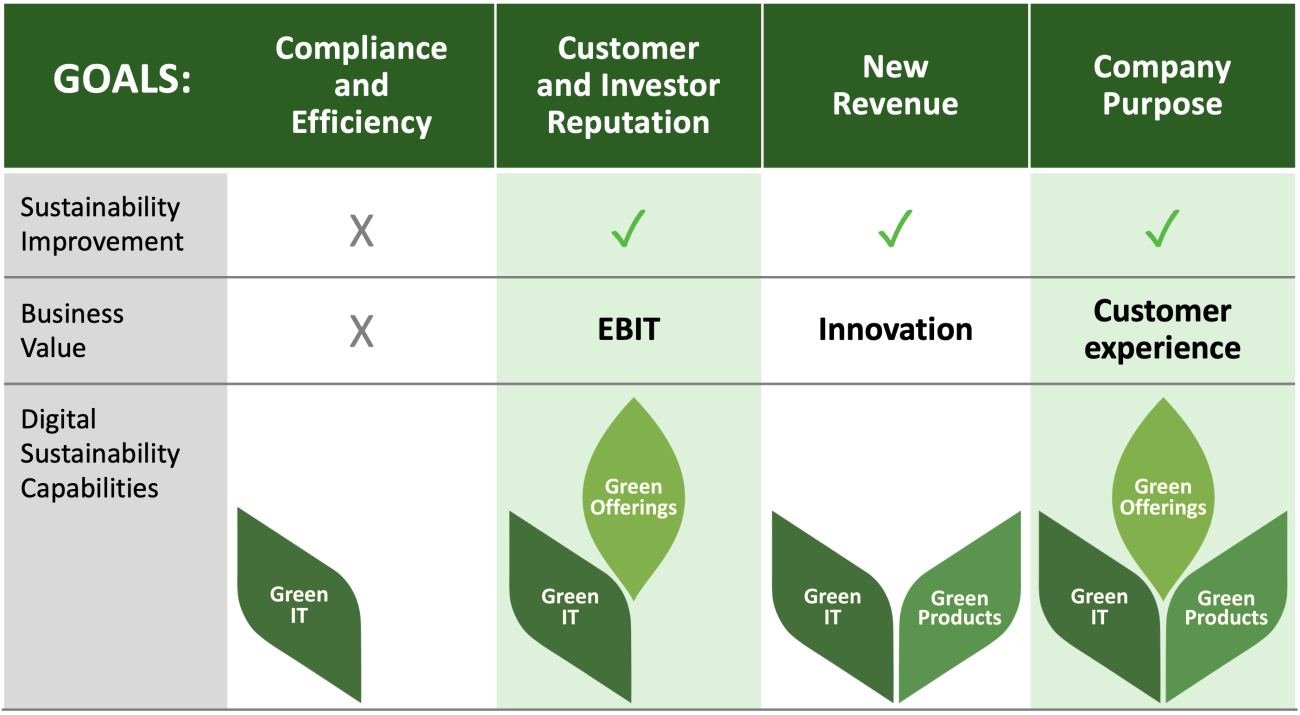

Earlier MIT CISR research showed that companies build three types of digital sustainability capabilities to scale carbon emission reduction: green IT, green products, and green digital offerings.[foot]I. M. Sebastian, T. Haskamp, and S. L. Woerner, “Creating an Enterprise Capability for Digital Sustainability,” MIT CISR Research Briefing, Vol. XXIV, No. 3, March 2024, https://cisr.mit.edu/publication/2024_0301_GreenCIO_SebastianHaskampWoerner.[/foot] Based on a recent survey, companies that do this make significant progress on sustainability. The survey found that from 2022 to 2023, companies in the top quartile on digital sustainability were 15 percent better at improving their sustainability than companies in the bottom quartile, and the top quartile companies were 19 percent more effective at incorporating circularity principles.[foot]Statistical results are based on an analysis of the annual Swiss Manufacturing Survey 2024, N=360 from 339 Swiss manufacturing companies in 21 industries. Thirty percent of participants reported global production locations. MIT CISR collaborated with the Institute of Technology Management, University of St. Gallen, Switzerland on the survey research by adding questions to the survey and conducting analysis for this research briefing.[/foot] Sustainability is becoming a performance metric and an important issue for both senior executives and boards; for example, in 2024, 24 percent of publicly traded companies had a board committee with ESG as part of its mandate.[foot]Company board committee information downloaded from BoardEx, a company board of directors database. MIT CISR researchers categorized board committees into fourteen different topics, one of which was sustainability.[/foot]

But in the recent survey, we also found that being a high performer on digital sustainability did not directly differentiate company performance. This lack of bottom-line impact makes it hard for companies to view sustainability as an opportunity for value creation rather than solely a cost of doing business—perhaps explaining some of the corporate pushback on sustainability investments.[foot]Mary Foley, “Do Businesses Need to Rethink their Approach to Sustainability Now?,” Forbes, December 16, 2024, https://www.forbes.com/sites/maryfoley/2024/12/16/do-businesses-need-to-rethink-their-approach-to-sustainability-now/. [/foot]

The survey research did find, however, that companies that pursued strategic sustainability goals saw bottom-line impacts. This briefing explores how and when companies create business value from digital sustainability, and the relationship between strategic sustainability goals and digital sustainability capabilities.