Data monetization strategies include some combination of three moneymaking approaches:

- Improving core business processes using data—making money from doing things better, cheaper, and faster

- “Wrapping” analytics around offerings—making money by distinguishing offerings with features and experiences

- Selling information solutions—making money by deploying new information offerings

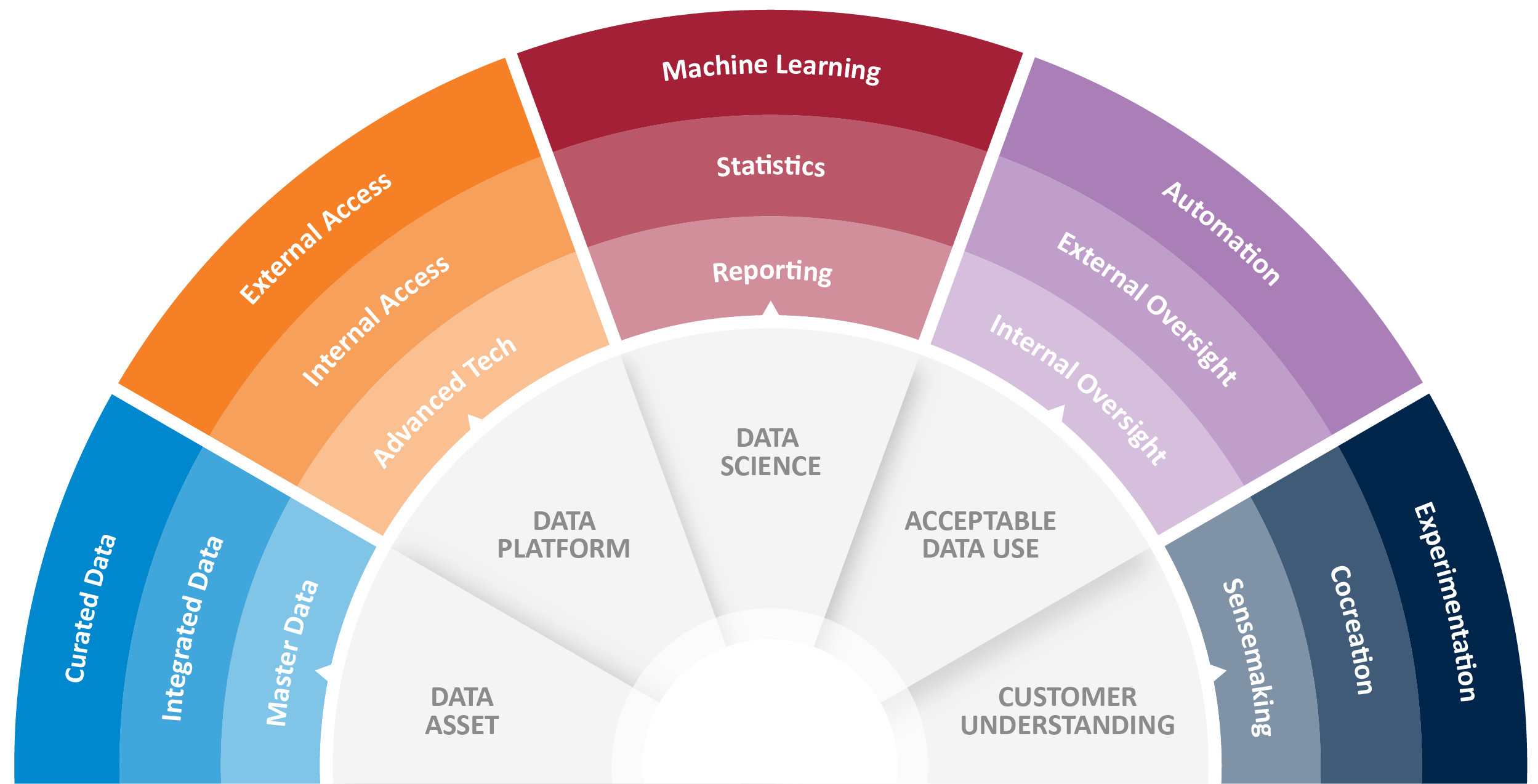

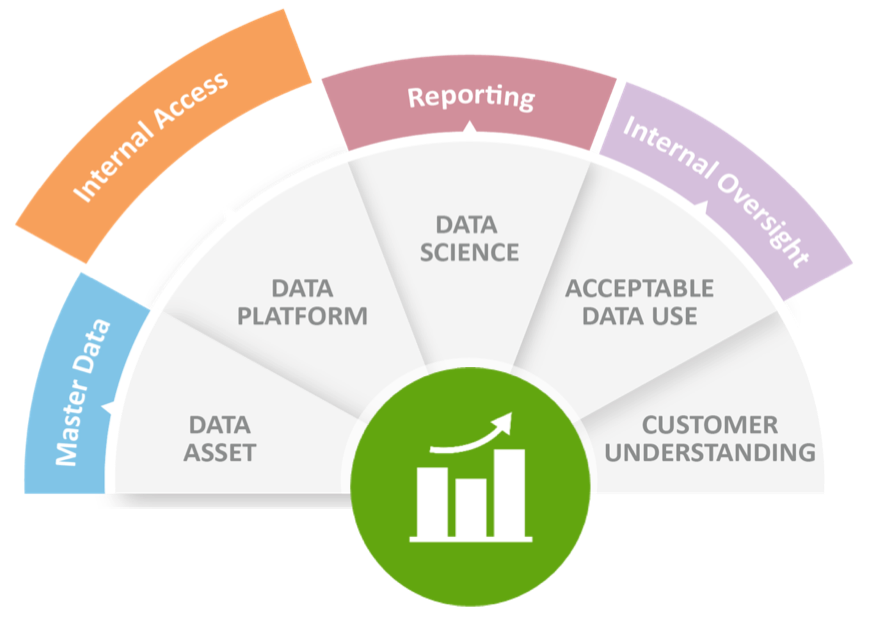

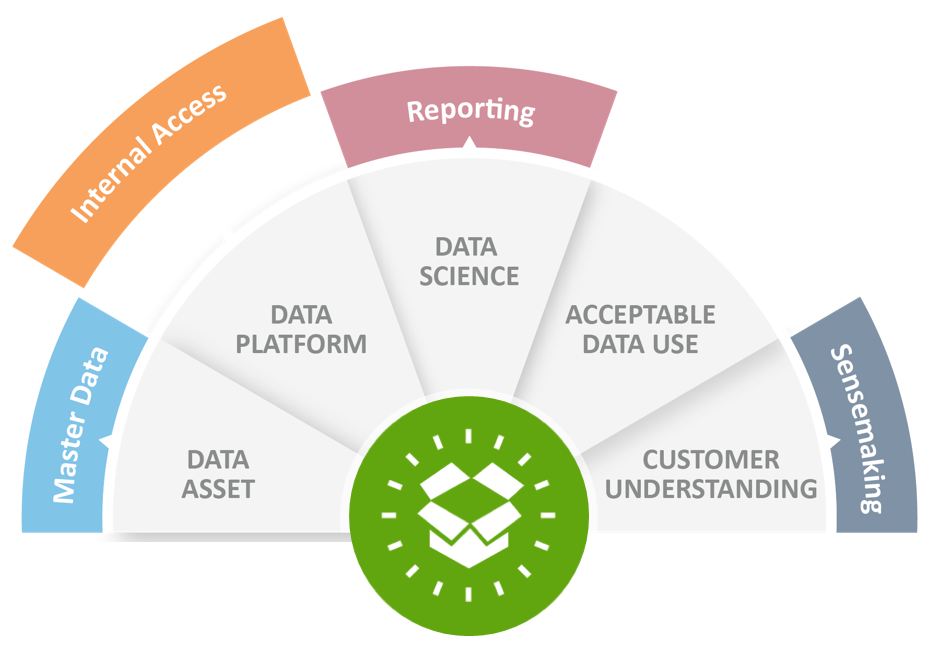

