Advancing the Internal Platform Design with the Digital Backbone

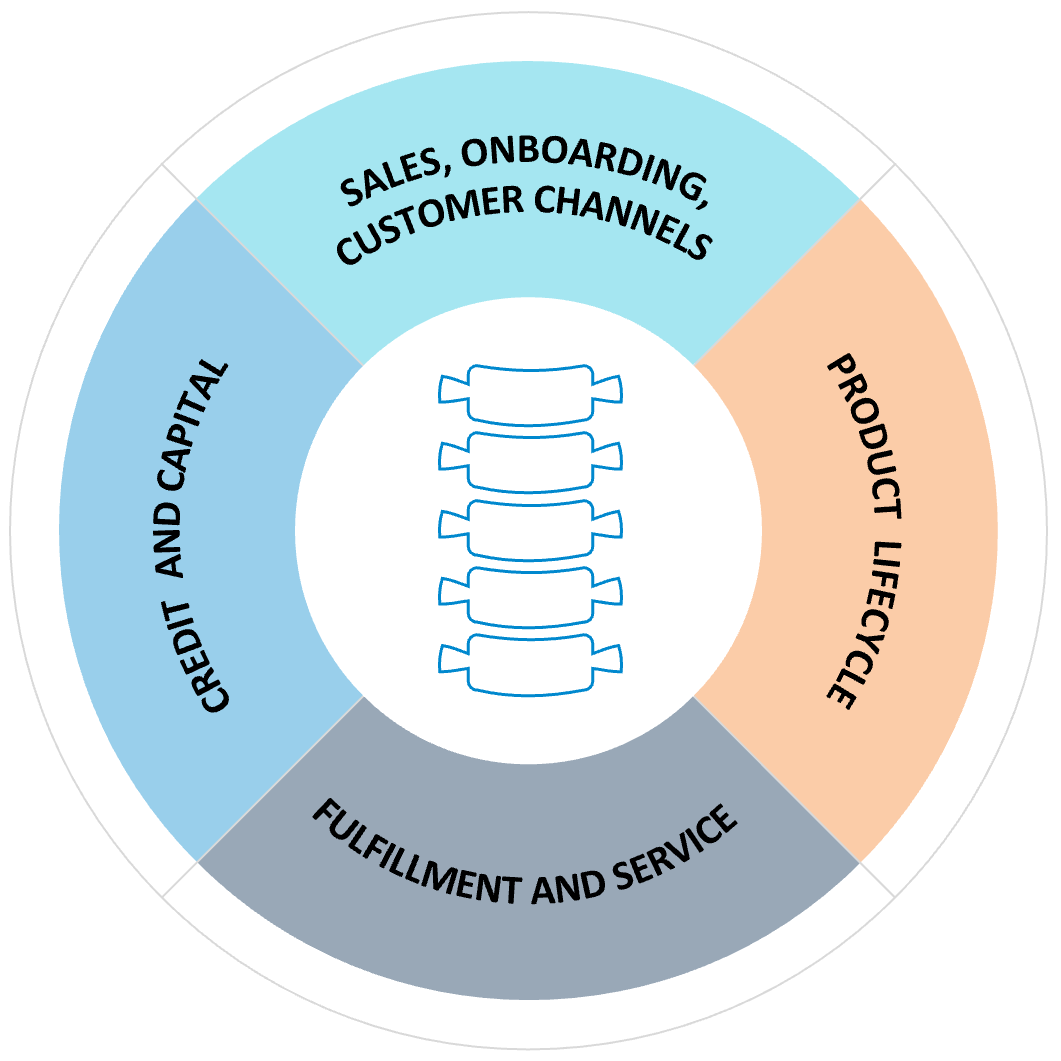

A key goal for the second phase of the digital business transformation was to simplify and connect platforms and data to enhance customer experience, decision-making, and automation, and to enable new customer offerings. ANZ Institutional leaders developed the concept of the division’s Digital Backbone (see the figure)—a technological “spine” of connected platforms, with each platform acting as a vertebra producing and consuming standardized data, contributing to ANZ Institutional’s growing data ecosystem. The concept helped to effectively communicate across the organization the platform design and the business benefits from becoming real-time producers and consumers of data products.[foot]Mark Whelan, “A Digital Backbone for our Global Network,” bluenotes, Australia and New Zealand Banking Group Limited, September 11, 2023, https://www.anz.com.au/bluenotes/2023/09/anz-whelan-payments-institutional/.[/foot] In 2021, after laying the groundwork, the leaders launched the Digital Backbone as a business-led, technology-enabled platform capability. All new business initiatives had to connect to the Digital Backbone and meet three core requirements: (1) produce data, (2) make that data available internally at scale, and (3) use a common customer identifier.

The first Digital Backbone use case, launched in 2024, transformed lending, a critical service that had been very federated (i.e., decentralized across different businesses and geographies that managed their own lending processes). By connecting its platforms supporting onboarding and Know Your Customer (identity verification process), loans processing, and credit limits, ANZ Institutional transitioned from batch-based lending to real-time lending across all geographies. By integrating data across these platforms in real time, ANZ Institutional enhanced the customer experience in lending by streamlining the loan origination process and eliminating repetitive data entry. Automatically populating onboarding data into credit and loan systems reduced manual input by 70 percent, reducing loan processing time and cost while lowering operational and compliance risks.

Today, the Digital Backbone underpins current and forthcoming digital business services including wholesale credit, digital assets, and foreign exchange. ANZ Institutional is continuously improving the Digital Backbone, enabling faster development cycles, reduced integration costs, and richer, more connected data. In 2024, the division implemented a new data analytics platform, which is connected to the Digital Backbone. This was established to provide real-time analytics for the Institutional division’s businesses, with connections to a scalable, multimodal AI capability (maintained in Amazon Web Services, with access to third-party large language models) to enable exploration of new capabilities. For example, CIO Peter Barrass and his team improved the accuracy of data extraction in the financial spreading process (the collection of data from financial documents for analysis), which had been 60 to 70 percent using machine learning but improved to 95 percent using generative AI provided by the connected AI capability.

What’s next for ANZ Institutional will include becoming more of a real-time business[foot]For more on real-time business, see P. Weill, E. van den Berg, J. Birnbaum, M. de Planta. “What’s Next: Top Performers are Becoming Real-Time Businesses,” MIT CISR Research Briefing, Vol. XXIV, No. 8, August 2024, https://cisr.mit.edu/publication/2024_0801_RealTimeBusiness_WeillvanderBergBirnbaumdePlanta.[/foot]: