Data investments have skyrocketed in recent years as companies build new data capabilities or modernize existing ones to advance their digital transformation efforts. It’s unclear, however, how these investments are paying off. Few companies we research formally isolate, measure, and track returns from data initiatives—and it’s hard for most companies to feel confident about their investment decisions unless they do this. MIT CISR research identified that one way to achieve data investment confidence is to pursue a clear data monetization strategy.[foot]This briefing reflects findings from the 2018 MIT CISR survey Data Monetization: Generating Financial Returns from Data and Analytics, N=315. The survey was distributed from April to August 2018 to senior executives possessing an understanding of their company’s enterprise-level data activities and outcomes. The briefing also reflects findings from years of data monetization case studies and interviews.[/foot] It is particularly important to achieve such confidence right now, with COVID-19 upending our world.

During a Crisis, Let Data Monetization Help Your Bottom Line

Abstract

In times of severe disruption, companies need a compelling pursuit to capture organizational attention and mobilize resources. MIT CISR research identified four data monetization strategies with potential to pay off: operational optimization, customer focus, data business, and future ready. Each strategy reflects a clear business priority and generates a unique mix of cost reduction, sales increase, and direct revenues outcomes. We urge business leaders to choose the data monetization strategy that is most feasible, aligned with, and promises to be most lucrative considering their company’s business model, strategic intent, and capabilities.

Although the global economy is frozen, companies can still find ways to directly or indirectly convert data and analytics into money, a process MIT CISR calls data monetization.

The coronavirus crisis forces business leaders to step forward and execute on new opportunities, while also stepping back to evaluate what activities to curtail in light of limited resources. Although the global economy is frozen, companies can still find ways to directly or indirectly convert data and analytics into money, a process MIT CISR calls data monetization. Companies monetize by improving processes, wrapping analytics around products, and selling information solutions,[foot]Findings from the 2018 MIT CISR Data Monetization survey showed that companies with high levels of five data monetization capabilities—(1) data asset curation, (2) data factory platform, (3) data science techniques and talent, (4) customer understanding, and (5) acceptable data use—report better monetization outcomes: cost reduction, sales increase, and direct revenue generation. See B. H. Wixom and K. Farrell, “Building Data Monetization Capabilities that Pay Off,” MIT Sloan CISR Research Briefing, Vol. XIX, No. 11, November 2019, https://cisr.mit.edu/publication/2019_1101_DataMonCapsPersist_WixomFarrell.[/foot] and the crisis compels leaders to mobilize attention and resources on monetization activities that offset slowdowns in traditional money-making parts of the business. For example, with a surge in call center volume, it’s time to get lean by mobilizing data to reengineer outdated product delivery activities; if the lights are off in stores, it’s time to use analytics to make mobile apps more useful and appealing; if the company generates data that could help others anticipate supply chain needs, it’s time to explore selling information solutions.

