Most global companies aim to treat data as a strategic asset, and recognize that data needs to be put to use to realize its value. For years, using more data to make better decisions has been the holy grail. But MIT CISR research has found that future-ready companies have greater ambition regarding their data. They strive to maximize their data monetization outcomes by pervasively improving processes to do things better, cheaper, and faster; wrapping products with analytics features and experiences; and selling new innovative information solutions.[foot]Companies can generate economic returns from their data via improving, wrapping, and selling as described in B. H. Wixom, “Data Monetization: Generating Financial Returns from Data and Analytics—Summary of Survey Findings,” MIT Sloan CISR Working Paper No. 437, April 2019, https://cisr.mit.edu/publication/MIT_CISRwp437_DataMonetizationSurveyReport_Wixom.[/foot] However, this ambition requires that companies first transform data such that it can be reused and recombined for new value creation. The easier the reuse and recombination, the higher the data’s liquidity, which we define as the ease of data asset reuse and recombination. In this briefing we explain why data liquidity matters.

Build Data Liquidity to Accelerate Data Monetization

Abstract

This briefing introduces the concept of data liquidity, defined as the ease of data asset reuse and recombination. While data is inherently reusable and recombinable, an organization must activate these characteristics by creating strategic data assets and building out its data monetization capabilities. As the company’s strategic data assets become more highly liquid and their number grows, data is made increasingly available for conversion to value, and the company’s data monetization accelerates. Fidelity is an excellent example of a company that is actively creating highly liquid strategic data assets for use enterprise wide.

