For the past few years at MIT CISR, we have studied Ecosystem Drivers, those companies that combine their own offerings and those of partners to become a go-to destination enabling customers to fulfill a broad range of needs. This is the dominant business model of some born-digital companies, such as Amazon, and Tencent, with its WeChat app; and some born-physical companies, such as Bayer Crop Science.[foot]In 2018, Bayer AG acquired Monsanto Company (with its Climate Field-View platform) and integrated it into Bayer’s Crop Science division.[/foot],[foot]For detail on MIT CISR’s Ecosystem Driver research findings, see Peter Weill, Stephanie L. Woerner, and Robert E. Samuel, “Aetna: Building a Healthier World via a Digital Ecosystem,” MIT Sloan CISR Research Briefing, Vol. XV, No. 11, November 2015. https://cisr.mit.edu/publication/2015_1101_AetnaDigitalEcosytem_WeillWoernerSamuel ; Peter Weill and Stephanie L. Woerner, “Thriving in an Increasingly Digital Ecosystem,” MIT Sloan Management Review, Vol. 56, No. 4, Summer 2015. https://sloanreview.mit.edu/article/thriving-in-an-increasingly-digital-ecosystem/; and Peter Weill and Stephanie L. Woerner, What’s Your Digital Business Model? Six Questions to Help You Build the Next-Generation Enterprise, (Boston: Harvard Business Review Press, 2018). https://cisr.mit.edu/publication/whats-your-digital-business-model [/foot] Now we turn our attention to Modular Producers, those companies that provide many of the products and services on Ecosystem Drivers’ digital platforms.[foot]Many new technology start-ups have a Modular Producer business model. See Erin Griffith, “The Next Wave of Unicorn Start-ups,” The New York Times, February 10, 2019, https://www.nytimes.com/2019/02/10/technology/new-wave-unicorn-start-ups.html.[/foot] For example, Alliance Data develops and runs loyalty and reward programs for more than one thousand companies. These programs are branded by and accessed through Alliance customers’ web sites; Alliance Data provides the services, but is not the face of the programs.[foot]ADS Alliance Data Systems, Inc., https://www.alliancedata.com.[/foot]

All Companies Need a Modular Producer Strategy

Abstract

For the past few years at MIT CISR, we have studied Ecosystem Drivers, those companies that combine their own offerings and those of partners to become a go-to destination enabling customers to fulfill a broad range of needs. Now we turn our attention to Modular Producers, those companies that provide many of the products and services on Ecosystem Drivers’ digital platforms. The Modular Producer model is financially attractive, second only to the Ecosystem Driver model in revenue growth and net profit. In this briefing we discuss three areas in which aspiring Modular Producers need to excel, and illustrate our findings with case studies from Fidelity Investments and Okta.

Modular Producer companies scoring in the top third on the combination of continuous innovation, connectability, and brand strength had growth 10 percentage points higher than all other companies in the research.

Companies we studied in diverse industries are ramping up Modular Producer business models, aspiring to partner with leading Ecosystem Drivers and capture market share. The Modular Producer model is financially attractive, second only to the Ecosystem Driver model in revenue growth and net profit.

THREE CRITICAL SUCCESS FACTORS FOR MODULAR PRODUCERS

One of the reasons customers go to Ecosystem Drivers like Amazon and WeChat is to “one stop shop” offerings by different providers. Modular Producers often partner with Ecosystem Drivers to reach more customers and grow fast. But to grow, they have to distinguish themselves from everyone else on the platform. A Modular Producer needs to be proficient in three areas to stand out: (1) continuous innovation, (2) connectability, and (3) brand strength.[foot]MIT CISR 2017 Ecosystems Survey (n=158), plus interviews in 2018 with 47 executives at 24 companies across different industries.[/foot] Modular Producer companies that scored in the top third on the combination of these three capabilities had growth 10 percentage points higher than all other companies in the research and 17 percentage points higher than Modular Producers scoring in the bottom third.

- Continuous innovation: Modular Producers, because they can be swapped in and out relatively easily from a platform, have to always be innovating to meet the needs of customers and Ecosystem Drivers. For example, PayPal, in the very competitive payments business, grew 2017 revenues to $13.1 billion, up 21 percent year over year, by constantly adding new features such as peer-to-peer payments.[foot]“PayPal Q3 2018 Fact Sheet,” Media Resources, PayPal.[/foot]

- Connectability: Modular Producers must identify the capabilities that make them distinctive—their crown jewels—and service enable them to plug and play into any ecosystem. The lifeblood of a Modular Producer is an architecture that connects data and applications to the systems of customers and partners. Think of PayPal, whose payments API is easily accessible by any vendor to securely accept online and mobile payments, and which enables customers to make payments with only a few clicks.[foot]“Payments API,” PayPal Developer.[/foot] Ultimately, continued Modular Producer success relies on a modern application architecture and infrastructure that enables continuous innovation without increasing complexity.

