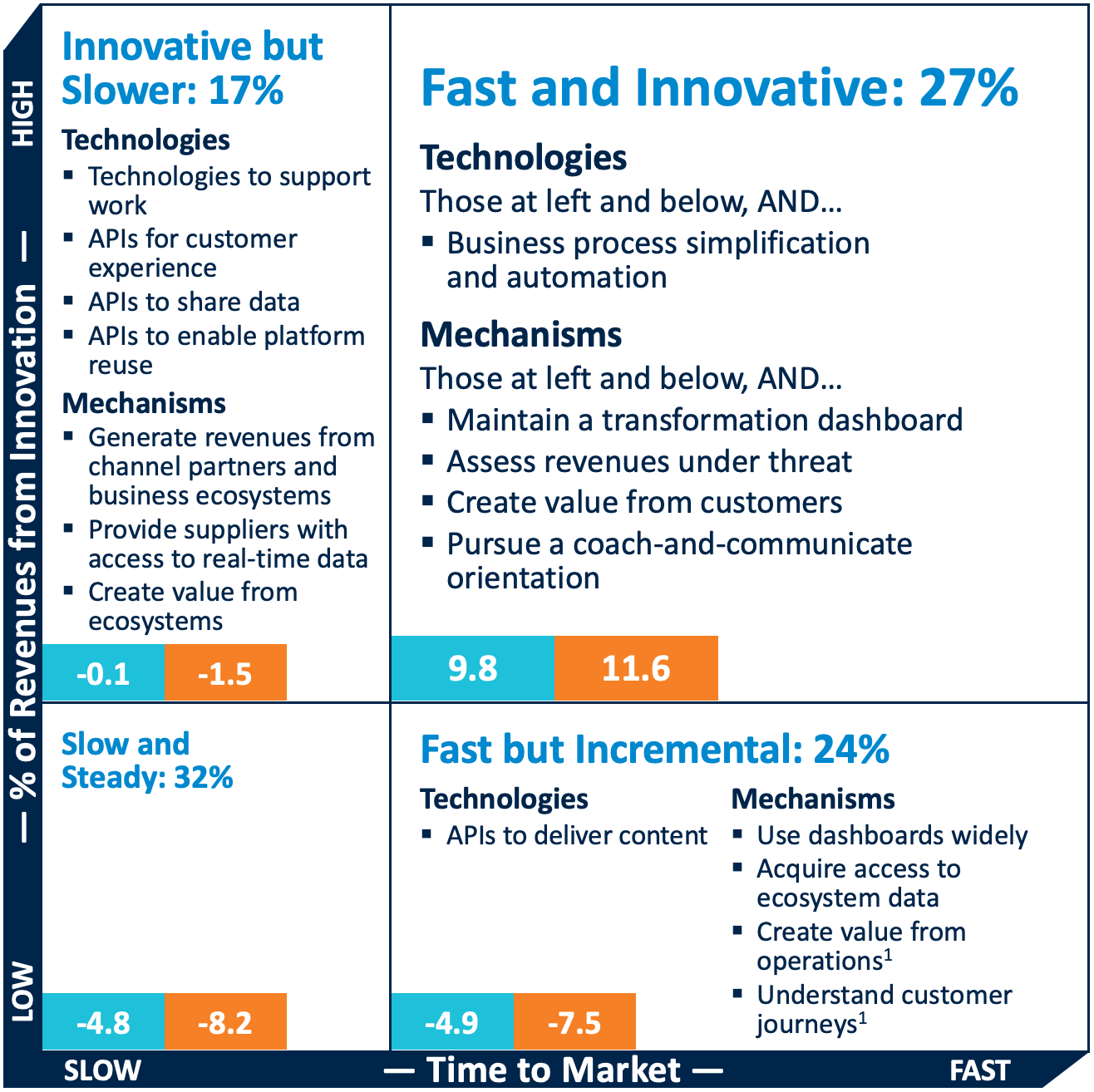

In the many workshops that MIT CISR conducts with senior executive teams, we often hear participants say “if only we could go faster.” So we decided to research what happens if a company goes faster, and the answer was surprising: speed alone doesn’t differentiate much. In our research, companies that were top performing on both growth and margin relative to their industries not only went faster to market but also innovated more effectively.

In this briefing, we identify four drivers of the combination of speed and innovation and discuss how it contributes to top performance. We describe how companies achieve this combination with a mix of enabling technologies and management mechanisms. Finally, we illustrate this approach with a case study of Mercedes-Benz that demonstrates how the company achieves resilience via combined speed and innovation.