In the April 2013 MIT CISR research briefing[foot]P. Weill and S.L. Woerner, “The Next-Generation Enterprise: Thriving in an Increasingly Digital Ecosystem,” MIT Sloan CISR Research Briefing, Vol. XIII, No. 4, April 2013, http://cisr.mit.edu/blog/documents/2013/04/18/2013_0401_digitalecosystems_weillwoerner.pdf/[/foot] we introduced a 2x2 framework with four distinct business models to help companies rethink their businesses in an increasingly digital economy. Since then, one business model—the ecosystem driver—has outperformed the rest. In this briefing, we will share evidence on the financial performance of ecosystem drivers and the digital and business capabilities required for success. We will also describe Aetna’s vision, and its transformation path from a primarily business-to-business health insurance provider to a health care destination for consumers.

Aetna: Building a Healthier World via a Digital Ecosystem

Abstract

MIT CISR recently introduced a 2x2 framework with four business models to help companies rethink their businesses in an increasingly digital economy. We found that one business model, the ecosystem driver, has become the highest performer, with companies like Fidelity, Amazon, and Aetna leading the way. In this briefing, we will share evidence on the financial performance of ecosystem drivers and describe the digital and business capabilities required for success.

Ecosystem drivers dominate in terms of performance, with the best customer experience, time to market, revenue growth, and net margins.

