For decades, companies have thought of themselves as operating in industries such as banking, retail, shipping, automotive, and energy. In contrast, most customers seek to fulfill specific needs—business customers might aim to manage their energy consumption, and consumers might navigate getting an education. We call these different customer problems and opportunities domains. The mismatch between a company’s industry-based mindset and a customer’s domain-based need often results in fragmented customer experience, with the company solving for only parts of the domain need and the customer having to integrate and add to the fragmented pieces. Digital technologies, and new business models such as ecosystems, provide an opportunity to rethink how to solve your customers’ needs in each of their important domains. In this briefing, we share our first efforts at identifying the key domains, scope the size of the opportunity, and provide examples of companies that are successfully serving customer domains. Most importantly, we argue for a company mindset shift from industries to customer domains.

Hello Domains, Goodbye Industries

Abstract

For decades, companies have thought of themselves as operating in industries such as banking, retail, and energy. In contrast, most customers seek to fulfill specific needs—business customers might aim to manage their energy consumption, and consumers might navigate getting an education. We call these different customer problems and opportunities domains. Digital technologies, and new business models such as ecosystems, provide an opportunity to rethink how to solve your customers’ needs in each of their important domains. In this briefing, we share our first efforts at identifying the key domains, scope the size of the opportunity, and provide examples.

The Domain Advantage

A domain describes a customer’s end-to-end need in an area such as home, mobility, energy, education, corporate services, or secure supply chain. Currently the customer’s domain need is fulfilled by combining digital services curated from companies across different industries—with the customer often doing the curating. Companies that are embracing the shift to customer domains curate the needed services themselves to create a go-to destination within a domain, while also refining the customer experience to reduce friction, such as by implementing single sign-on and coordinating compliance.

For example, in serving its B2B customers, Schneider Electric moved from selling discrete products to connected energy solutions. The company’s best customers now realize 65 percent energy efficiency, compared to average business energy efficiency of 30 percent.[foot]Jean-Pascal Tricoire, “Capital Markets Day” (presentation, Schneider Electric Capital Markets Day, Rueil-Malmaison, France, June 26, 2019), https://www.se.com/ww/en/assets/564/document/46841/26-presentation-strategy-investor-day-2019.pdf.[/foot] Schneider identified a customer domain—managing energy needs—and has curated a set of services that span the traditional energy products industry as a basis for energy management solutions. The result is that over 50 percent of Schneider’s revenues come from IoT-enabled digital services.[foot]Schneider Electric SE, “Universal Registration Document 2019," March 17, 2020, from the Schneider Electric company website, https://www.se.com/ww/en/assets/564/document/124836/annual-report-2019-en.pdf.[/foot]

Fidelity recognized that its B2C customers want solutions, not just stand-alone products, and so has curated life event-driven offerings. For example, for the life event of sending a child to college, Fidelity combines its own products such as mutual funds with partner products like student loan refinancing through Credible.[foot]“Navigating the college journey,” https://myguidance.fidelity.com/ftgw/pna/public/lifeevents/content/sending-child-to-college/overview, and “Attending college,” https://myguidance.fidelity.com/ftgw/pna/public/lifeevents/content/sending-child-to-college/overview/attending-college, Life Events, Fidelity.[/foot]

MIT CISR characterizes an ecosystem driver business model as one where a company becomes a go-to-destination for a particular domain by curating its own and partners’ products and services to produce a great customer experience. In a 2019 survey[foot]MIT CISR 2019 Top Management Teams and Transformation Survey (N=1311). Self-reported net profit margin/growth correlates significantly with actual profit margin/growth at the p<.01 level. Net profit margin/growth is compared to industry.[/foot] we found that companies with an ecosystem driver model grew at 27 percentage points faster than their industry, with 19.9 percentage points higher margins. Companies can also achieve a domain focus via an omnichannel model, where a company integrates products and services from across its own business units to create solutions for customers.

Key Domains

To understand the size of the prize, in our survey we asked C-level executives about their firm performance and the dominant domains in which their enterprises operate. The three fastest growing domains at the end of 2019 were B2B marketplace, housing, and education; the three most profitable domains were education, global corporate services, and housing. This is our first attempt at identifying the appeal of various domains, and we believe that how domains are defined will change quite dramatically over the next five years. Let’s look at examples of today’s B2B and B2C domains.

Participate in the Research!

We invite you to take a short survey to help us identify the most important domains for companies in the next three-to-five years. You should be able to complete this survey in five minutes.

Your identity and data will be kept confidential. Data will be used solely for aggregate statistics. Contact Dr. Stephanie Woerner with any questions.

B2B Domain: eCommerce

Shopify exemplifies a company shaped around a domain rather than an industry.[foot]Researcher interpretation based on information from “Shopify Q2 2020 Results” (Shopify Q2 2020 Financial Results Conference Call, July 29, 2020), https://s23.q4cdn.com/550512644/files/doc_downloads/2020/Shopify-Investor-Deck-Q2-2020.pdf, and from the Shopify website, https://www.shopify.com/.[/foot] Shopify CEO Tobi Lütke had set out to start an online snowboard shop, building the e-commerce software to support it—and in the process realized the software itself would be a more promising venture. Shopify holds a 5.9 percent share of US retail e-commerce sales, second only to number one Amazon. Shopify’s vision is deceptively simple: the company supports the entire customer journey—building a brand, creating an online presence, setting up a store, selling, marketing, and managing. To cultivate its go-to destination, Shopify partners with developers, designers, marketers, warehousers, payment companies, and others. A customer can also get educated on how to run a small business or hire help from a vetted freelancer or agency via the Shopify Experts Marketplace. A million-plus merchants use Shopify, including Walmart, Heinz, and Heineken, fueling a 46 percent compound annual growth rate.[foot]Tricoire, “Capital Markets Day,” 11 and 17.[/foot] Perhaps the most important and for now largely untapped benefit of a focus on customer domains is potential access to data: As Shopify adds functionality to its platform and its share of e-commerce services grows, so will the company’s access to transactional level data it can analyze to identify additional customer needs.

B2C Domain: Home

Zillow focuses on the home domain in the United States; the US home transaction market opportunity was estimated to be $1.9 trillion in 2019.[foot]Zillow estimate based on US Census Bureau and National Association of REALTORS® 2019 data. “Zillow Investor Relations Presentation” (Zillow Group, May 2020), https://s24.q4cdn.com/723050407/files/doc_presentations/2020/05/(05.22.20)-ZG-Investor-Deck-IR-Blog-v2-(ZG-Legal-updates-5.22.20).pdf.[/foot] The company began with Zillow 1.0, which focused on helping consumers—buyers, sellers, and renters—search for and find properties and connect with professionals—agents, lenders, and landlords. To facilitate this connection, the company created Zestimate,[foot]“Zestimate (ZEST-ti-met),” Zillow, https://www.zillow.com/z/zestimate/.[/foot] a home valuation model that incorporates public and user-submitted data to estimate how much a dwelling is worth. Recently the company released Zillow 2.0, which broadened the original offering to include buying, selling, renting, and financing.

Our analysis of the home domain shows there are participants from multiple industries including services, IT services, insurance, financial services, and heavy industry. And over the next few years, we expect to see companies from other participating industries—for example, banking, insurance, professional services (such as legal and real estate), and telecom and media—also partner or converge, producing more end-to-end services in this domain. Digital partnering will become a key capability in companies following the domain approach.[foot]Ina M. Sebastian, Peter Weill, and Stephanie L. Woerner, “Driving Growth in Digital Ecosystems,” MIT Sloan Management Review, August 18, 2020, https://sloanreview.mit.edu/article/driving-growth-in-digital-ecosystems/.[/foot]

Domain Thinking

Most companies think industries rather than domains because that’s what they’ve always done. This thinking is reinforced as Wall Street analyzes companies by industry, the federal government classifies companies by industry (e.g., the North American industry classification system, or NAICS), and industry associations provide industry-specific skills training for executives and lobbying for their industry. But perhaps most limiting of all are the company strategy taxonomies that frame competition as industry-based.[foot]For example, see the five forces analysis described in Michael E. Porter, Competitive Strategy: Techniques for Analyzing Industries and Competitors (New York: Free Press, 1980).[/foot]

