3. Develop a Set of Reusable Components

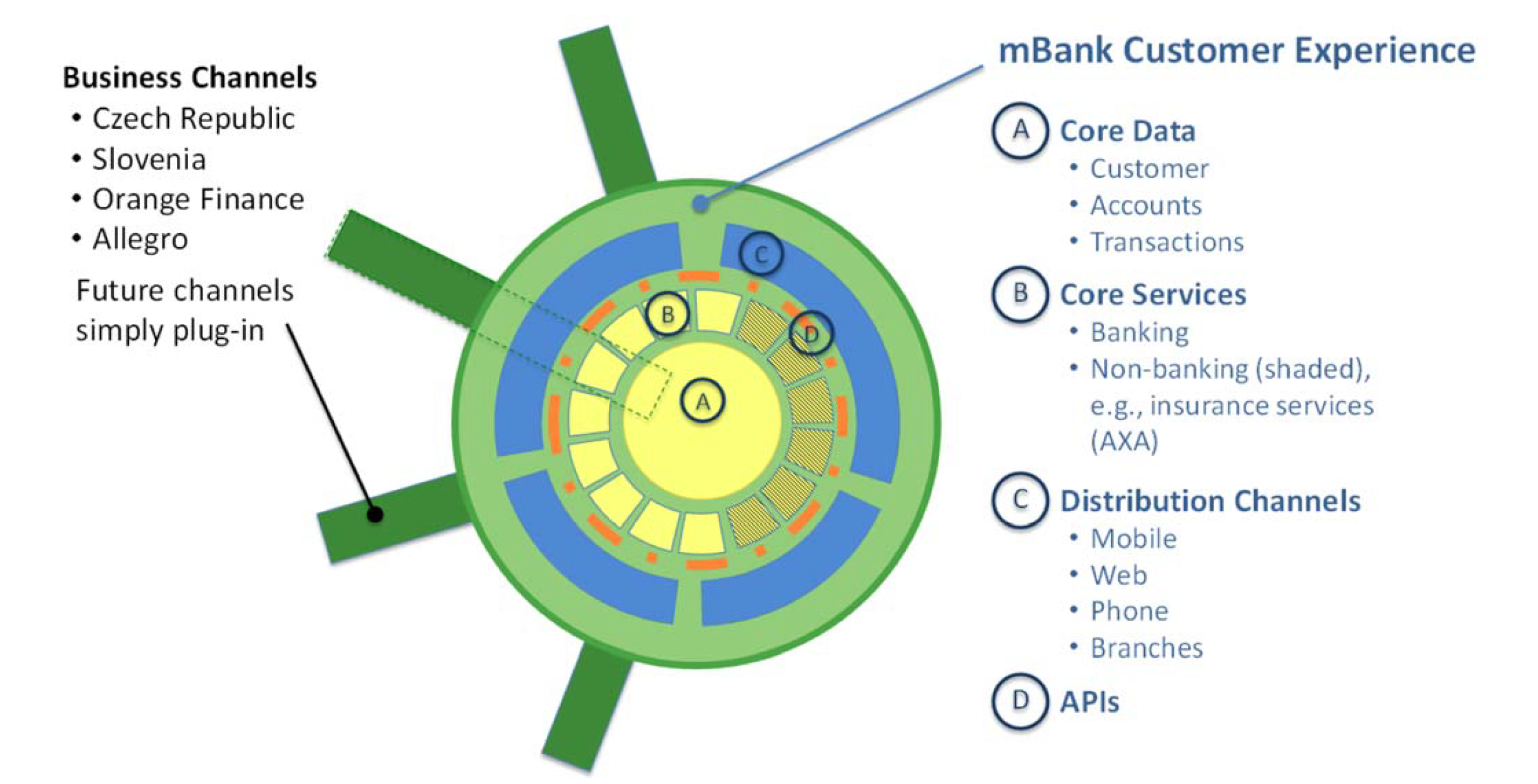

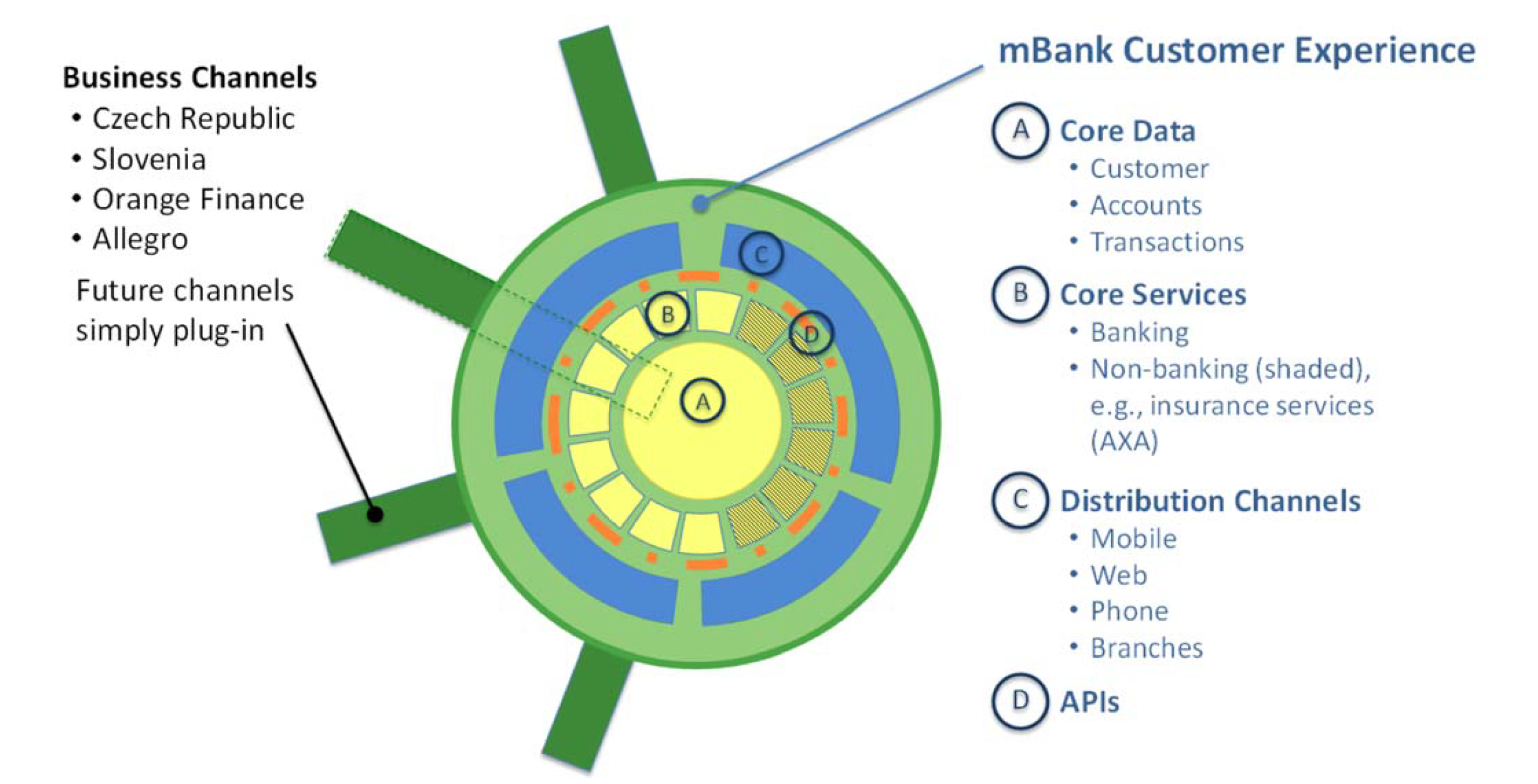

The customer experience at mBank is made up in part of over two hundred features such as the aforementioned quick credit applications and loan approvals plus display for forecast, mobile payments, peer-to-peer (P2P) transfers, and cardless ATM withdrawals. Teams create these features using only four types of components from mBank’s digitized platform (see figure 1): (1) core data; (2) core services, including both banking and non-banking services;[foot]In 2015, mBank introduced two kinds of physical branches: light acquisition branches and advisory centers. Its light acquisition branches won the bank the Best of Show award at FinovateEurope 2015.[/foot] (3) distribution channels, such as mobile, web, branches, and call centers; and (4) APIs that enable all distribution channels to access core data and core services. As a result, when a customer performs a transaction or makes a change on her/his mBank mobile app, the information is immediately available to customer representatives and distribution channels. This design enables a consistent customer experience across channels. Creating features from a simple set of reusable components enables mBank to innovate more rapidly, effectively, and efficiently than competitors.