How and Why Ecosystem Drivers Outperform

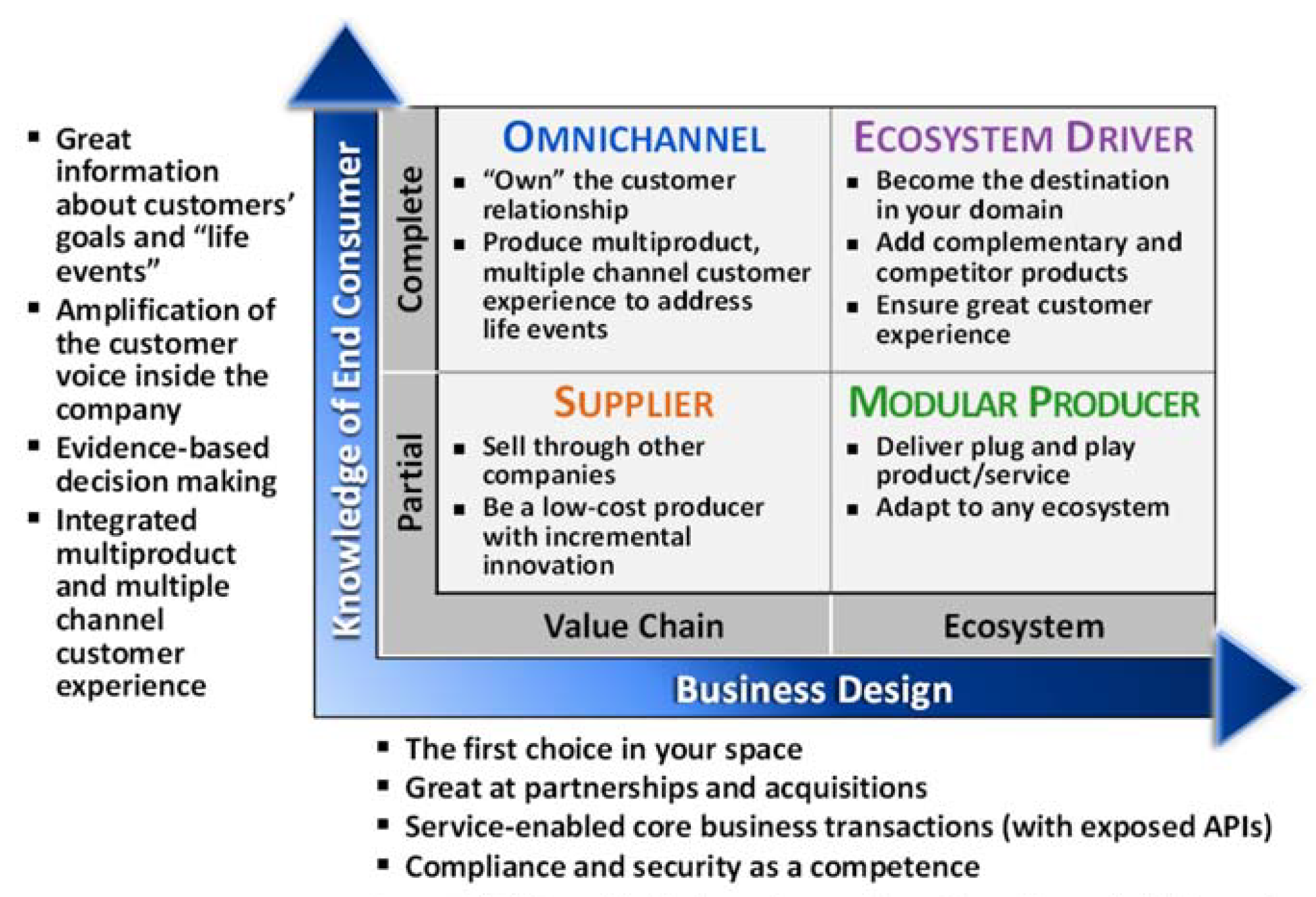

Figure 1 describes the framework and what it takes to move a business from one model to another. The horizontal axis of the 2x2 is the business design, with value chain and ecosystem as options. The vertical axis is the ability to understand and act on the needs of the end consumer. All four models—ecosystem driver, supplier, omnichannel, and modular producer—are viable business models, each with distinct opportunities and challenges. In our survey, we found that ecosystem driver was the dominant business model of only 12% of larger companies (companies with over $1 billion in revenues), while the remaining companies’ dominant models were respectively supplier (46%), omnichannel (24%), and modular producer (18%).[foot]MIT CISR 2013 Ecosystem Survey, N=101; and MIT CISR-Gartner 2013 Ecosystem Survey, N=93. Large firms >1 billion in revenues, Complete Customer Knowledge = 4 or 5 on at least 6 of the 7 customer knowledge questions and revenues 50% or greater from ecosystems. [/foot] However, 31% of smaller companies (with less than $1 billion in revenues) were ecosystem drivers, demonstrating the ability of small companies to strategically position themselves when they are young or to move quickly to that model—and also suggestive of the digital disruption that they can create.

Ecosystem drivers dominate in terms of performance. Relative to their industry average, ecosystem drivers had the best customer experience, time to market, revenue growth, and net margins. In more general terms, firms with a dominant model further up and to the right on the framework had better profitability.[foot]Statistically significant regression analysis of large firms (revenues > $1 billion); N= 91.[/foot] We expect that there will be a few dominant and profitable ecosystem drivers in each domain and an increasing number of modular producers. We think that each consumer will want an ecosystem driver for every service, or perhaps a “go-to” ecosystem driver for each domain (e.g., retail, financial services, entertainment, health care).

What It Takes to Move to Ecosystem Driver

Using our case studies and survey data, we identified four key capabilities to move up in the framework, and another four to move to the right (see figure 1).

Figure 1: Becoming an Ecosystem Driver

To move up and learn more about its customers, an aspiring ecosystem driver needs to:

- Use digital capabilities to obtain information about customers’ goals and life events. Many companies have customer data stored in separate departments, systems, and geographies, but frequently can’t deliver that data to a customer on his or her mobile device, during a phone call, or at a physical outlet at the “moment of truth”—when the customer decides to engage.

- Amplify the customer voice inside the company. Every company we saw that put a premium on better customer knowledge found a way to amplify the customer’s voice inside the company. This typically involves the widespread use of some kind of customer satisfaction metric—like accessing customers’ unvarnished sentiments via social media—and using big data techniques to test and learn.

- Emphasize evidence-based decision making. Many companies have relied on gut instinct and management experience to make key decisions about customer needs. However, in the era of big data, real-time dashboards, and many other sources of hard evidence, companies need to foster an evidence-based culture.

