A common concern of CIOs and CTOs is how best to work with the nimble tech companies we call xTechs[foot]MIT CISR defines xTechs as businesses that use technology to modify, enhance, or automate an area of services (e.g., financial, legal, marketing) for organizations or consumers.[/foot] to help business colleagues realize the benefits while also managing risks.

This briefing on xTechs is the second in a series identifying what executives and xTech entrepreneurs want out of partnerships and how xTechs can add value safely.[foot]This study continues research begun by the author in 2021 (see A. Thorogood and P. Reynolds, “Growing with xTechs,” MIT CISR Research Briefing, Vol. XXIII, No. 2, February 2023, https://cisr.mit.edu/publication/2023_0201_GrowingwithxTechs_ThorogoodReynolds). The author began this study by administering a survey (MIT CISR 2023 Survey of Copenhagen Fintech members, N=52) which included twenty-seven responses from large established financial services organizations and twenty-five from fintechs. Copenhagen Fintech is a global fintech hub for corporate and start-up innovators; see Copenhagen Fintech, https://www.copenhagenfintech.dk/.

The author then conducted a qualitative case study with Bendigo and Adelaide Bank in 2023 on its use of xTechs, interviewing 11 executives and collecting substantial secondary data. Finally, he administered two surveys in the US, one to established firms (MIT CISR 2023 xTech Survey, Establishment View, N=172) and one to xTech companies (MIT CISR 2023 xTech Survey, xTech View, N=166). In all phases of the study, the author asked questions about the value the interviewees sought to achieve and the risks they encountered.[/foot] In the first briefing, we reported that in our research, senior executives from large organizations aspired to deliver innovation, speed to market, and the internal adoption of an agile mindset through partnerships with xTechs.

In a digital world, no organization can thrive on its own, and xTechs offer potent capabilities to deliver quickly and agilely. In a recent survey,[foot]MIT CISR 2023 Survey of Copenhagen Fintech members (N=52).[/foot] more than 75 percent of the financial services leaders who responded expected xTechs would deliver innovation and enable their organizations to move quickly. At the same time, the executives were concerned with brand, regulatory, and compliance risks. Forty-eight percent of respondents reported that the due diligence necessary to protect the brand and ensure compliance is extensive—and expensive.

We spoke with both financial services executives and xTech entrepreneurs to investigate if organizations that apply methodical risk management to partnerships with xTechs see more successful product and service innovations. We found that working slowly is a significant obstacle both for the executives, who want their organizations to be faster, and the entrepreneurs, who must maintain growth of their valuations.

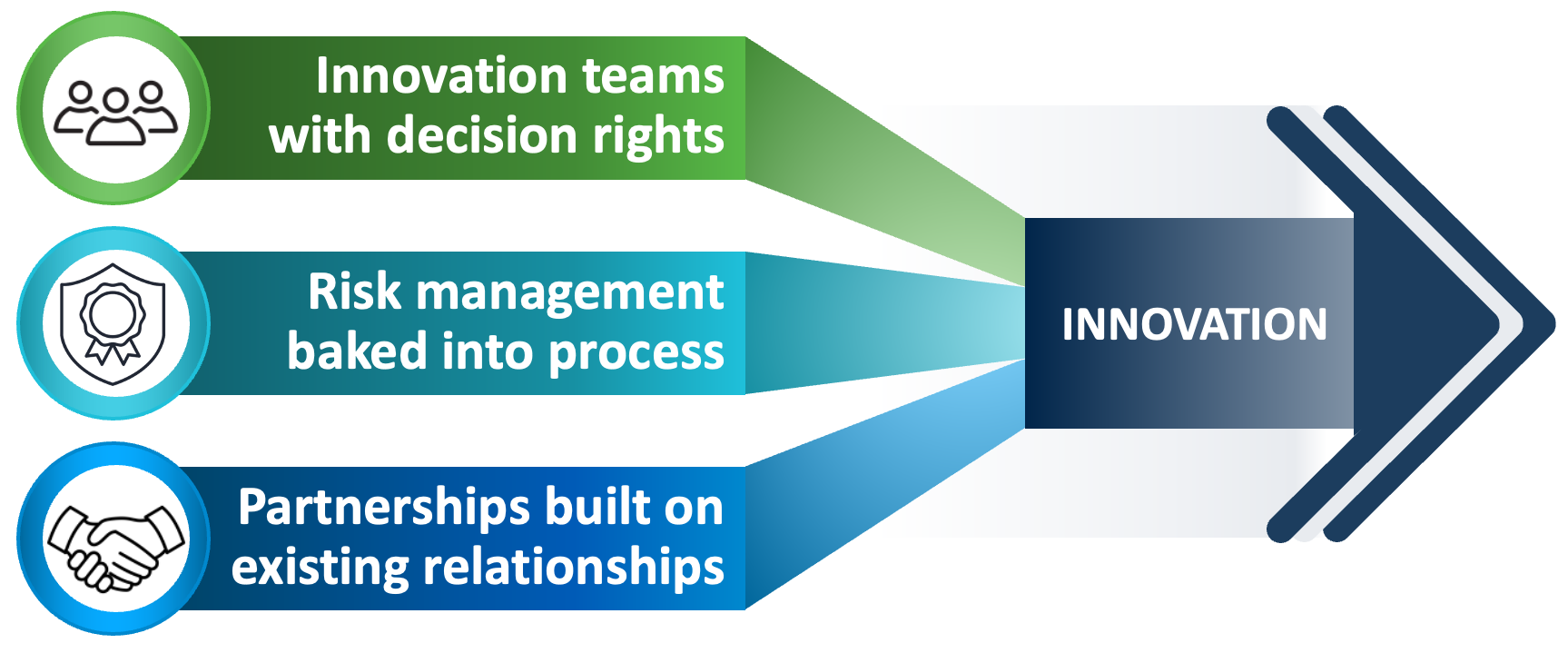

To better understand what it takes to get increased innovation from xTech partnerships, at the end of 2023[foot]MIT CISR 2023 xTech Survey, Establishment View (N=172).[/foot] we surveyed 172 large companies that engage with xTechs. We asked a number of questions about the mechanisms these companies used to enable partnerships with xTechs. We ran regressions to identify which mechanisms contributed to increasing innovation (measured by the percentage of revenues from new products and services introduced in the last three years). We found that three mechanisms were statistically significant for increasing innovation (see figure 1):

- Using collaborative innovation teams that have decision rights

- Incorporating risk management into the innovation process

- Partnering with xTechs where there are existing relationships, which builds a base of trust