A 2017 survey conducted by MIT Sloan Management Review found that higher levels of data sharing with customers, suppliers, and competitors are associated with higher levels of innovation.[foot]Sam Ransbotham and David Kiron, “Analytics as a Source of Business Innovation,” MIT Sloan Management Review, February 2017, https://sloanreview.mit.edu/projects/analytics-as-a-source-of-business-innovation.[/foot] MIT CISR research finds that simply sharing data in old ways does not pay off. Instead, companies must share new data in new ways to realize the full value potential of digital opportunities.

Historically, companies have shared minimal data—and only when it was required—to execute a transaction, solve a well-defined problem, or comply with regulation. They engaged in data sharing 1.0: sharing transactional data assets and capabilities to enable or preserve an existing value proposition.

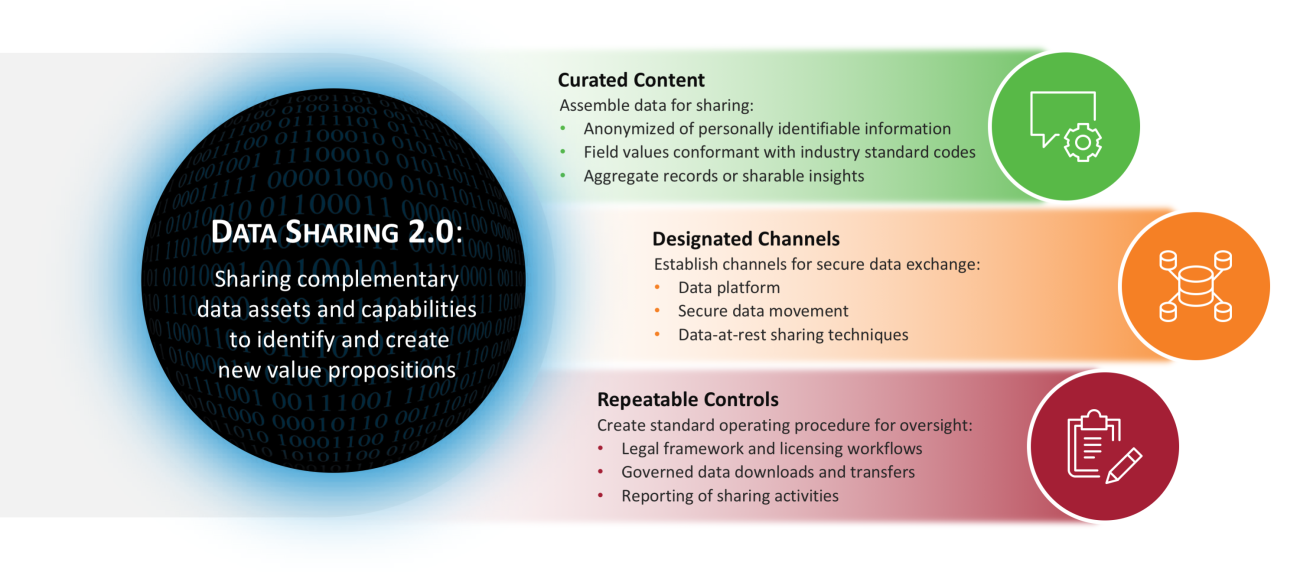

Today, companies are beginning to appreciate data sharing as an opportunity rather than an obligation, opening doors for new value creation. Companies that sell products through platform marketplaces see opportunity in data about the characteristics and behaviors of all platform consumers, including those who looked at their products but did not buy them. Companies that manufacture sensored products see opportunity in data about how and why their customers are using the products—and how customers are making or saving money from that use. Companies that amass rich data assets that reflect customer journeys, supply chain activities, and manufacturing operations see opportunity in start-ups, crowds, and partners who can contribute analytics, skills, leading-edge tech, and outside-the-box thinking to help solve hard problems and search for blue ocean ideas. In order to exploit these opportunities, companies need to engage in data sharing 2.0: sharing complementary data assets and capabilities to create new value propositions.

For the past three years, MIT CISR has investigated interorganizational data sharing at twenty-three distinct organizations.[foot]The research is based on 24 interviews with executives representing 23 companies, conducted from 2019–2020. The analysis also draws on the June 2018 MIT CISR Data Research Advisory Board discussion; research on information businesses led by Barbara Wixom; and research on digital partnering and on value in digital business led by Ina Sebastian.[/foot] We explored why and how companies share data, and how data sharing activities contribute to value and innovation from digital initiatives. This briefing illustrates several data sharing 2.0 use cases from the research, and describes three sets of data sharing practices that position companies to fully exploit digital opportunities.