- Develop an integrated multiproduct and omnichannel customer experience. To make actual customer needs and goals central to the business model, companies need to stop selling products and instead meet the customer’s needs in the context of life events. This change requires companies to develop integrated products across multiple channels simultaneously.

In order to participate in a vibrant ecosystem, to move to the right a company must:

- Become the first choice in its space. For many customers, Amazon is the first choice for retail. Aetna would like to be your first choice for health care needs. Fidelity would like to be your first choice for wealth management.

- Become great at building partnerships. Ecosystem drivers have to find ways to partner with providers of complementary products and services (and probably also with competitors in the space) and then integrate the other things that customers want, such as payments and delivery.

- Create service-enabled interfaces that others can use. Take what makes you great: your core business transactions. Then make them easily and securely available throughout your business—and also to your partners. How? First, standardize and make your business rules available.

Aetna: Building a Healthier World

Aetna, with 2014 revenues of approximately $58 billion and approximately 50,000 employees, is a diversified health care company providing a broad range of health insurance products and associated services. Aetna identified that the current health care ecosystem is primed for disruption: companies that insure their employees face rising costs, consumers’ out-of-pocket expenses are increasing, and providers are being compensated for volume rather than rewarded for value. Worse still, Aetna has pointed out that with a customer experience rating below that of hotels, airlines, and cable TV providers, health insurers are ill prepared for the consumer environment. With the rise of health care exchanges, consumers across the US have fundamentally different ways to enroll in health care plans (Aetna currently operates in seventeen different public health care exchanges in the US). All of these changes led Aetna to adopt a new vision: to build a healthier world.

