Data liquidity—the ease of data asset reuse and recombination—matters to business performance. In a recent MIT CISR survey,[foot]2024 MIT CISR Data Monetization: Generating Financial Returns from Data and Analytics Survey (N=349).[/foot] organizations with high data liquidity[foot]The sample was split into quartiles by composite data liquidity scores. High quartile (mean score of 3.7/5, N=89) and low quartile (mean score of 1.9/5, N=86) data liquidity organizations were compared using ANOVA.[/foot] reported 14 percent higher scores for customer experience and time to market than organizations with low data liquidity. High-liquidity organizations also outperformed low-liquidity organizations in other ways: data sharing within the enterprise and beyond was 28 percent easier, data monetization impact was 24 percent greater, and employees spent nearly twice as much time gleaning insights from data.

How do organizations build data liquidity?[foot]This briefing draws on four research studies: (1) in 2020, 73 interviews with data and analytics leaders MIT CISR researchers and collaborators conducted to learn about data investments as a part of strategic digital initiatives; (2) in 2022, 33 interviews with members of the MIT CISR Data Research Advisory Board and conceptual development described in Gabriele Piccoli, Joaquin Rodriguez, Barbara Wixom, and Ida Asadi Someh, “Data Liquidity: Conceptualization, Measurement, and Determinants,” Proceedings of the International Conference on Information Systems (ICIS), December 2022, https://aisel.aisnet.org/icis2022/entren/entren/16/; (3) the 2024 MIT CISR Data Monetization survey; and (4) from July 2023 to December 2024, the case study on Caterpillar. For the Caterpillar study, the authors conducted 56 interviews with 42 stakeholders. The authors supplemented those interviews with information from publicly available sources, informative decks provided by Caterpillar, and iterative content review by Caterpillar case participants during development of the case narrative.[/foot] Our previous research identified important foundational tactics: Organizations invest in data monetization capabilities, using practices such as data cataloging and data lineage management as well as adopting cloud-based database technology and implementing security controls.[foot]B. H. Wixom and G. Piccoli, “Build Data Liquidity to Accelerate Data Monetization,” MIT CISR Research Briefing, Vol. XXI, No. 5, May 2021, https://cisr.mit.edu/publication/2021_0501_DataLiquidity_WixomPiccoli.[/foot] And they design and deploy modular data assets.[foot]J. Rodriguez, G. Piccoli, and B. H., Wixom, “Increase Data Liquidity by Building Digital Data Assets,” MIT CISR Research Briefing, Vol. XXI, No. 11, November 2021, https://cisr.mit.edu/publication/2021_1101_DigitalDataAssets_RodriguezPiccoliWixom.[/foot]

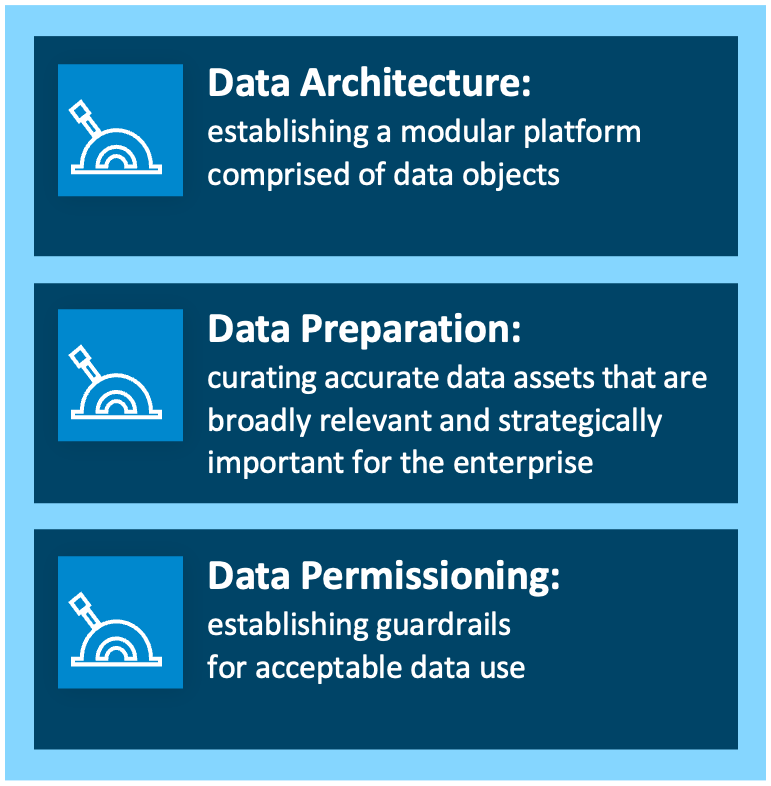

Caterpillar®, a heavy equipment manufacturer, built highly liquid data assets as a cornerstone of its digital vision to double its 2016 $14 billion services revenues by 2026.[foot]The case study on Caterpillar in this briefing draws from B. H. Wixom, J. Rodriguez, G. Piccoli, and C. M. Beath, “Caterpillar’s Digital Data Journey,” MIT CISR Working Paper No. 467, August 2025, https://cisr.mit.edu/publication/MIT_CISRwp467_CaterpillarDataJourney_WixomRodriguezPiccoliBeath.[/foot] By 2025, Caterpillar had established a digital platform that enabled capabilities including e-commerce, fleet management, and predictive and preventative maintenance. Also by 2025, Caterpillar had grown services from $14 billion to $24 billion. In this briefing, we describe how Caterpillar successfully executed foundational data liquidity tactics by managing three data domain practice areas we call data liquidity levers.