Preparing Data for New Value Creation

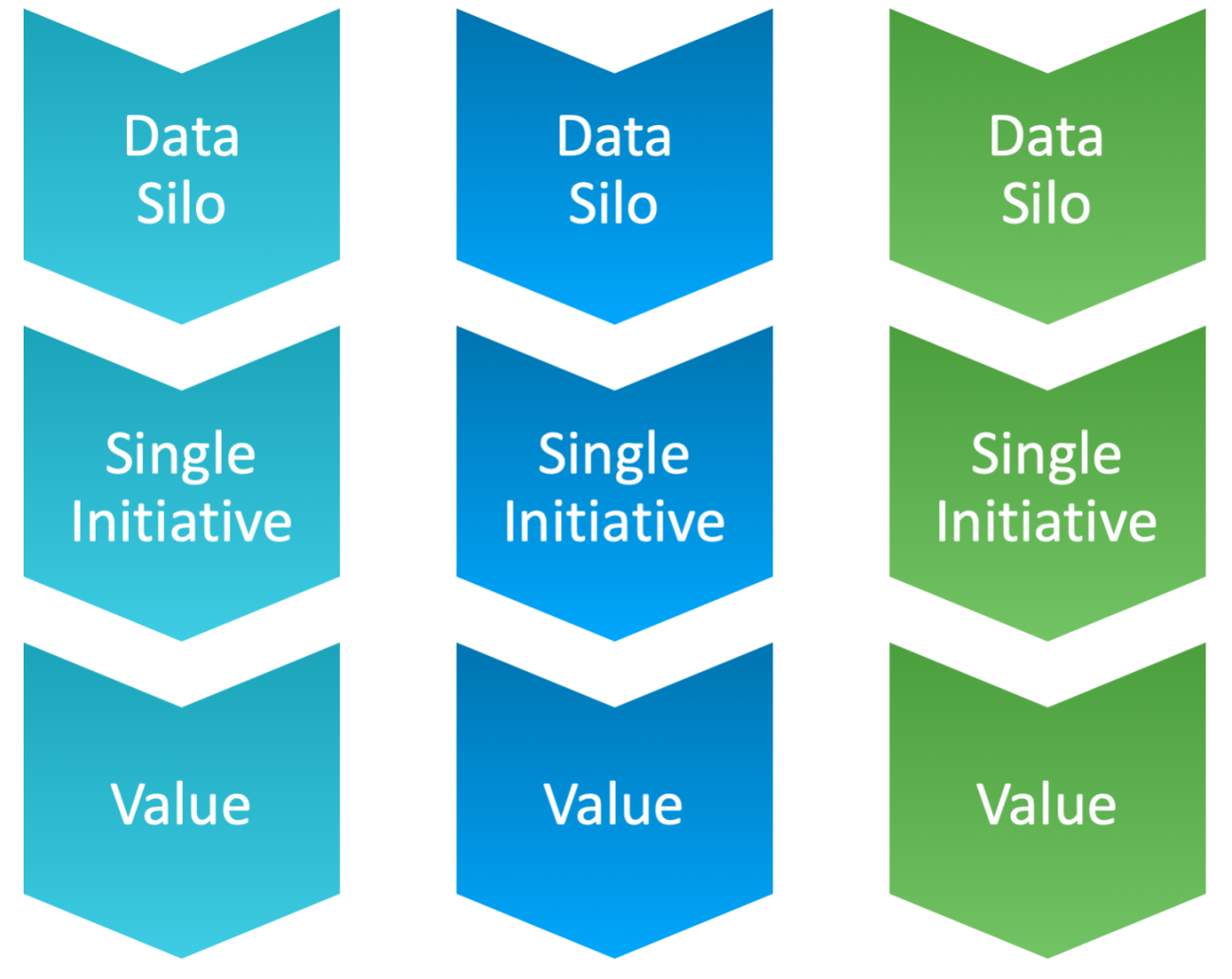

A company’s data typically has low liquidity; the data is trapped in local business processes, locked in closed platforms, replicated in multiple locations, incomplete, inaccurate, and poorly classified or defined. It’s no wonder that a lot of managerial attention focuses on liberating data from silos and applying it to a new specific use such as calculating customer churn or spotting supply chain breaks (see figure 1).

Figure 1: Liberating Data for a New Specific Use

This is a good exercise, but not a strategic one. Sure, an initiative on customer churn or supply chain will realize new value for the company. But if you continue to pursue only a linear value creation cycle, you are leaving money on the table.

It’s crucial to recognize that data does not have to be treated like traditional company assets. Heavy equipment, office furniture, land, and even cash will deteriorate or be depleted; companies have no choice but to control their use. Data is different—it can be reused and recombined freely without degradation. Data assets are born to be liquid!

While data is inherently reusable and recombinable, the organization must activate these characteristics. A data asset that has been curated—a strategic data asset—is prepared for innumerable data monetization initiatives and can be used for new value creation. To move from simply using data to building strategic data assets, companies need to decontextualize data from a designated purpose and prepare each asset to become accurate, complete, current, standardized, searchable, and understandable enterprise wide. Companies achieve this by drawing on practices such as master data management, metadata management, data integration, data quality management, and taxonomy/ontology. This data asset capability combined with the capabilities for data platform, data science, customer understanding, and acceptable data use—the five data monetization capabilities MIT CISR identified in its research[foot]We explain the five data monetization capabilities in B. H. Wixom and K. Farrell, “Building Data Monetization Capabilities that Pay Off,” MIT Sloan CISR Research Briefing, Vol. XIX, No 11, November 2019, https://cisr.mit.edu/publication/2019_1101_DataMonCapsPersist_WixomFarrell.[/foot]—drive an increase in data’s liquidity. As a company’s strategic data assets become more highly liquid and their number grows, data is made increasingly available for conversion to value and the company’s data monetization accelerates (see figure 2).

Figure 2. Greater Data Liquidity Drives Exponential Growth in Data Monetization

Building Highly Liquid Strategic Data Assets at Fidelity

Fidelity Investments is a Boston-based financial services company whose mission is to inspire better futures and deliver better outcomes for the customers and businesses they serve. Fidelity employs more than 47,000 associates and has multiple distinct business units, including asset management, retail brokerage, clearing and custody, 401(k) and employer recordkeeping services, and capital markets. In 2020, the company reported a record $21 billion in revenue. Enterprise Head of Data Mihir Shah attributes this continued success in part to “the interconnection between all of Fidelity’s businesses.”

In 2019, Fidelity clustered sets of common strategic initiatives from each business into “neighborhoods” and assigned an executive responsible for driving each neighborhood’s progress and synergy. Shah, charged with a neighborhood specific to data, initiated a four-year program aimed to rationalize 100-plus data warehouses and analytics stores into a common analytics platform. The program’s primary objective was to organize the data around a set of priority entities that are common Fidelity-wide—such as customer, employee, and investible security—into strategic data assets that are integrated and easily consumable.

We want to create long-term data assets for creating value—not only immediately, but also for use cases that are yet to be identified.

