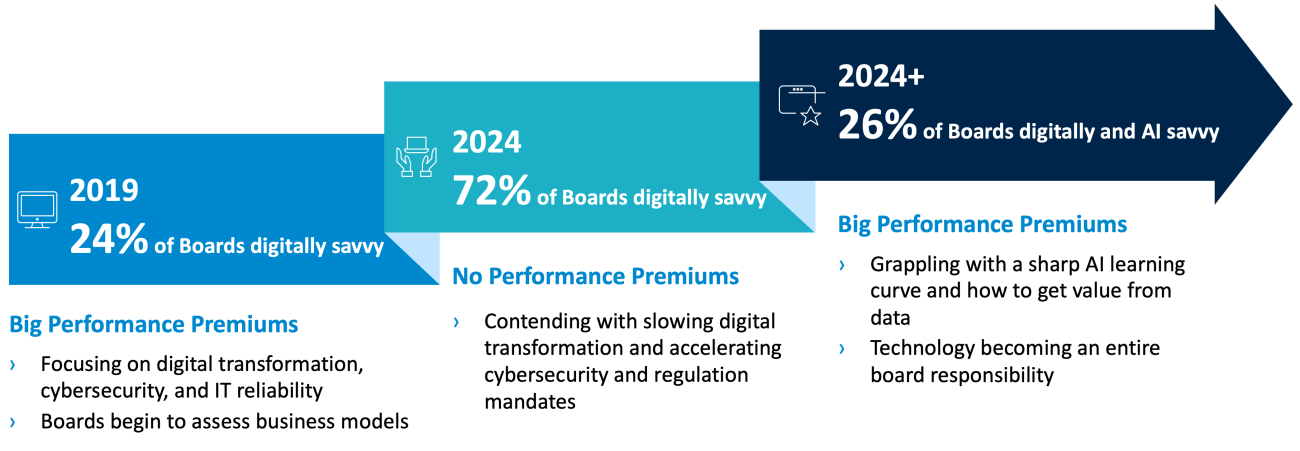

In 2019 MIT CISR published findings from our research on digitally savvy boards.[foot]MIT CISR defines digital savvy as an understanding, developed through experience and education, of the impact that emerging technologies will have on businesses’ success over the next decade, and a digitally savvy board as a company board having a critical mass of directors who are digitally savvy. MIT CISR published key findings from its digitally savvy board research in P. Weill, S. L. Woerner, T. Apel, and J. S. Banner, “Companies with a Digitally Savvy Board Perform Better,” MIT CISR Research Briefing, Vol. XIX, No. 1, January 2019, https://cisr.mit.edu/publication/2019_0101_DigitallySavvyBoards_WeillWoernerApelBanner, and the complete findings in “It Pays to Have a Digitally Savvy Board,” MIT Sloan Management Review, March 2019, https://sloanreview.mit.edu/article/it-pays-to-have-a-digitally-savvy-board/.[/foot] We found that 24 percent of the boards of all US-listed companies with over $1 billion in revenues were digitally savvy, and that these companies had outperformed their industry peers by approximately 30 percent across several metrics.

Since 2019, the technology innovation curve has steepened, with large organizations leveraging new digital technologies such as generative and agentic AI, robotics, and xTech technologies. In 2024, we repeated the 2019 analysis and found that having a digitally savvy board based on our original criteria no longer differentiated a company’s performance. However, when we updated the criteria with technologies that had emerged or evolved between 2019 and 2024—notably, newer types of AI, as well as machine learning—the results were similar to our original analysis, with 26 percent of company boards being digitally and AI savvy, and their companies outperforming their peers. We complemented these findings with an examination of board committees to understand how the boards’ focus related to their company’s financial performance.[foot]Thank you to Thomas R. Schoales for help in coding committee topics and Dr. David R. Chase for his work in analyzing committee topics. [/foot] In this briefing we share these results plus insights from twelve interviews of non-executive board directors, and show how companies in our research used board committees to help manage their work.