Recent MIT CISR research showed that large, established organizations gain a competitive edge when they decentralize decision-making. In this approach, senior leaders set strategic objectives for the organization but empower most of its teams with the authority and accountability to decide how best to achieve those objectives. As teams are closest to emerging opportunities, they are best positioned to quickly sense and seize them. This increases organizational agility, and produces higher returns from innovation as well as net profit margins and revenue growth rates well above industry averages.[foot]These findings are based on data from the MIT CISR 2022 Decision Rights for the Digital Era Survey (N=342). Compared to reports from peers at large centralized organizations, respondents from large decentralized organizations reported average net profit margins and revenue growth rates that were respectively 6.2 and 9.8 percentage points higher, and their revenues from products and services introduced in the last three years (a key measure of innovation) were 1.5 times as high, measuring 28.8 percent. We classified organizations as decentralized if ≥50 percent of teams had operational decision rights. For a full overview of these findings, see N. van der Meulen, “Realizing Decentralized Economies of Scale,” MIT CISR Research Briefing, Vol. XXIII, No. 1, January 2023, https://cisr.mit.edu/publication/2023_0101_DecentralizedDecisionMaking_VanderMeulen.[/foot]

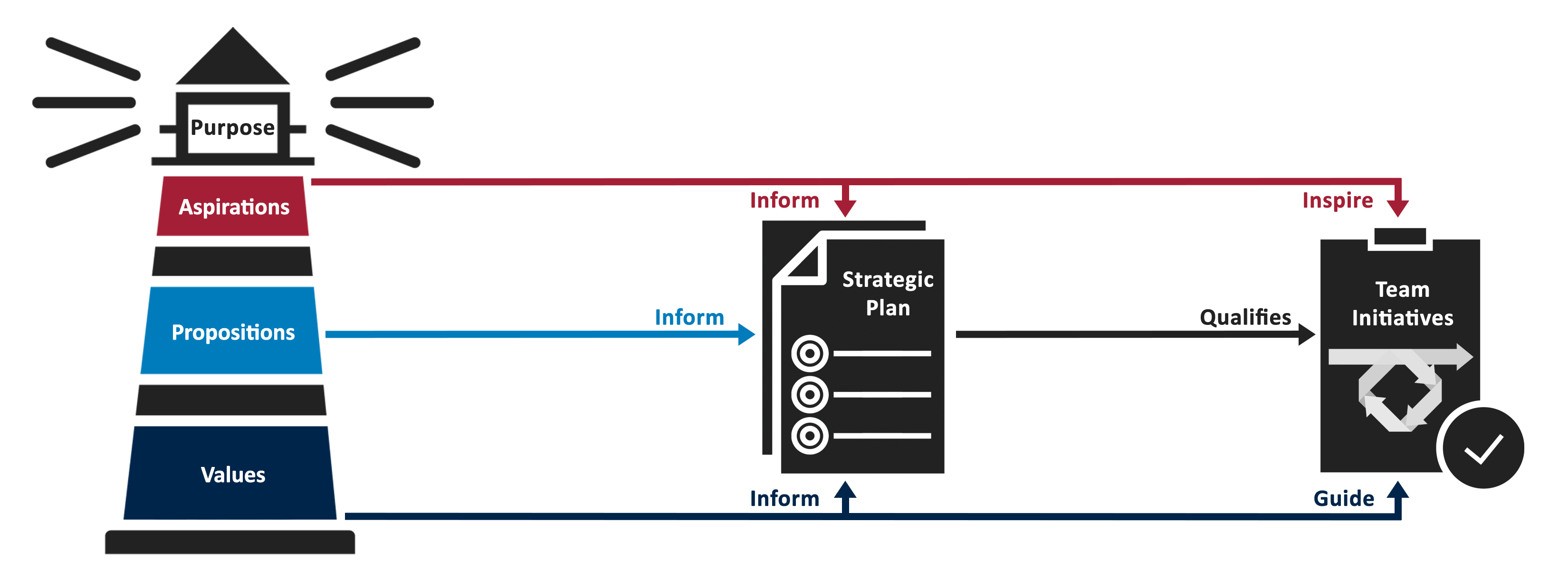

However, the success of decentralized decision-making hinges on the organization having a comprehensive organizational purpose: a multi-faceted statement that articulates why the organization exists by outlining future aspirations, value propositions, and core values. An organization’s purpose can serve as a source of inspiration to teams, inform strategic planning, and guide decision-making.

We found that the performance benefits organizations achieve from decentralized decision-making were amplified in organizations where purpose was ingrained in leaders’ planning and teams’ decision-making processes. In our survey, these organizations reported average net profit margins and revenue growth rates that were respectively 5.4 and 12.9 percentage points above their industry averages. Without an ingrained purpose, however, decentralized organizations fell behind their industry peers, reporting net profit margins and revenue growth rates that were respectively -0.2 and -0.7 percentage points below industry averages.[foot]MIT CISR 2022 Decision Rights for the Digital Era Survey (N=342). To measure how ingrained an organization’s purpose was, we asked about the extent to which purpose was integrated into employee decision-making processes and ways of working, purpose informed strategic objectives and metrics, and teams linked their decisions to strategic objectives and metrics.[/foot]

In this briefing, we describe the three core components that make up a comprehensive organizational purpose and discuss how these components support decentralized decision-making by aligning leaders’ strategic objectives and teams’ decisions.