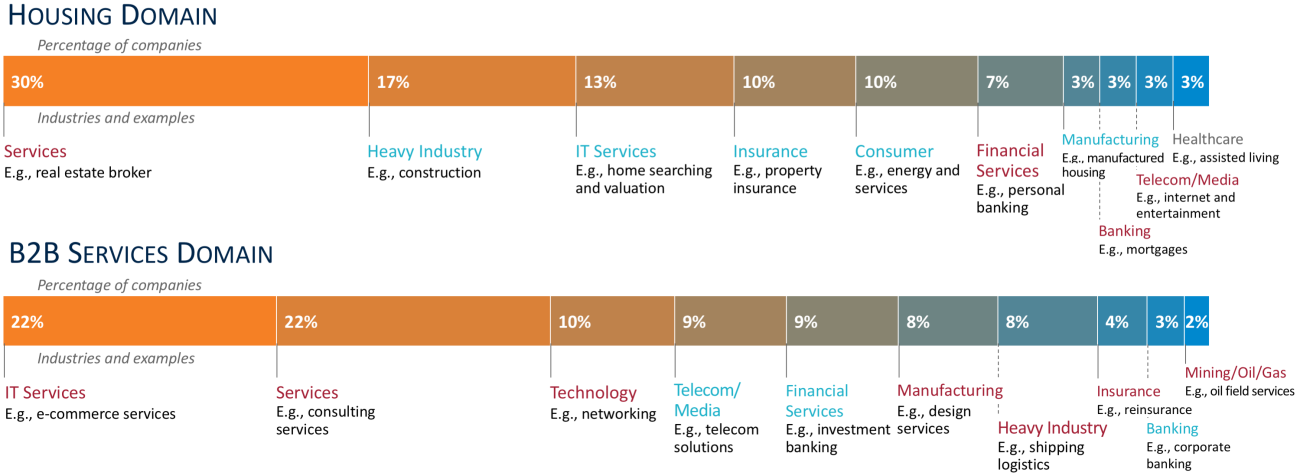

To get you thinking about domains versus industries, in figure 1 we’ve listed the industries participating in the home and B2B services domains. This listing highlights how the profitability of companies within an industry varies widely based on the dominant domain in which those companies are operating. For instance, telecom and media companies focusing on B2B services are more profitable compared to their industry than telecom and media companies operating in the housing domain.

Figure 1: Industry Composition of Two Domains

Source: MIT CISR 2019 Top Management Teams and Transformation Survey (N=1311). Respondents were asked to choose one dominant domain for their enterprises.

Domains are based on data collected in the MIT CISR 2017 Ecosystem Survey (N=158) and ten of the twelve McKinsey categories described in Venkat Atluri, Miklós Dietz, and Nicolaus Henke, “Competing in a World of Sectors without Borders,” McKinsey Quarterly, July 12, 2017, https://www.mckinsey.com/business-functions/mckinsey-analytics/our-insights/competing-in-a-world-of-sectors-without-borders. Digital Content and Public Services were omitted. Industries are based on NAICS categories. B2B Services includes technology, consulting, accounting, and legal. In the Housing domain, Edu/NonProfit/Gov, Mining/Oil&Gas, and Technology had 0% representation. In the B2B Services domain, Edu/NonProfit/Gov, Consumer, and Healthcare had only 1% representation.

It takes a massive mindset change for a company to shift its focus from industry to domain, and requires a digitally savvy top management team (TMT) to lead it. Digitally savvy TMTs have an understanding, developed through experience and education, of the impact that emerging technologies will have on businesses’ success over the next decade.[foot]P. Weill, S. L. Woerner, and A. M. Shah, “Companies with a Digitally Savvy Top Management Team Perform Better,” MIT CISR Research Briefing, Vol. XX, No. 3, March 2020, https://cisr.mit.edu/publication/2020_0301_TMTDigitalSavvy_WeillWoernerShah.[/foot] They use that understanding to ensure the company focuses on fulfilling customers’ needs, both now and in the future.

In our research, we found that digitally savvy TMTs were significantly more effective than their non-savvy counterparts at creating multiproduct, cross-business solutions, and that they allocated more of their digital spending to transformation investments. Ecosystem drivers had, at 58 percent, the largest percentage of digitally savvy TMTs, followed by omnichannel TMTs at 42 percent, indicating that companies with either business model are well positioned in the short term to focus on domains. We are seeing digitally savvy TMTs leading their firm into a domain perspective by managing at least three changes:

- Using data to inform action. Taking a customer-centric outside-in approach rather than a company-centric inside-out approach is a significant shift for companies. Companies in our research that were more effective at creating multiproduct, cross-business solutions were statistically significantly better than their peers at customer journey mapping and using agile methods that incorporate customer feedback.

- Innovating and tracking to prioritize investments. Companies making the switch to domain thinking will have to make hard decisions about what projects they are going to fund. An effective business case process that allows experimentation coupled with dashboards showing real-time progress is key to getting those investments right.

- Architecting systems around strengths to create connectable services. Companies that were in the top quartile of more effectively creating multiproduct, cross-business solutions had 54 percent of their core capabilities API-enabled and open to external parties, significantly higher than bottom quartile companies at 23 percent.

First Steps Toward a Shift to Domains

If we are right that the world is moving from industries to domains, a rethink is required in most companies’ strategies and mindsets. We recommend that you:

- Identify your typical customer’s end-to-end journey, including beyond your company’s scope, and consider how you could improve it—or even own it as a one-stop destination.

- Enable customer curation of your company’s products and services and break down silos to make it easier for the customer to create their own domain solution.

- Digitally partner to achieve coverage of the customer’s domain needs, enabling cross-system information sharing that you manage to produce a great customer domain experience.[foot]I. M. Sebastian, P. Weill, and S. L. Woerner, “Three Strategies to Grow via Digital Partnering,” MIT CISR Research Briefing, Vol. XX, No. 5, May 2020, https://cisr.mit.edu/publication/2020_0501_DigitalPartneringStrategies_SebastianWeillWoerner.[/foot]

© 2021 MIT Sloan Center for Information Systems Research, Woerner, Weill, and Diaz Baquero. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.