Large established organizations allocate on average US$80 million—approximately 2 percent of annual revenue—to their data budgets, according to a recent MIT CISR survey.[foot]This briefing reflects findings from the 2024 MIT CISR Data Monetization: Generating Financial Returns from Data and Analytics Survey (N=349). The survey was distributed globally from August 2023 to August 2024 to senior executives possessing an understanding of their organization’s enterprise-level data activities and outcomes. The reported average data budget of US$80 million applies to organizations in the survey with revenues of at least US$3 billion (40 percent). Generally this briefing reports insights from across organizations in the survey, including those with revenues of at least US$3 billion and those with revenues between US$500 million and US$3 billion (23 percent) and under $500 million (37 percent).[/foot] Yet while some organizations struggle to recoup data investments, others achieve returns that far exceed their initial outlays. A key factor in these disparities is the organization’s chosen data monetization strategy: a high-level plan that communicates how the organization will improve its bottom line using its data assets.

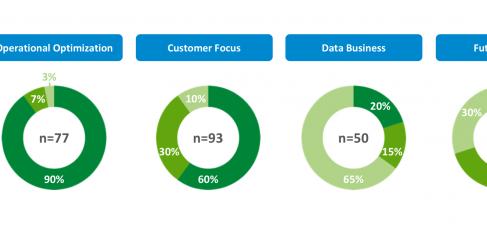

MIT CISR research has identified four data monetization strategies, each of which reflects a distinct portfolio of initiatives that focus on data monetization approaches for improving (optimizing internal processes and decisions), wrapping (delivering a product enhancement that customers value), and selling (developing new revenue-generating information solutions). These strategies are:

- Operational optimization: This relies on streamlining work tasks and eliminating inefficiencies, primarily from improving initiatives.

- Customer focus: This relies on delighting customers and serving them cost efficiently, using a mix of wrapping and improving initiatives.

- Information business: This relies on leveraging data assets to solve problems for other organizations or consumer markets, using selling initiatives to produce information offerings and wrapping initiatives to sustain the sales of those offerings.

- Future ready: This enables and encourages the use of improving, wrapping, and selling initiatives, as needed, to improve customer experience while simplifying operations and generating novel business models and revenue streams.

Yet while these strategies help to guide organizations’ investments in data initiatives, our research shows that organizations experience vastly different levels of monetization returns—even when following the same strategy (see table 1). The organizations that achieve the strongest returns in relation to their budgets are those that demonstrate high data monetization impact, which we define as the extent to which an organization’s data initiatives help the organization realize its strategic business outcomes.[foot]To determine data monetization impact, we asked respondents to report the extent to which their organization’s data monetization initiatives (1) contributed to overall revenues, (2) reduced operating expenses, (3) enabled changes to the business model, and (4) provided a competitive advantage. These are four outcomes that organizations typically seek to achieve by monetizing data, and that statistically correlate strongly with financial and non-financial measures of firm performance.[/foot]

What distinguishes high-impact organizations is their ability to execute their chosen strategies effectively, by adopting strategy-specific practices that translate their aspirations into results. This briefing explores these practices and provides guidance for leaders looking to maximize their data monetization returns.