All data should not be treated equally. Establishing a single set of data practices that applies to all data across the firm is cost prohibitive and unnecessary, particularly at a time when many companies are engaged in data growth activities such as amassing data lakes for future analytical exploration or building voluminous data sets from new Internet of Things projects. Instead, companies need to be discerning and focus on applying their best practices to their best data. When data has speculative value and is not sensitive, minimal checks and controls are sufficient.

Data as a Strategic Asset at Tetra Pak

Tetra Pak Inc. is the world’s leading food processing and packaging solutions company, with products sold in over 175 countries. It has more than 23,000 employees based in more than 85 countries. In 1997, Tetra Pak embarked on a business transformation program to standardize business processes worldwide. The company established seven global processes to deliver the company’s most critical business capabilities, and it designated global process owners to be accountable for execution and outcomes.

By the early 2000s, leadership recognized that data was a strategic asset for Tetra Pak. It clarified that high-quality data was required for the firm to execute high-quality business processes. To create data process alignment, top management charged each core process owner with the accountability for data that was requisite for the success of his or her process. The company created a global master data management (MDM) team to help process owners curate data; the MDM function was housed in the business transformation office and had roles directly reporting to each global process.

MDM staff helped the process owners to identify the data that was most important for process execution success and to establish quality metrics for those specific data elements. Dashboards were used to monitor data quality and the impact of data on the business processes at a very granular level. As data quality issues surfaced, the MDM team worked with people within the business process to conduct root cause analysis and remediate issues. Process owners learned the tangible impact of poor quality data, such as how much longer it takes to create a sales order when customer information is missing, and the actual cost of pausing production when product definitions are inaccurate. Gradually, its improvement of data enabled Tetra Pak in establishing a global BI function. BI staff helped the process owners develop and seed BI experts throughout their organizations to help employees generate value from process improvements.

Data as a Strategic Asset at State Street

State Street Corporation (NYSE:STT) is the second-oldest financial institution in the United States, operating in twenty-nine countries around the world with 30,000 employees. In 2015, State Street held $28 trillion in assets under custody and administration. The company’s key role is to provide data and reporting services for institutional investors. It also delivers services like fund administration for real estate and private equity funds. In the course of administering these funds, State Street provides regulators and shareholders with reports to indicate compliance and to reveal performance.

At its core, State Street is a data reporting business for institutional investors. Over time the company was providing clients with more and more analytics, such as risk or liquidity analytics, at no additional cost. Leadership was concerned that these analytics were being given away as bundled offerings while the value of the analytics was not well understood.[foot]“Cashing In on Your Data,” video recording of panel presentation at the MIT Sloan CIO Symposium at the Massachusetts Institute of Technology, May 20, 2015, http://www.mitcio.com/cashing-your-data[/foot] Leaders clarified that data was a strategic asset of the firm because it could be used to create new business opportunities—and new revenue streams—for the company. In April 2013, State Street established the 900-person Global Exchange business division and charged its new leadership team with using strategic data assets to generate value from data monetization. The division was formed using existing components from State Street’s research and advisory, analytics, Currenex, Global Link®, and derivatives clearing capabilities.[foot]“State Street Names Jeff Conway to Lead Data and Analytics Solutions for Clients,” State Street Corporation, http://newsroom.statestreet.com/ press-release/state-street-global-advisors/statestreet-names-jeff-conway-lead-data-and-analytics-so[/foot]

Global Exchange leaders inspired action across the division to prepare for effective curation of the division’s strategic data assets. Legal teams reviewed and renegotiated data usage rights with State Street clients to secure appropriate commercial use rights. Technologists established platforms that supported superior scalability, performance, and service delivery. HR developed new hiring strategies to attract digital talent.

By 2015 Global Exchange was acting like an information business,[foot]MIT CISR defines an information business as a company that monetizes data by selling information-based offerings.[/foot] and it was focused heavily on innovation, a requisite for sustained data monetization success. A key component of Global Exchange’s innovation strategy was academic partnerships. That year, the company funded a data science research center at the University of California at Berkeley.[foot]Howard Baldwin, “In Searching for Big Data Answers, State Street Queries Academia,” Forbes, April 27, 2015, http://www.forbes.com/sites/howardbaldwin/2015/04/27/in-searching-for-bigdata-answers-state-street-queries-academia/[/foot] The research center is investigating next-generation data science techniques for mitigating economic and financial risk.