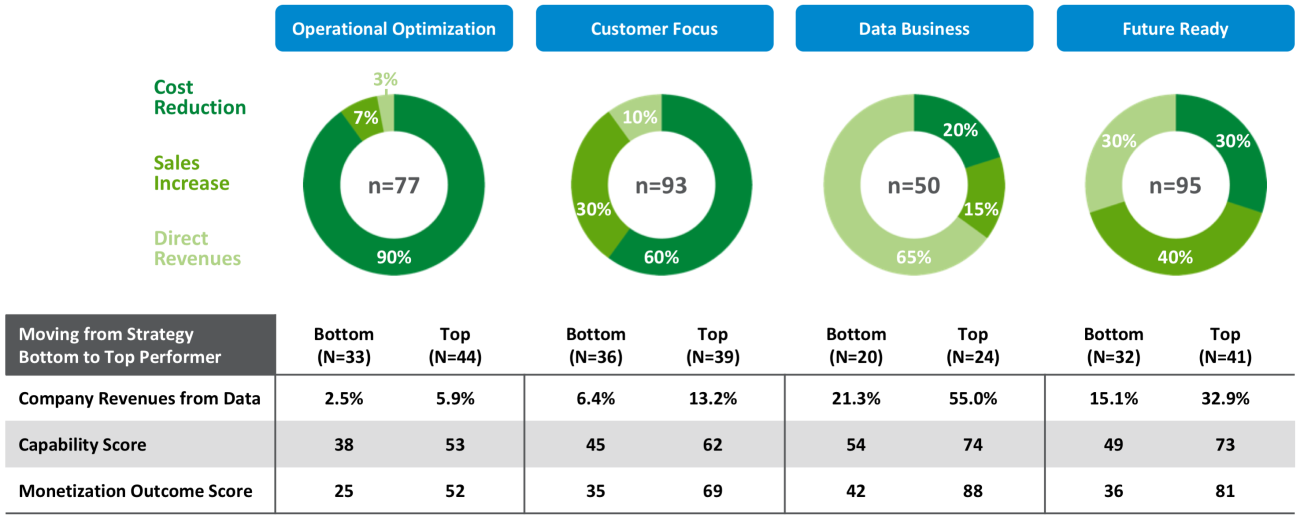

MIT CISR research identified four data monetization strategies with potential to pay off;[foot]The 2018 MIT CISR Data Monetization survey (N=315). Responses were clustered based on monetization outcomes composition, using k-medoids clustering. To determine monetization performance, sample was split into low-performing and high-performing companies based on self-reports of an aggregated score of cost reduction, sales increase, and revenue generation. The splits were formed by removing responses that scored between bottom and top scores such to create a gap while preserving statistical testing properties. Operational Optimization (top N=44/bottom N=33), Customer Focus (top N=39/bottom N=36), Data Business (top N=24, bottom N=20), and Future Ready (top N=41/bottom N=32). Comparison groups’ means were significantly different using t-tests (p<.05).[/foot] each strategy reflects a business priority and leverages different data monetization approaches to produce a portfolio of cost reduction, sales increase, and direct revenue generation outcomes (see figure 1). Amidst this time of intense stress and change, these strategies each offer a way in which business leaders can articulate exactly how and why data investments pay off. We urge leaders to consider the following strategies and choose one to help the company reap critical financial returns.

Figure 1: Data Monetization Strategy Characteristics by Top and Bottom Performers

MIT CISR 2018 Data Monetization survey (N=315). Responses were clustered based on monetization outcomes composition (cost reduction, sales increase, and direct revenue generation), using k-medoids clustering. Each ring is broken into outcome percentages comprising that strategy. Responses in each strategy divided into top and bottom performers based on aggregated monetization outcomes. Table shows (1) average contribution of revenues from data to overall firm revenues in each strategy for bottom and top performers, (2) aggregated and scaled (0 to 100) capabilities score of five monetization capabilities, and (3) aggregated and scaled (0 to 100) data monetization outcome score. Differences in comparison groups’ score means were significantly different using t-tests (p<.05).

Strategy 1: Operational Optimization

When a company uses real-time dashboards, predictive alerts, automated workflow, and product sensor data to help employees perform work tasks cheaper, better, faster—or differently, its data monetization strategy is operational optimization. Twenty-four percent of companies pursue this strategy and generate, on average, returns that represent 4.4 percent of overall firm revenues. Operational optimization works well for companies with (1) an operating model that can scale process efficiencies across franchises, production lines, or customer touchpoints or (2) reengineering aspirations. Forty percent of heavy-asset companies and thirty-six percent of government and healthcare organizations pursue this strategy.[foot]The 2018 MIT CISR Data Monetization survey (N=315). Companies grouped into Finance (N=75), Technology (N=55), Heavy Asset (N=48), Public Health (N=33), Retail (N=20), and Other (N=81) based on survey responses. In each strategy section, industry percentages correspond to the percent of industry present in the cluster.[/foot]

Top performers using an operational optimization strategy achieve 112 percent greater data monetization outcomes than their bottom-performing counterparts, leveraging monetization capabilities that are forty-one percent better; they have 3.4 percentage points more of revenues from data as part of overall company revenues than bottom performers. Three things set these companies apart: First, they prioritize data monetization capabilities specific to improving and make process owners accountable for clear operational results. Second, they approach operational optimization with an innovative reengineering mindset, prepared to find ways to automate or eliminate the status quo. Finally, they work to improve processes that touch and matter most to customers, which as a consequence of achieving operational goals such as improved product quality and faster product delivery pleases customers and leads to increased sales.

