Future-ready companies monetize their data assets by improving processes, wrapping products with analytics features and experiences, and selling innovative information solutions.[foot]Companies can generate economic returns from their data via improving, wrapping, and selling as described in B. H. Wixom, “Data Monetization: Generating Financial Returns from Data and Analytics—Summary of Survey Findings,” MIT Sloan CISR Working Paper No. 437, April 2019, https://cisr.mit.edu/publication/MIT_CISRwp437_DataMonetizationSurveyReport_Wixom.[/foot] MIT CISR research[foot]To date, MIT CISR data liquidity research includes interviews with 85 executives in 2020 regarding their company’s strategic data initiatives and the nature of the associated data assets; a Q2 2021 MIT CISR Data Board discussion regarding data liquidity measurement; and theoretical work regarding digital data assets, as described in Gabriele Piccoli, Joaquin Rodriguez, and Varun Grover, "Strategic Initiatives and Digital Resources: Construct Definition and Future Research Directions," Proceedings of the International Conference on Information Systems (ICIS), December 14, 2020, https://aisel.aisnet.org/icis2020/digital_innovation/digital_innovation/5/. [/foot] has found that data liquidity—the ease of data asset reuse and recombination—accelerates the pursuit of new data monetization opportunities.

Data liquidity varies along a continuum. One data asset may be more or less liquid than another, with highly liquid data being more prepared for planned and unplanned new value creation opportunities. Google Maps is a familiar service based on a highly liquid data asset. The data asset represents map information that can be reused and recombined for innumerable value creation initiatives (e.g., route optimization) by numerous firms (e.g., rideshare company Uber).[foot]The authors identified the Google Maps API as a DDA by applying their theoretical work, which conceptualizes DDAs, to the characteristics and structure of the Maps API.[/foot]

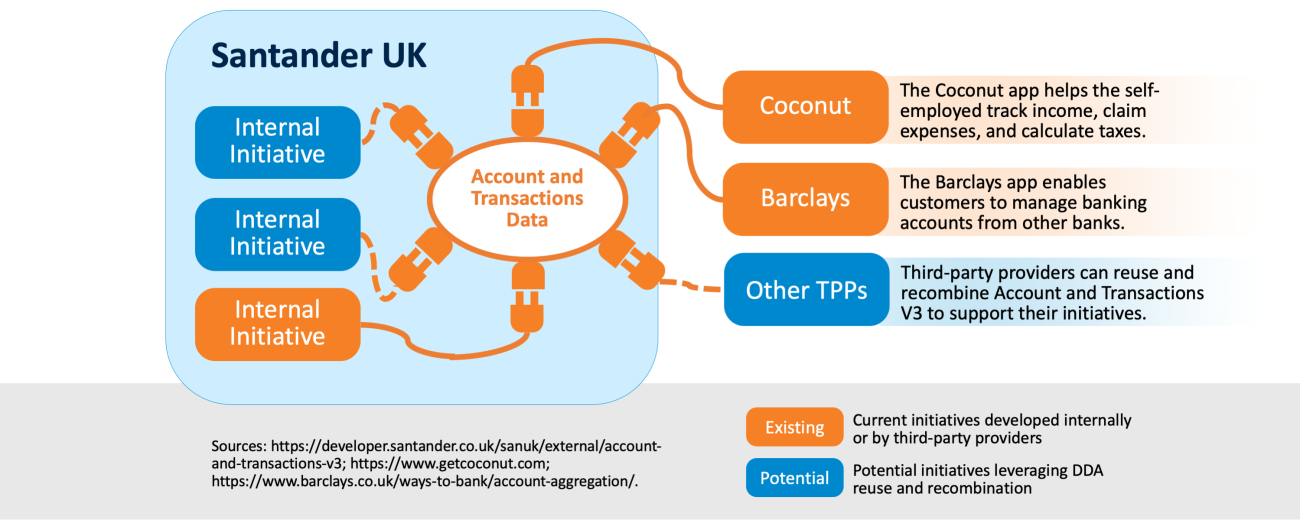

Data often is illiquid because it is trapped in local business processes, closed platforms, or obsolete data structures; it requires movement, consolidation, or translation; or it is constrained by regulation, organizational boundaries, or technical limitations. Incumbent banks, healthcare organizations, and companies with long-established business models are often mired in illiquid data assets.

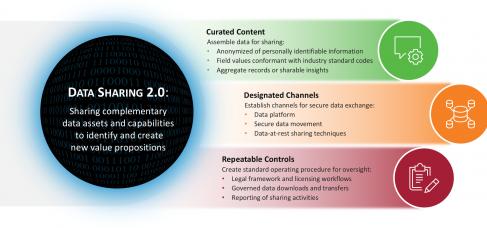

Increasing the liquidity of a data asset can be a costly, labor-intensive endeavor. Yet having liquid data is critical for organizations that hope to respond quickly to novel value creation opportunities. In a previous briefing,[foot]B. H. Wixom and G. Piccoli, “Build Data Liquidity to Accelerate Data Monetization,” MIT Sloan CISR Research Briefing, Vol. XXI, No. 5, May 2021, https://cisr.mit.edu/publication/2021_0501_DataLiquidity_WixomPiccoli.[/foot] we explained that companies can increase data liquidity by investing in the company’s data monetization capabilities. The theoretical work of the first two authors of this briefing identified a second approach: building digital data assets, or DDAs.