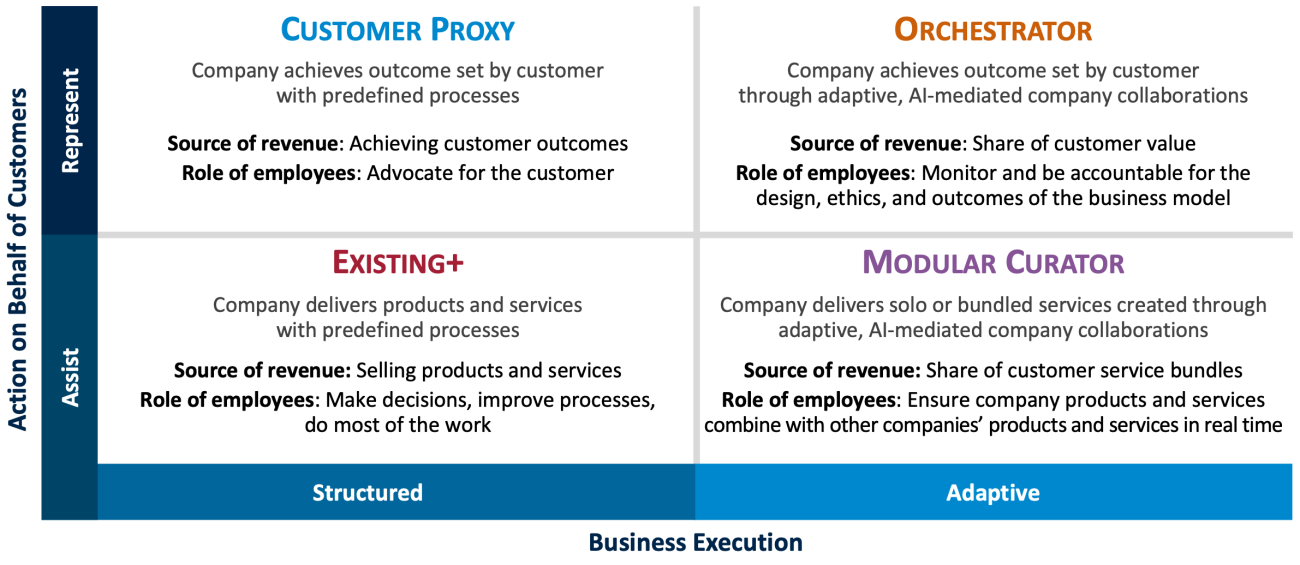

Given the speed with which AI is developing and the opportunities it offers to reinvent companies, we are sharing our predictions of how business models—how companies make money—will evolve over the next five-plus years. We started this work by analyzing MIT CISR studies from 2013 to 2025 (with data from 2,378 companies) on how business models have evolved.[foot]MIT CISR collected business model data from companies in 2013 (101 companies in one survey, 93 in another), 2019 (1,311 companies), 2022 (721 companies), and 2025 (152 companies), each time using the same questions and placing companies on MIT CISR’s Digital Business Models framework, described in Peter Weill and Stephanie L. Woerner, What’s Your Digital Business Model?: Six Questions To Help You Build the Next-Generation Enterprise (Harvard Business Review Press, 2018). The methodology places each company into one business model, but companies can operate in multiple business models, as our case vignettes and interviews show. In 2025, to contemplate business models five years out and beyond, we convened a group of four researchers (including a former CIO) to imagine how the key dimensions differentiating business models will evolve with the rise of advanced AI (e.g., generative AI, agentic AI, robotic systems) and formulate a new framework. We then tested the framework by presenting and discussing it in a series of senior executive meetings.[/foot] For example, the percentage of companies in our research that lead or participate in a digital ecosystem has increased from 30 percent in 2013 to 81 percent in 2025, with commensurate increases in revenue growth and net profit. This dramatic shift illustrates how in just twelve years digital technologies have revamped business models. We expect the next decade will see an even more dramatic change as companies develop AI-driven, real-time business models.

In this briefing we describe how business models have developed over the last twelve years and share our business model framework for the AI era. We then illustrate how companies are navigating these changes with a case study of One New Zealand.