Strategy 2: Customer Focus

Companies that pursue a customer focus data monetization strategy use analytics to help customers better acquire, use, and create value from core offerings. These companies are digitally connected with customers through an app or website or the product itself, and they continually experiment with and iteratively hone analytics features and experiences with the aim of raising a customer’s willingness to pay. Thirty percent of companies pursue this strategy and, on average, returns represent 8.8 percent of overall firm revenues. Customer focus is a great strategy choice for companies with a business model that requires delighting customers or distinguishing the company’s products in competitive markets; in our research, sixty percent of retailers, forty percent of heavy-asset firms, and thirty-three percent of finance companies reported having this strategy.

Top performers pursuing a customer focus strategy achieve ninety-five percent greater data monetization outcomes than their bottom-performing counterparts, leveraging monetization capabilities that are thirty-eight percent better; they have 6.8 percentage points more of revenues from data as part of overall company revenues than bottom performers. Three things set these companies apart: First, they prioritize data monetization capabilities specific to wrapping, and hold product owners accountable for sales metrics such as increased wallet share, market share, retention, and price. Second, they design features and experiences that anticipate, advise, adapt, and act in ways that delight customers; and they draw on activities that improve to lower the cost to serve. Finally, they establish market-ready platforms that can deliver high-quality analytics at service levels consistent with those of the core offering.

The four data monetization strategies each reflect a business priority and leverages different data monetization approaches to achieve cost reduction, sales increase, and direct revenue generation outcomes.

Strategy 3: Data Business

Companies that seek to generate direct revenues from data sets, insights, or analytics-based services pursue a data business strategy. Today, all types of companies can do this—consider manufacturers that sell maintenance solutions, transportation companies that sell mobility services, and insurers that sell home monitoring. Sixteen percent of companies pursue data business monetization strategies and generate, on average, returns that represent forty-two percent of overall firm revenues. The technical requirements and organizational commitment to deliver information as a product are intense; companies like Experian, Bloomberg, and comScore demonstrate that data businesses require industrialized processes, relentless innovation, and deep marketplace understanding in order to remain viable over time. Only the technology industry has a sizable number of companies—27 percent—that pursue this strategy.

Top performers with a data business strategy achieve 107 percent greater data monetization outcomes than bottom performers, with capability scores that are 37 percent higher; they have 33.7 percentage points more of revenues from data as part of overall company revenues than bottom performers. Three things set these companies apart: First, they prioritize data monetization capabilities specific to selling, and make leaders who have experience in deploying informational offerings accountable for realistic profit and loss expectations. Second, they invest heavily in data science to produce algorithmic techniques and approaches that are difficult and unappealing for competitors to replicate. Finally, they concurrently manage at global and local levels to balance achieving scale economies from data platforms and processes with meeting market needs that are forever in flux.

Strategy 4: Future Ready

Some companies want to do it all—to use data and analytics to enable across the organization activities for cost reduction, sales lifting, and revenue building. Thirty percent of companies pursue this strategy and generate, on average, returns that represent twenty-four percent of overall firm revenues. However, this is by far the most difficult strategy to get right. The companies most able to pursue future-ready data monetization are digital companies (or digitally transformed ones) and companies that are incredibly mature in data-driven practices. Forty-five percent of tech companies, thirty-six percent of healthcare and public health, and thirty-two percent of finance companies report having this strategy.

Top performers following a future-ready strategy achieve 125 percent greater data monetization outcomes than bottom performers, with capability scores that are forty-seven percent higher; they have 17.8 percentage points more of revenues from data as part of overall company revenues than bottom performers. Three things set these companies apart: First, they have data monetization capabilities that can be used for improving, wrapping, and selling—but as data initiatives are deployed, it is clear to a designated process leader, product owner, or business head exactly what approach to prioritize and what outcomes to achieve. Second, they aggressively build up data governance and data platforms that can effectively and acceptably enable a diverse array of monetization activities. Finally, they generate value from data in synergistic ways at the business activity level. So, for example, a proposed website feature would be expected to lower cost to serve and drive more sales while contributing new data to the company’s information solutions.

A Clear and Cohesive Data Monetization Strategy

Data is a critical currency in a crisis. In this time of severe disruption, your company needs a compelling pursuit. Consider the four data monetization strategies and ask yourself:

- Which strategy offers the most for your business model?

- Which strategy aligns best with your strategic intent?

- Which strategy is achievable given your current state of capability?

The crisis offers a chance not simply to advance on your data journey, but to break away from the pack. Choose the strategy with the clearest potential for payoff—and strive for top performance.

© 2020 MIT Sloan Center for Information Systems Research, Wixom, Farrell, and Owens. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.