- Brand strength: In many ecosystems, customers rely on the Ecosystem Driver to curate Modular Producers. It is tempting for a Modular Producer to downplay investments in brand and ride the coattails of the Ecosystem Driver; however, our findings indicated that developing a recognizable brand helps drive growth. In pursuit of increased scale, many Modular Producer companies we studied partnered with a few big brands; the enhancement of their own brands led in turn to more partnerships and customers. For example, by partnering with popular brands, PayPal has become a household name globally, drawing almost half of its revenues from customers outside the US,[foot]“PayPal 2018 Annual Meeting of Stockholders and Proxy Statement & 2017 Annual Report,” Investor Relations, PayPal, https://investor.paypal-corp.com/static-files/69fe62b6-0756-4a86-9666-cae4c4c5c387.[/foot] with more than 254 million active accounts in about 200 countries.[foot]“PayPal Global Scale Q3 2018,” Media Resources, PayPal, https://www.paypalobjects.com/digitalassets/c/website/marketing/global/shared/global/media-resources/documents/PayPal_Global_Scale_Q3_2018.pdf.[/foot]

TWO TYPES OF MODULAR PRODUCERS

As automation increases, an Ecosystem Driver’s bots could make many purchase decisions for customers, using preset parameters. And most Ecosystem Drivers want to set pricing and capture the lion’s share of the data from purchases. To avoid becoming a commodity, Modular Producers must continue to evolve. We have identified two types of Modular Producers, which we call “Mod Prod Pure” and “Mod Prod Plus.” Mod Prod Pure companies “stick to their knitting,” focused on selling their own products and services through Ecosystem Drivers—as PayPal did when it only offered payments. In contrast, Mod Prod Plus companies diversify their offerings, typically through partnerships. For example, PayPal now also offers Business in a Box,[foot]“Business in a Box: An all-in-one solution to help build your business,” PayPal.[/foot] a toolkit that supports small businesses in online commerce by combining PayPal services with those of partner providers. PayPal also partners with companies such as Walmart on cash withdrawal and instore payments and Chevron on a mobile payment app.[foot]Dan Schulman, “Five Key Takeaways from PayPal’s Third Quarter Earnings,” PayPal Stories, October 18, 2018, https://www.paypal.com/stories/us/five-key-takeaways-from-paypals-third-quarter-earnings.[/foot]

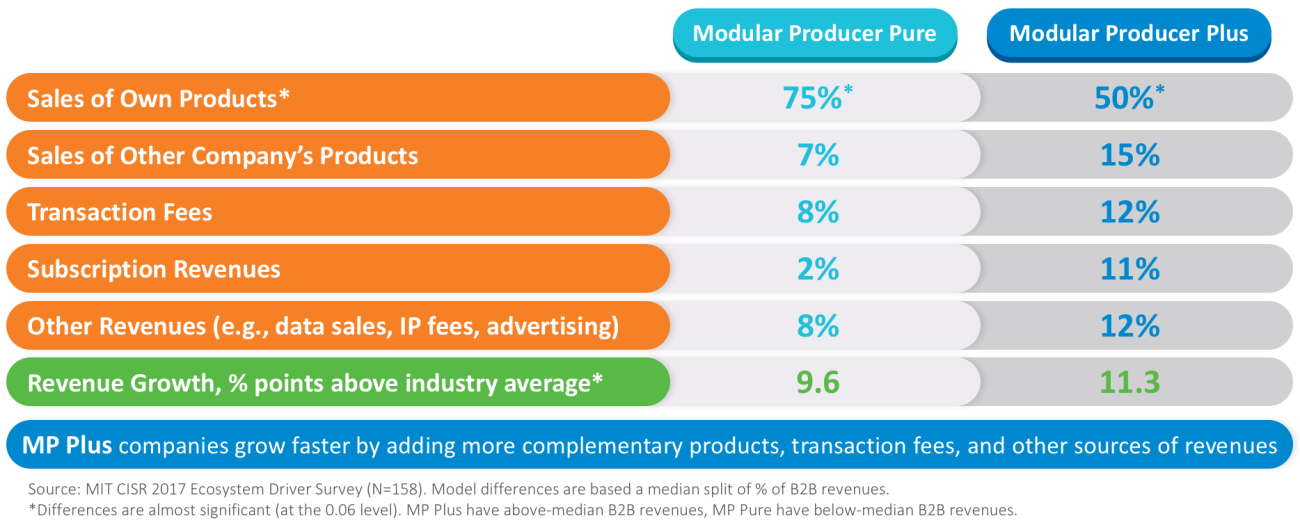

Mod Prod Plus companies have more partnerships and types of revenue, and sell products in different ways. Compared to Mod Prod Pure companies, Mod Prod Plus companies have double the sales revenue from selling partner company products, and five times the revenue from subscriptions (see figure 1).[foot]MIT CISR 2017 Ecosystems Survey (n=158).[/foot] Our research shows that both types of Modular Producer companies are growing fast, with Mod Prod Plus and Pure companies growing at respectively 11.3 and 9.6 percentage points above industry average. But partnering may help Mod Prod Plus companies be more “sticky” in ecosystems, and more resilient based on broader sources of revenue.

Figure 1: Modular Producer Pure Versus Modular Producer Plus Companies—Comparison of Revenues

TWO HIGH-PERFORMING MODULAR PRODUCERS

Fidelity Investments and Okta are examples of high-performing companies with successful Modular Producer models.[foot]The case studies on these companies draw from 2018 MIT CISR interviews with 13 executives from Fidelity Investments and 2 executives from Okta.[/foot]

Fidelity Investments

Fidelity Investments is an asset management company with three customer-facing businesses: personal investments; workplace services; and brokerage, custody, and clearing. The company has 28 million individual investors and more than $7 trillion total customer assets. While Fidelity is becoming an Ecosystem Driver—with big pushes to build marketplaces in personal investments[foot]“Tax Information,” Fidelity Investments, https://dpcs.fidelity.com/prgw/dpcs/tax-information/. [/foot] and healthcare[foot]“Fidelity Health MarketplaceSM Expands to Colorado, Bringing More Benefit Choices to Small and Midsized Businesses,” Fidelity Investments, December 14, 2016.[/foot]—its brokerage business is already an established, successful Modular Producer. Fidelity’s brokerage platform, Wealthscape,[foot]Wealthscape, https://www.wealthscape.com/.[/foot] is sold to thousands of financial institutions and broker dealers as a Mod Prod Pure white-label service. The offering is attractive to customers who do not want to deal with the complexity of a back office or have the needed scale for one.

Additionally, Fidelity is introducing Mod Prod Plus offerings in the recently launched Wealthscape Integration Xchange storefront, which makes more than 100 third-party technology solutions (such as for customer relationship management, financial planning, analytics, and portfolio management) available in a single go-to place via a self-service model.[foot]“Fidelity Introduces WealthscapeSM Integration Xchange,” Fidelity Investments, October 16, 2018.[/foot]

Fidelity’s crown jewels include its scale and customer trust. The company works hard to understand the business drivers for its Modular Producer revenue, such as optimal experiences from a trading perspective or an account onboarding perspective. To help accelerate innovation, Fidelity is working towards democratizing data and making it available in real time for data-driven decisions. The company has developed a set of APIs that are easy to consume, fulfill a spectrum of activities such as opening an account or moving money, and provide common functionality to a diverse set of customers. Fidelity is modernizing its brokerage platform, transitioning it from a mainframe to a cloud environment, and in the process building enterprise-wide digital capabilities with one API strategy and API store. To become truly plug and play, Fidelity has moved from a code base to a rules-based engine to address partner differences.

Okta

Okta provides identity and access management services in the cloud. The company—founded in 2009 by two former Salesforce executives—is growing rapidly, with more than 6,000 commercial customers and over 100 million registered users.[foot]Elizabeth Gurdus, “Okta now has over 100 million registered users, says CEO,” CNBC, January 24, 2019.[/foot] Okta had revenues of $392 million in 2018, increasing 62 percent year over year.[foot]“Okta Announces Record Fourth Quarter and Fiscal Year 2018 Financial Results,” Investor Relations, Okta, March 7, 2018.[/foot] With single sign-on and an increasing number of additional services (e.g., multifactor authentication, lifecycle management), Okta is making it seamless for users to access many different technologies. The Okta Integration Network is a library of prebuilt integrations to more than 6,000 applications and technology services provided by partners. Customers of these partner companies deploy Okta services for user identity.

Okta’s crown jewel is identity management as a standalone, cloud-based service—a Mod Prod Pure offering. Okta has continuously innovated on this base, and added new Mod Prod Plus offerings by increasing its network of partners that provide identity governance, security event management, privileged access, cloud access brokering, and other functions. Okta can connect easily to customers that have legacy applications and systems in their corporate data centers and/or a variety of security and compliance certifications. It achieves its motto “Always on” via a highly redundant and resilient AWS infrastructure, sophisticated DevOps engineering methodology, and a dedicated team that monitors the service 24/7.

YOUR STRATEGY FOR MODULAR PRODUCER SUCCESS

Fidelity built revenues in its Modular Producer business leveraging its strong brand and robust capabilities; Okta started as a Mod Prod Pure company and is now growing fast as Mod Prod Plus. To parallel their growth, companies need

a Modular Producer strategy that reinforces the three critical success factors of continuous innovation, connectability, and brand strength, and provides a clear path to Mod Prod Plus. Some companies will then be able to build an Ecosystem Driver business on their Modular Producer success, at least for a subset of their customers. In an ecosystem world, what’s your Modular Producer strategy?

© 2019 MIT Sloan Center for Information Systems Research, Woerner, Sebastian, and Weill. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.