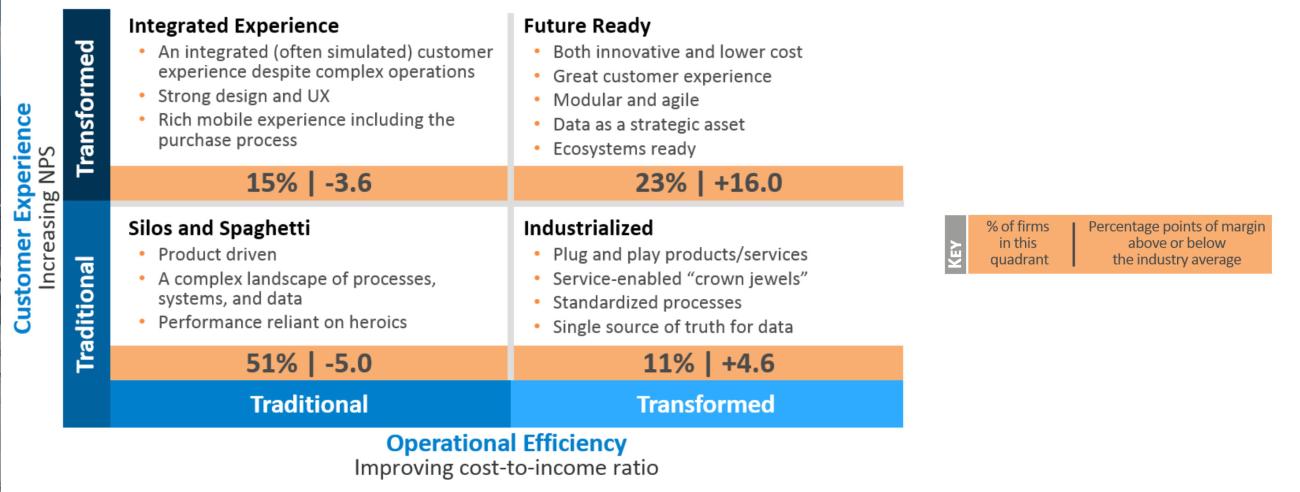

FOUR PATHWAYS TO TRANSFORMATION

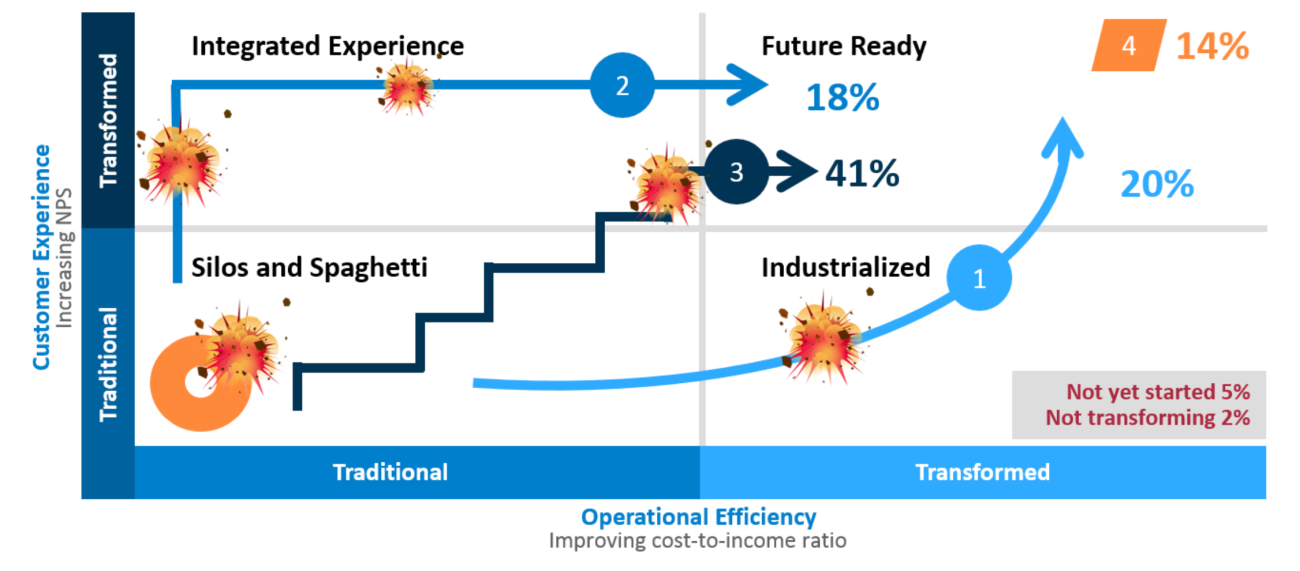

We observed four distinct pathways to Future Ready; figure 2 shows the percentage of firms following each pathway. All the pathways begin in the Silos and Spaghetti quadrant and involve some substantial organizational disruption—indicated by the figure’s explosions! The explosions represent significant or radical changes, typically in decision rights (e.g., which customer onboarding process to use, who can launch a new offering) or company structure (e.g., from a product to services focus). In a future publication on pathways, we will discuss the explosions and effective practices for each pathway.

