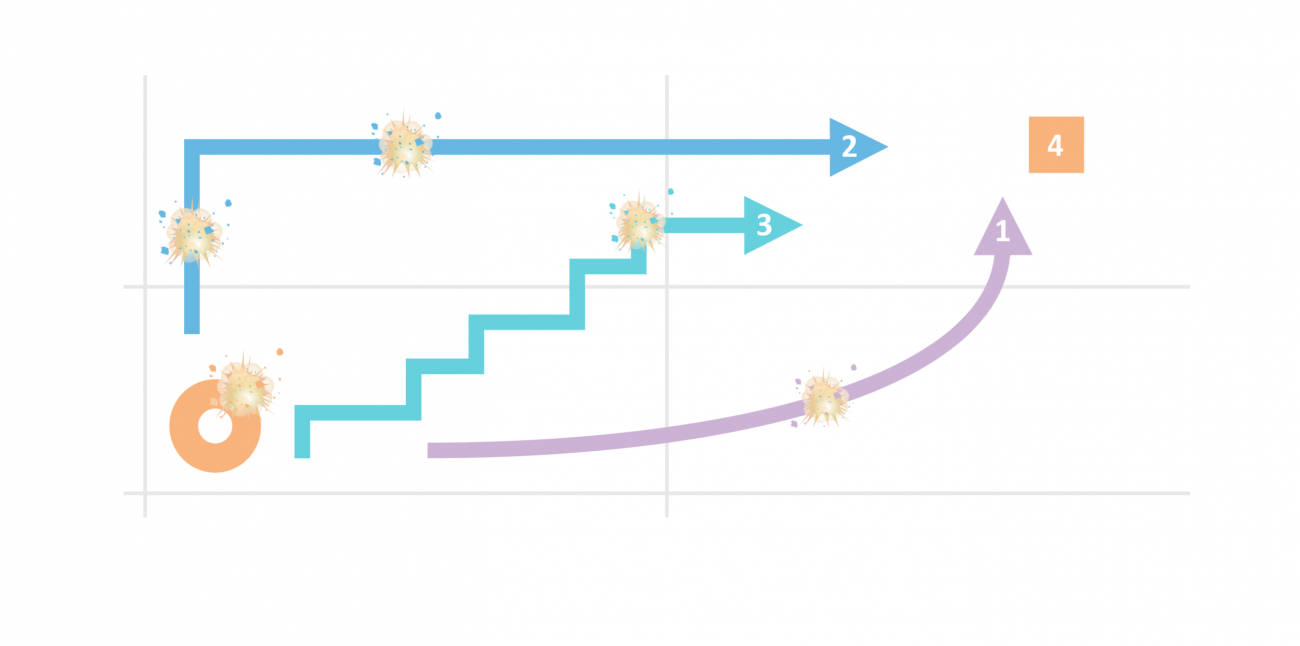

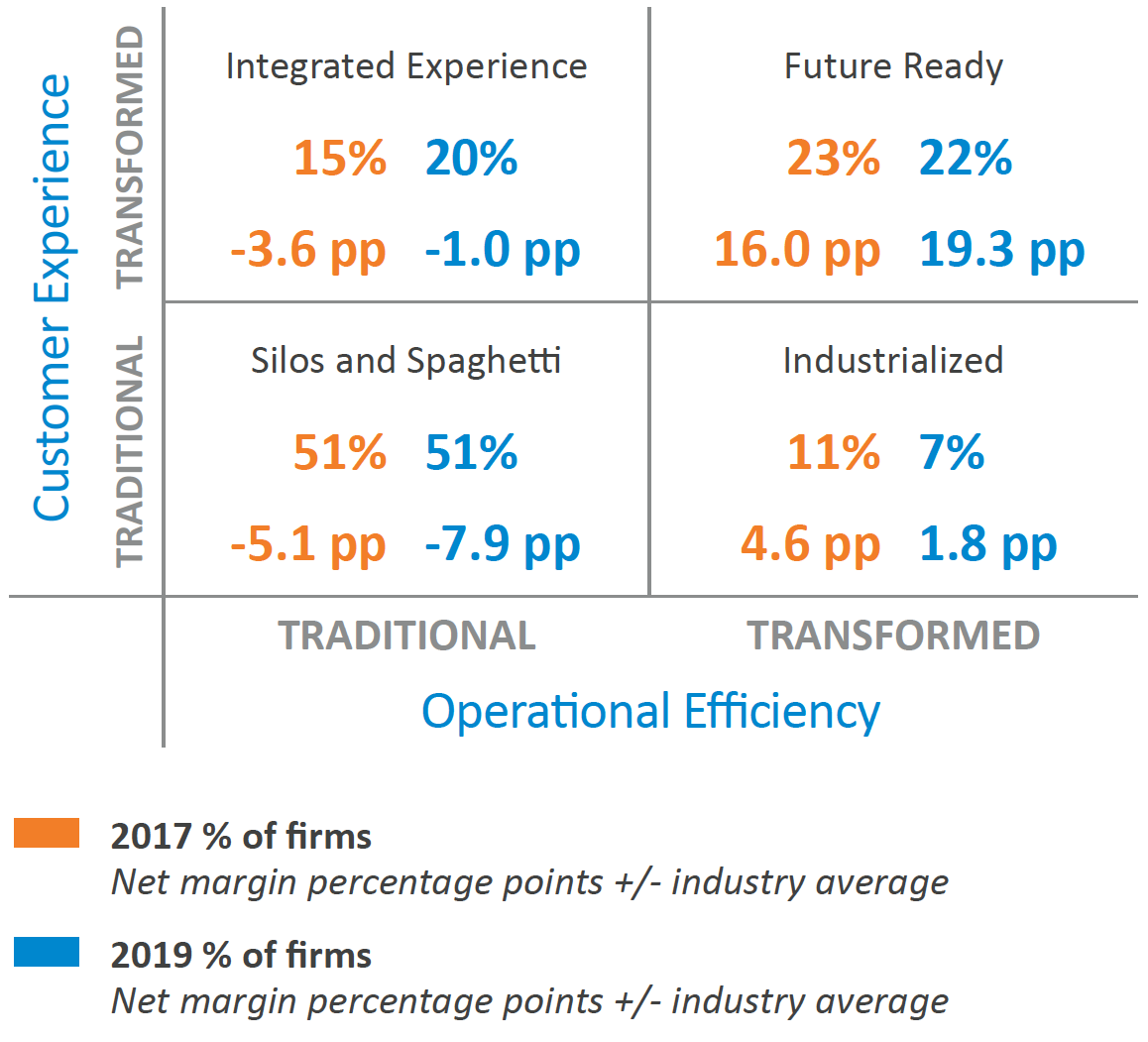

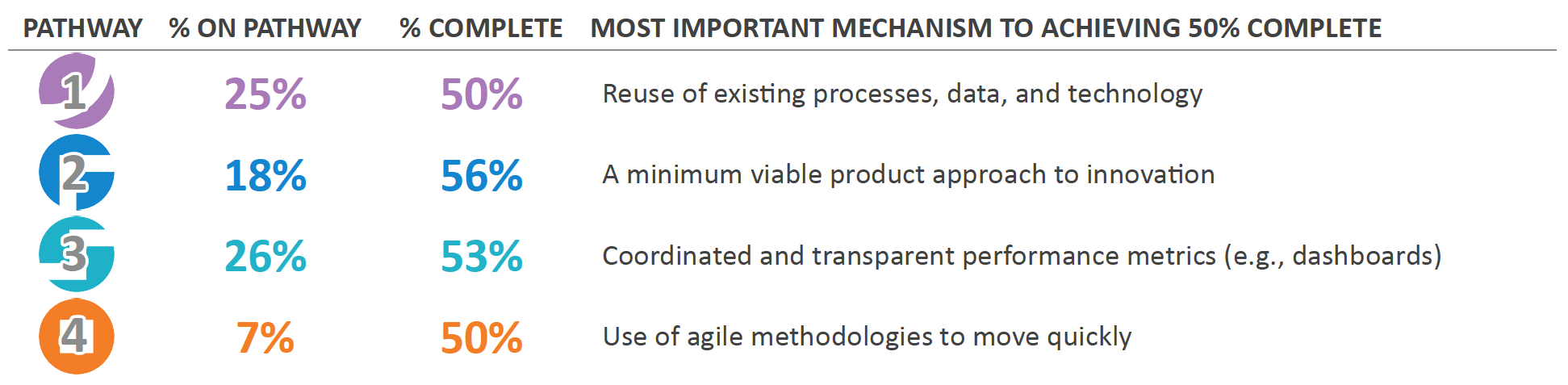

In 2017 we first observed how almost every big old company was on a digital transformation journey, many without a playbook.[foot]P. Weill and S. L. Woerner, “Future Ready? Pick Your Pathway for Digital Business Transformation,” MIT Sloan CISR Research Briefing, Vol. XVII, No. 9, September 2017, https://cisr.mit.edu/publication/2017_0901_DigitalPathways_WeillWoerner.[/foot] We described the goal of business transformation—to become Future Ready—and our research identified four pathways that companies can follow to outperform their industry.

When we asked one CEO why he drove development of a playbook at his company, he explained: