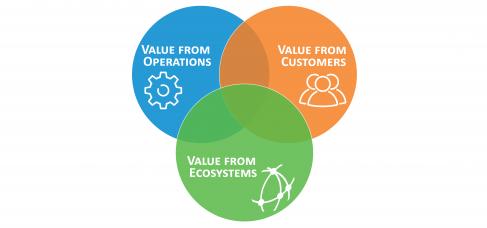

Increasingly, companies partner across industries and sectors in fundamentally new ways to solve complex challenges. For example, the Reserve Bank of Australia (RBA) and the government agency Services Australia collaborated to provide real-time emergency relief payments to citizens who had lost their homes and livelihoods in the country’s 2020 bush fires. The organizations developed an innovative service to deliver more than AUD$233 million in disaster recovery payments directly to Australian citizens’ bank accounts as the citizens were requesting help from Services Australia online, on the phone, or in a service center. The organizations offered the same service in 2021 to deliver COVID support payments. The service leveraged a real-time payments system called the New Payments Platform (NPP)[foot]“NPP Roadmap October 2021," New Payments Platform, October 25, 2021, 1, https://nppa.com.au/wp-content/uploads/2021/10/NPP-October-2021-Roadmap.pdf.[/foot] that was launched in 2018 by an RBA-initiated industry collaboration of thirteen banks.[foot]The description in this research briefing of the development of the NPP and the collaboration of RBA and Services Australia to leverage it is based on I. M. Sebastian, “Reserve Bank of Australia: Collaborating to Build and Leverage the New Payments Platform,” MIT Sloan CISR Working Paper No. 456, May 2022, https://cisr.mit.edu/publication/2022_0501_RelationalEcosystems_SebastianGittell.[/foot]

Collaborative efforts by organizations in an ecosystem to create new digital solutions like the NPP can benefit participants economically, but such efforts create two coordination challenges: uncertainty and interdependence. Ecosystems must adapt on the fly in response to new information that surfaces emergent opportunities and challenges (e.g., an urgent need to make payments quickly). At the same time, due to participants’ interdependence, ecosystem leaders must orchestrate decisions across the ecosystem to ensure communal success. The contemporary challenge for digital leaders is how to effectively coordinate ecosystem collaboration.

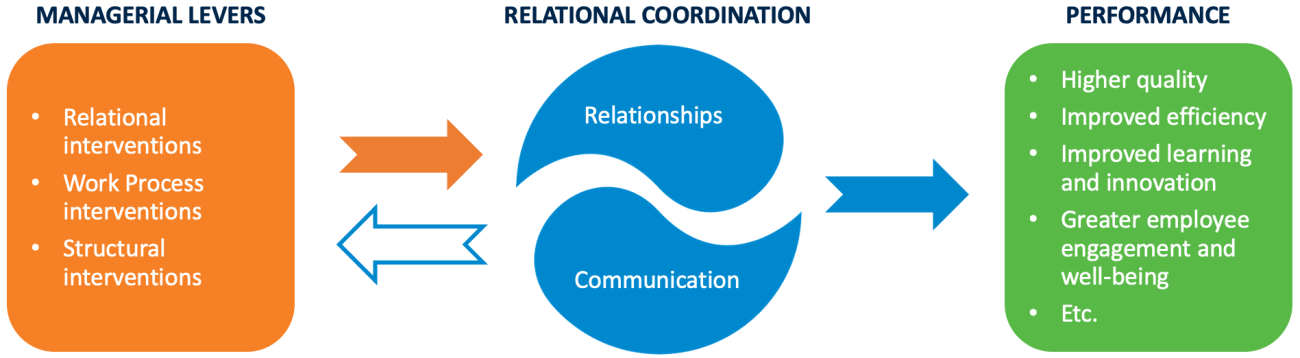

In this research briefing, we describe three managerial levers that can help ecosystem leaders manage this challenge. We then describe the ecosystem collaboration to create the NPP and illustrate each managerial lever using examples from the collaboration.