Pathway 1 moves the company right from Silos and Spaghetti to Industrialized. This pathway relies on building API-enabled business services for delivery across the company and externally. The advantages include discarding some legacy processes and systems and starting afresh. But ask anyone who’s been through an ERP, CRM, or core banking implementation: it is a multiyear, expensive, all-consuming process to rip out and replace the core of the company. And meanwhile, many other important projects stop or stall. Cloud computing, APIs, micro- services, and better solution architectures are making this industrialization process quicker and less risky and disruptive. As they move right and improve operational efficiency, companies on pathway 1 see a welcome lift in customer experience—but only after completing the long, flat, and arduous initial stages, and as more reusable services that improve customer experience are made available. Danske Bank, Nielsen, CBA, and Tetra Pak are among those that have adopted this approach.

Pathway 2 moves vertically up from Silos and Spaghetti to Integrated Experience. mBank, a fast-growing bank based in Poland that took this approach, focused on adding features and channels and growing the customer base rapidly—but then customer experience at the bank started to suffer. Companies on this pathway find that after initial investments, the marginal benefits from spending more on customer experience decrease. The complexity of underlying systems, processes, and data constrains further proportional improvement in customer experience. An explosion occurs on this pathway when power and decision rights are passed from product owners to executives who are focused on a multi-product, multichannel customer experience.

Eventually, companies on pathway 2 have to transform their operations. mBank refocused its efforts, and over fifteen months implemented a new customer-at-the-center banking platform, moving the company right on the framework.[foot]N.O. Fonstad, S.L. Woerner, and P. Weill, “mBank: Creating the Digital Bank,” MIT Sloan CISR Research Briefing, Vol. XV, No. 10, October 2015.[/foot]] Pathway 2 produces an intense customer experience focus, with clear market impact. But fulfilling the new customer experience puts pressure on the complex landscape of processes, systems, and data to do things it wasn’t designed to do—with heroics still required—at a high cost.

Pathway 3 takes small steps in each direction—alternating improving the customer experience and then operations—over several iterations. The first move to improve the customer experience might be to implement an omnichannel capability or a mobile app. Then the company’s focus switches to improving operations, perhaps by replacing a few legacy processes and systems or creating an API layer. The next effort might be to improve the customer experience by better using the company’s data and providing a more tailored set of offerings. And so on. A key difference between success and failure with this approach is having an overall transformation roadmap that informs each of these individual efforts. BBVA and Schneider Electric are examples of companies that have effectively taken Pathway 3. The advantage is that the company can take smaller steps in each direction, reducing risk. A disadvantage is that continually shifting the company’s internal focus can take a toll on employees.

Leaders on Pathway 4 have decided that it’s going to be very difficult to transform their current company. Instead, they start a new Future Ready company with all the advantages built in. Many companies have used this approach. More than a decade ago, ING launched ING Direct, first in Canada and then in multiple countries, to create a very successful new bank. The hardest part of this pathway occurs when you later try to merge the parent company and the new company—the cultures and everything else about the two organizations are completely different. ING recently announced a company reorganization with a loss of 7000 jobs.[foot]“ING to spend EUR800 million on digital integration; shed 7000 jobs,” Finextra, October 3, 2016.[/foot]

PICK YOUR PATHWAY

Leadership’s role is to determine which of the four pathways the company (or business unit) will take and how aggressively to transform. Start by determining where you are today using metrics like NPS and net margin compared to your industry. Then choose:

- Pathway 1 if your customer experience is around industry average

- Pathway 2 if your customer experience is significantly below average and you can’t wait to improve or there are new scary new competitors

- Pathway 3 if customer experience is a problem but you can identify a few limited initiatives that will make a big difference. Start with those and then focus on operations and repeat in small steps

- Pathway 4 to build a new company if you can’t see a way to change the culture, customer experience, and operations fast enough to survive