Figure 1: Reinventing the Core of Banking: mBank’s Customer Experience Relies on a Single Digitized Platform

In 2008, mBank opened up its digitized platform to business channels. mBank creates a business channel to extend its customer experience to a new set of customers, whether to set up a bank in a new market such as the Czech Republic or to partner with a company such as Orange or Allegro (an e-commerce marketplace) in order to offer its customers mBank services. A business channel can draw on all four components of the mBank’s platform. This enables mBank to deliver tailored services without creating separate systems to reach a new set of customers, and thereby supporting multiple tenants on a single platform.[foot]In mBank’s multitenant system, each customer has a Customer ID and a Business Channel ID. Customers are identified not only by who they are but also by the bank to which they belong. Multitenant architecture permits mBank to maintain a single system that it partitions logically to support multiple business channels. [/foot]

New features are developed by teams led by one each IT and non-IT managers; the two are jointly responsible to develop a feature that both enhances the customer experience and complements mBank’s digitized platform. If a new feature needs a component that is not already part of the platform, mBank will decide whether to develop the component internally or to partner with external service providers to deliver the functionality. All enhancements to the digitized platform are developed in response to a new business opportunity and then become available to all, enabling maximum reuse.

4. Partner the Business and IT

Improving customer experience results from early and tight collaboration between IT and the rest of the business. Together, they manage a variety of trade-offs inherent in developing new features for customers, creating solutions that both fulfill customer demands and safeguard the digitized platform. Jacek Iljin, managing director of Sales and Processes at mBank, explained, “If we do not include IT early on, then we risk producing something completely inadequate and overly complex from a functional perspective.” IT contributes a strong understanding of how the business operates, whereas the business co-leader brings a strong sales perspective and understanding of customers. Top management leaders primarily play the role of arbiters.

All feature developments are assessed along a variety of metrics. Two key dimensions are complexity and value to the end customer. Complexity is measured by ascertaining whether the feature consists of existing platform components or is already available on the market. Customer value is assessed by looking at the importance of the problem being solved by the new feature and how many customers are expected to use it.

If a proposed feature is completely new for mBank, it is rated very high along the complexity dimension (no existing components nor internal expertise with the feature). However, because mBank has for several years been regularly assessing its platform components to ensure that they are relevant, there are now few new features that are typically rated high in complexity on the current platform. “The IT architecture affects the business decisions you are going to make in the future. This is a key reason why IT needs to work hand-in-hand with the rest of the business,” explained Krzysztof Dąbrowski, managing director of mBank IT.

mBank relies on external partners to provision some new, complex services. According to mBank COO/CIO Jarosław Mastalerz, “The bank is unable to master all kinds of services complementary to banking, and as a result [it] must learn how to govern the relations with third parties.”

5. Extend Services and Access More Customers via External Partners

Partnerships have enabled mBank to provide new services to existing customers as well as to access new pools of customers. Before partnering with the insurance provider AXA, mBank bought insurance products and services and sold them to customers. The new partnership gives AXA exclusive access to mBank customers, as well as access to its platform services (e.g., a payment scheme to collect premiums). AXA develops and provisions the insurance services—but because AXA’s sales takes place by means of the mBank platform, mBank retains control of the customer experience and the platform services. The collaboration with AXA has allowed mBank to transition from a seller of a few insurance products to a host of best-of-breed insurance options for customers.

In another kind of partnership that gives the bank access to potential customers, mBank serves as a white label banking service. mBank’s first significant partnership of this type was with telecommunications provider Orange Polska. Orange Finance—the result of the partnership—debuted in October 2014, just six months after the agreement was signed. The launch of Orange Finance was quick because the development team essentially took mBank’s distribution channel, applied a new skin with Orange’s branding, and enabled a subset of available functionality (i.e., core services and data). As a result of the partnership, by the end of July 2015 mBank had acquired close to 150,000 new customers, and Orange Finance customers got access to banking services with enhanced customer experience. This was enabled by:

- mBank’s banking license, modern platform for mobile and online banking, and know-how and expertise in the banking industry

- Orange Polska’s attractive client base, broad distribution network, and significant marketing and branding

A Digital Bank Pays Off

mBank is reinventing banking for a digital economy. Using the five practices described above, mBank has developed a strong internal capability that combines the best of both worlds: the fast track tech-enabled innovation typically found in a FinTech company; and the mature management, funding, and relationships of a bank.