Many companies plan to achieve breakthrough performance via digitally enabled business transformation. They are now in the middle of the hard work of execution—implementing the difficult organizational changes needed to succeed. We call these changes “organizational explosions” because that’s what they feel like; they are significant, disruptive changes that affect most of a company’s customers, employees, and partners.

In this briefing we share insights from the digital transformation journeys of 216 companies.[foot]The analysis was performed on a subset of respondents to the MIT CISR 2017 Pathways to Digital Business Transformation survey (N=413)—specifically, those 216 companies that had started their digital transformation and provided performance data. For N=216 we compared the (industry-corrected) net margins and revenue growth of companies greater and less than 50% complete relative to the cross-industry average.[/foot] When we grouped these companies by whether they had completed more or less than 50% of their journey, we saw impressive differences in performance: Companies whose transformation was at least 50% complete had 32% higher net margins and 67% higher revenue growth than companies whose transformation was less than 50% complete.

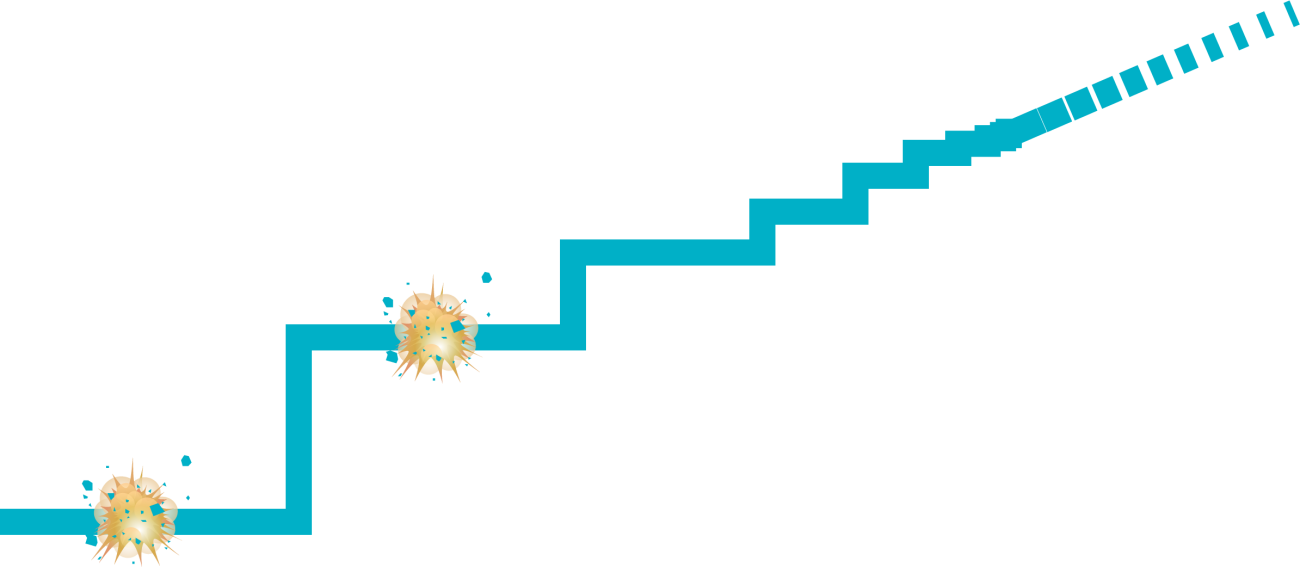

Achieving breakthrough performance is not easy and typically requires four types of controlled organizational explosions. To ensure the explosions create—rather than destroy—value, they need to be carefully designed, and their impacts anticipated and managed.