Walking the Talk Leads to Business Value

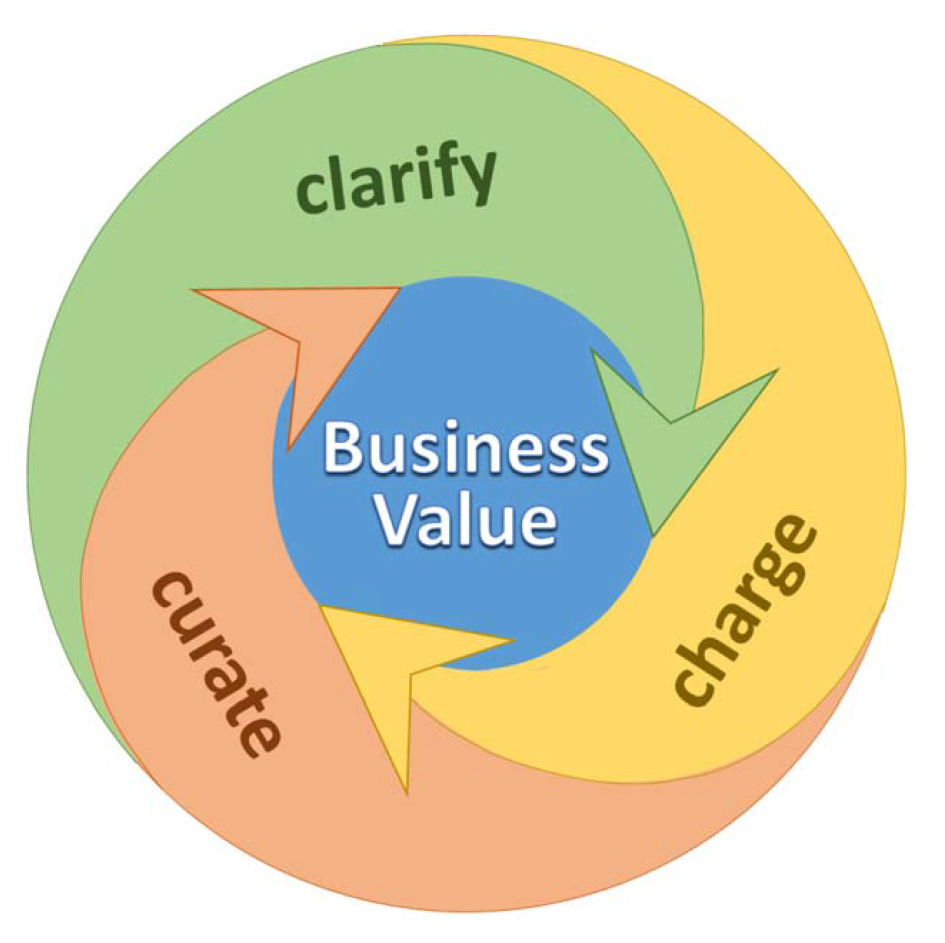

If you are not already having tough conversations regarding data at your company, then it’s time to begin. Data conversations will lead to the clarity required to shape firm-wide messages regarding how the company intends to use data in order to generate business value. Armed with clarity about data’s value proposition, the company can charge the right people with data ownership and curate the data in effective ways.

The clarify-charge-curate relationship is reinforcing (see figure 1). As companies improve the quality and increase the use of strategic data assets, top management will become savvier regarding data—and it can leverage data in new and more business strategies. Our research supports this positive reinforcing relationship: companies that walk the talk regarding their data establish superior data management practices and generate greater value from data over time.[foot]Firms that treat their data as a strategic asset have better data governance, enterprise data warehousing, enterprise analytics capabilities, data architecture, and customer data. Firms better at using data to improve internal processes are better at wrapping (i.e., differentiating core products and services with information offerings), and firms better at wrapping are better at selling information offerings. (n=40, all correlations are significant at the .05 level).[/foot] Our research also indicates that you cannot walk the talk regarding data—until you can talk with clarity.