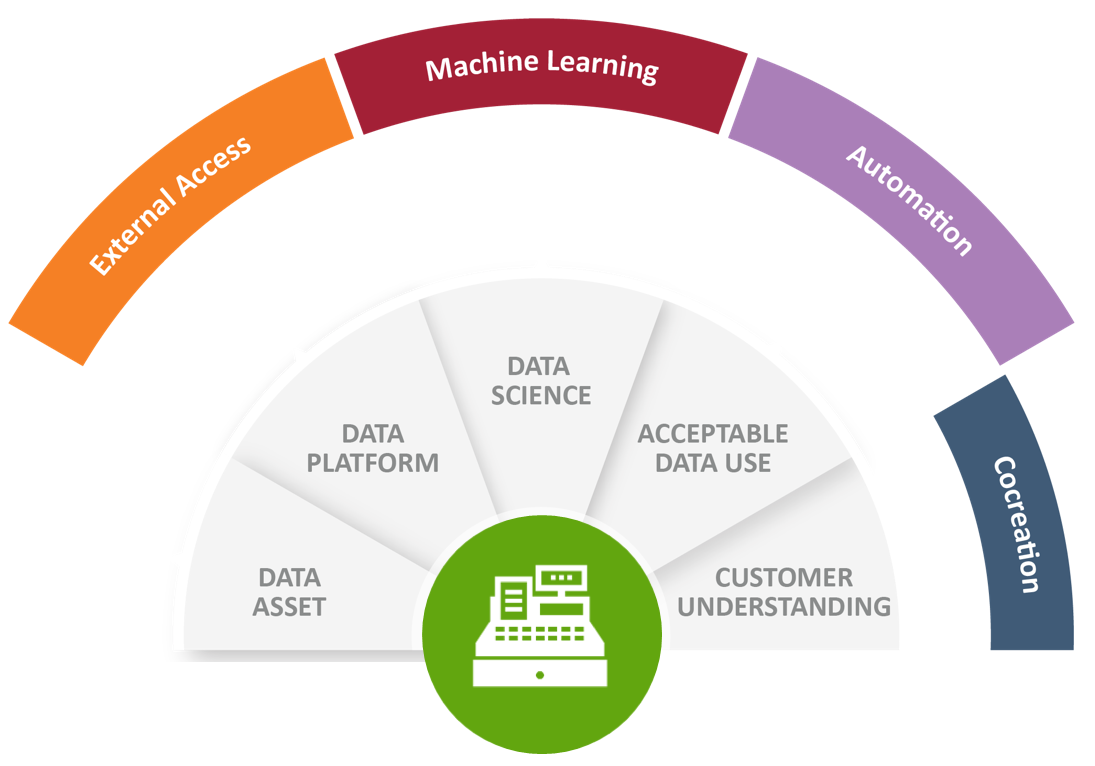

MIT CISR research has identified that companies need five enterprise capabilities—a data asset, a data platform, data science, acceptable data use, and customer understanding[foot]MIT CISR 2018 Data Monetization Survey (N=315). Firms split into distinct top (N=146) and bottom (N=105) performers on data monetization metrics (operational efficiencies created, increased prices/sales, direct revenues generated). All five capabilities were significantly higher for top performers, p<.0001.[/foot]—to execute data monetization strategies. Building these capabilities, however, is not easy; our research found that the capabilities companies have in place today are … average.[foot]Ibid. Response means for capability development fell between 2=“somewhat poorly developed and 3=“of average development”; the full scale ranged from 0=“no development” to 5=“very well developed.”[/foot] In this briefing we explain why you need to be persistent and purposed for your data monetization capabilities to pay off.