Mihir Shah, Enterprise Head of Data, Fidelity Investments

To start, Fidelity implemented a set of key foundational structures:

- Universal IDs: a common identifier for each major data entity universal across the company

- Single customer profiles: 360-degree views of customers to serve the customer better across all channels of interaction

- Single analytics platform: an advanced cloud-based analytics platform to house and serve data products at a large scale

- Central taxonomy and catalog: a repository to organize shared Fidelity terminology and the definitions of more than 3,000 company data elements

- Governance: a strong governance function to ensure strict enforcement of privacy, legal, contractual, and ethical policies

The operating model chosen for the new platform was an internal marketplace. Local data owners contribute to Fidelity’s strategic data assets by conforming new data to the enterprise taxonomy; a non-negotiable rule dictates that data and definitions align with the central catalog. Data owners maintain ownership of the data. When employees request access to data, they initiate a simple workflow that confirms their access is compliant and that they understand and would be responsible for using the data acceptably. As long as core platform rules are followed, consumers can take data from multiple producers, combine the data, and build for local requirements.

In many regards, technology advancement has been critical to making the large platform efficient and effective. Built using cloud-based technology, the platform allows data sharing, access, and application to happen without data being moved; instead of transferring data, it maintains data in place and allows owners to control access. Security technology allows tokenization of the data fields, rendering them undecipherable if they fall into the wrong hands. Central repository technologies enable enterprise search and cataloguing.

In 2021, Fidelity is well into program execution; each quarter, leaders communicate anticipated value creation outcomes that are already materializing. Further, company leaders have begun to identify value-add opportunities using data that were never before possible—activities that would add value for customers, revenue, and efficiency.

Growing Data Liquidity as Evidenced in Strategic Digital Initiatives

The Fidelity data replatforming effort represents one of seventy-three strategic initiatives that MIT CISR researchers learned about while exploring how companies create competitive advantage using data assets.[foot]In 2020, MIT CISR researchers and collaborators conducted 73 interviews with data and analytics leaders at MIT CISR member organizations to understand emerging data-related strategic digital intiatives.[/foot] A notable finding from this exploration was how organizations are using strategic digital initiatives to build data liquidity in high-profile ways. For example:

- BNP Paribas created a proprietary environmental, social, and governance (ESG) scoring framework to quantify a company’s performance on material ESG issues relative to peers.[foot]“ESG Scoring Framework,” BNP Paribas Asset Management, https://www.bnpparibas-am.com/en/esg-scoring-framework/.[/foot] This initiative was particularly compelling because of the company’s overall strategic emphasis on using ESG considerations to inform investment decisions. The framework is fueled by underlying strategic ESG data assets. BNP Paribas also now uses this exclusive ESG performance score to inform a host of investment decisions.

- The Australian Taxation Office (ATO) uses advanced analytics to prepopulate tax forms and evaluate in-process claims to simplify tax filing.[foot]I. A. Someh, B. H. Wixom, and R. W. Gregory, “The Australian Taxation Office: Creating Value with Advanced Analytics,” MIT Sloan CISR Working Paper No.447, November 2020, https://cisr.mit.edu/publication/MIT_CISRwp447_ATOAdvancedAnalytics_SomehWixomGregory.[/foot] This initiative helps ATO achieve its stated mission of reinventing the citizen tax experience. It draws on strategic data assets produced by a dedicated program called Smarter Data, which the agency launched in 2015 to increase its capabilities in the area of data analytics.

- Pegasystems Inc. (Pega) adapted the company’s commercial B2C AI-based tool for its own use to streamline and rationalize the company’s B2B customer outreach.[foot]B. H. Wixom and C. M. Beath, “Pega Drives Customer Engagement Using AI-Enabled Decision Making,” MIT Sloan CISR Working Paper No. 449, forthcoming. [/foot] The AI model draws on strategic data assets about Pega contacts to deliver an always-on outreach capability that automatically serves up relevant content to leads as they move through the Pega sales cycle.

For each of these strategic digital initiatives, the beauty lies not in a single use of data, but in the recurring reuse and recombination of the carefully curated underlying strategic data assets. For BNP Paribas, it’s easy to imagine myriad work processes that can be improved, customer experiences that can be enhanced, and new market offerings that be innovated using the company’s strategic ESG data assets. With this in mind, the breadth of Fidelity’s data replatforming effort and its future data monetization potential is striking.

As companies transform into future-ready entities, they need to view their strategic digital initiatives not simply as a way to exploit digital possibilities, but also as opportunities for reshaping their data into highly liquid strategic data assets. How far away is your organization from exponential value from data monetization?

© 2021 MIT Sloan Center for Information Systems Research, Wixom and Piccoli. The authors thank MIT CISR’s Leslie Owens for her help in producing this briefing. MIT CISR Research Briefings are published monthly to update the center’s patrons and sponsors on current research projects.

About the Researchers

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.