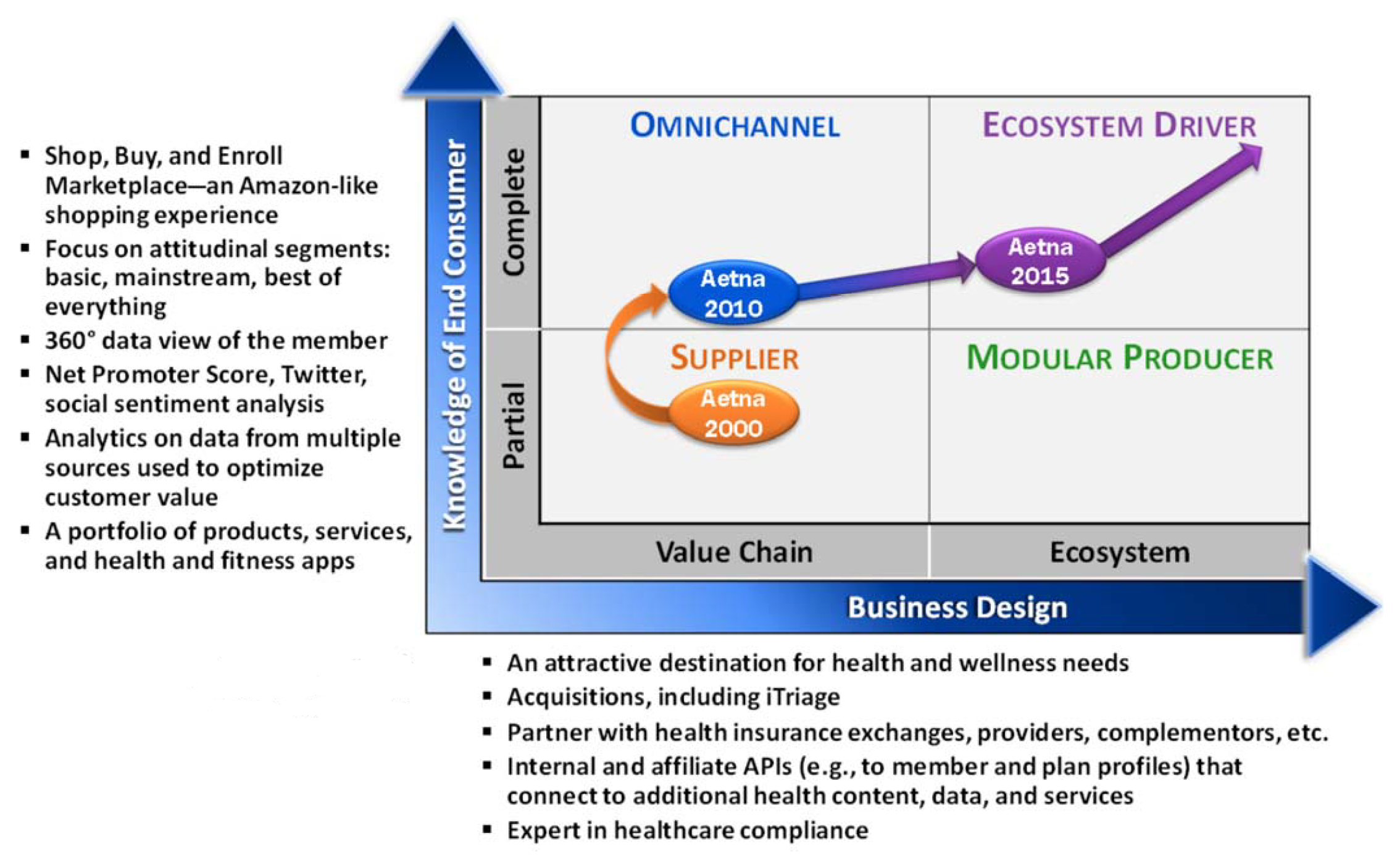

As part of that vision, Aetna seeks to be the most attractive destination to meet the needs of consumers and to provide the integrated services that ensure great customer experience (see figure 2 for examples of some of the integrated services). One example of Aetna’s recent offerings is iTriage, a mobile app that helps users assess their symptoms, research doctors, and find nearby treatment options, as well to make appointments, share their medical history with permission, and help to manage follow-up treatment. Last year, unique visitors to iTriage grew 516%—more than Uber! Users of iTriage benefit by receiving information and making 40% fewer emergency room visits, saving costs for all.

Figure 2: Aetna—Becoming an Ecosystem Driver

How Aetna Moved

Over the course of fifteen years, Aetna’s digital strategy moved the company from a supplier of insurance (2000), to an omnichannel business that allowed customers to interact with it seamlessly on any channel (2010), to an ecosystem driver with digital capabilities to broker connections between the company, its customers, and its partners. Aetna developed a number of digital capabilities to move up and to the right in our framework. For example, to better understand the customer (moving up), the IT organization led an effort to integrate multiple systems across the company in order to provide a 360° data view of every member. Aetna is using integration engines, business rules engines, and data science insights to improve customer engagement and health plan utilization. To increase the customer’s voice inside the company, Aetna uses Net Promoter Scores (a measure of customer satisfaction), engages with customers on Twitter and other social media, and tracks social sentiment analysis.

In order to become an effective ecosystem driver, Aetna had to be an attractive destination for health and wellness needs. The company achieved this through initiatives that included developing a clear vision, integrating a series of acquisitions and partnerships, and opening up Aetna’s business capabilities so that others could connect. For example, the IT group led a program to API-enable many of Aetna’s key business capacities so that internal colleagues and external affiliates could use them for innovation and service provision. Aetna architected a layered approach to support various systems of engagement that include mobile, wearable platforms, and web apps. Security, management, scalability, and maintainability were key architectural drivers for Aetna. The goal of enabling API integration is to bring a delightful and intuitive experience to the customer, like the experience delivered by the API-enabled integration of Aetna’s traditional plan offerings with consumer wellness offerings.

What to Do?

We believe digitization will move business designs toward becoming more open, with increasing competition and probably consolidation among companies. For example, the media industry is well along this transformation. We recommend that every company buy options for the future by experimenting with becoming an ecosystem driver for least some of its best customers. Without having a successful ecosystem driver business, the only viable option is to become a modular producer—a much more competitive and easily replaced business model. Will you become an Amazon or a seller on Amazon? As one of our workshop participants so eloquently put it, “It’s all about who’s going to become the head of the snake.”

© 2015 MIT Sloan CISR, Weill, Woerner, and Samuel. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.