While most companies have not yet completed their digitally enabled business transformations, what’s next for leading companies is to operate more in real time. Real-time businesses are those that can respond immediately to opportunities and challenges by executing key business processes through automated digitized operations and employee-made data-driven decisions, supported by governance and risk guardrails.

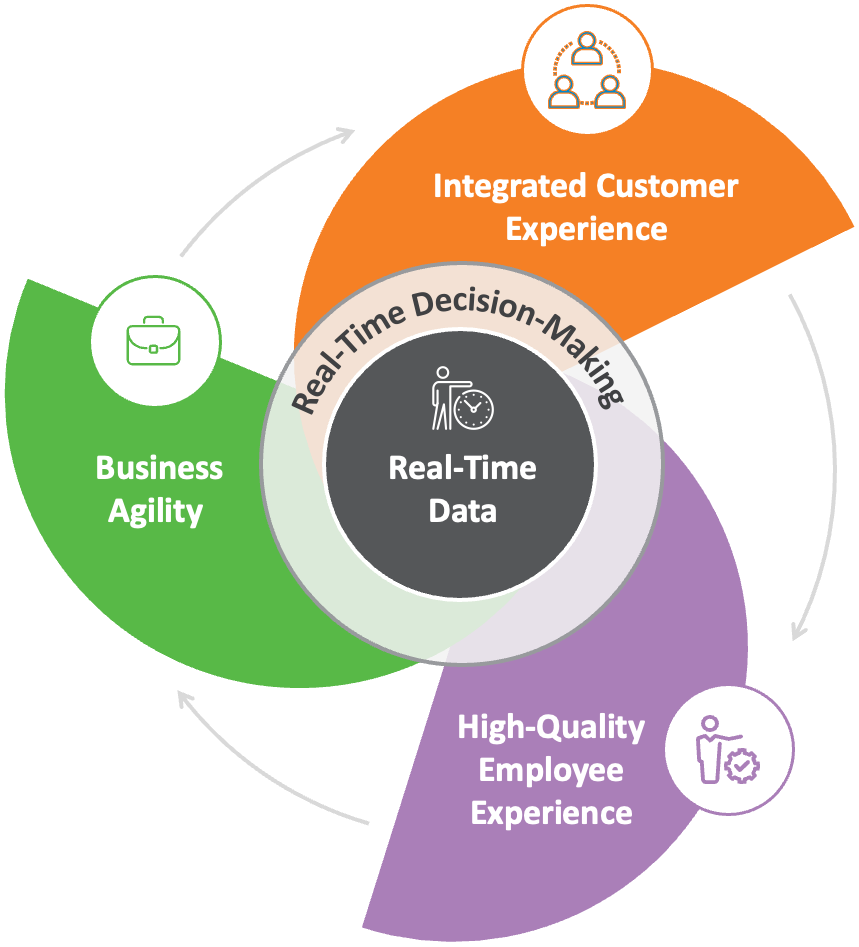

In a study with Insight Partners, we found that companies operating in the top quartile versus the bottom quartile of “real-time-ness” had more than 50 percent higher revenue growth and net margins—a huge premium.[foot]Insight Partners (https://www.insightpartners.com/) and Peter Weill of MIT CISR collaborated in 2023 on a study of real-time businesses, administering a survey of 259 global companies and conducting interviews at 4 companies. Respondents were all CxOs. All the financial results reported were adjusted for industry and statistically significant (p<0.01). Respondents assessed the extent of their company’s “real-time-ness” with a single measure. Respondents self-reported performance metrics including revenue growth and net margin. 50 organizations in the study were publicly traded, and we collected publicly reported net margin and revenue growth for them. The correlations between self-reported and publicly reported performance were over 0.5 and statistically significant at p<0.01, so the analyses used the self-reported financial performance metrics. The Insight Partners research team in 2023 included Maxime de Planta, Daniel Prior, and Elizabeth van den Berg.[/foot] The top-quartile companies automated processes and enabled fast decisions by employees at all levels using trusted and easily accessible data. Real-time decision-making enables digital customer journeys that are more seamless, empowered employee experiences, and increased business agility.

Operating increasingly in real-time helps companies sense and respond to changes in an increasingly volatile business environment. There is no longer time to pass decisions up and down the traditional business hierarchy. This briefing describes what it takes to become a real-time business (RTB) and illustrates the journey with a case study of United Airlines.