The business world is rapidly digitizing, connecting individuals, enterprises, devices, and governments, and enabling easier transactions, collaboration, and social interaction. Sure, such sweeping tech changes often take longer than we expect, but in time they usually have greater impact than we imagine (think airplanes, TVs, telephones, and digital media). We think digitization is blurring boundaries to the point that it’s hard to tell where your enterprise ends and a partner enterprise or customer engagement begins. Given these tech changes, we are trying to understand what the next generation enterprise will be like in five to seven years. In this briefing we present a framework and examples to support the key insight so far: that businesses have the opportunity to move from value chains to ecosystems.

The Next Generation Enterprise: Thriving in an Increasingly Digital Ecosystem

Abstract

With digitization rapidly transforming business, MIT CISR is trying to understand what the next generation enterprise will look like in five to seven years. A review of seventy-seven breakthrough initiatives in large organizations produced a framework and examples to support the key insight so far: that businesses have the opportunity to move from value chains to ecosystems. This briefing describes four viable business models—supplier, omni-channel business, plug and play module producer, and ecosystem driver—and presents a series of questions to guide your next steps.

We think of a business ecosystem as a coordinated network of enterprises, devices, and consumers that creates value.

In this research we have adopted the principle that “the future is already here—it’s just not evenly distributed.”[foot]Quote attributed by Wikipedia to William Ford Gibson, an American-Canadian writer.[/foot] If that principle is correct, we would expect to see leading companies commencing one or more breakthrough initiatives to see what works. In experimenting this way, companies are in effect buying options for the next generation enterprise (i.e., making an investment now that can be exercised in the future). We asked senior executives to describe their enterprises’ most important IT-enabled transformation initiatives to achieve breakthrough performance, collecting 77 initiatives from 30 companies. By classifying and aggregating the breakthrough initiatives, we seek to identify the key characteristics of the next generation enterprise. As you read this briefing, we suggest you think about the most important IT-enabled business transformation initiative in your enterprise today.

What Is an Ecosystem and What Value Is Created?

We think of a business ecosystem as a coordinated network of enterprises, devices, and consumers that creates value. The activities of a business ecosystem include transactions and other exchanges enabled by digital connections. Ecosystems typically have two kinds of players: drivers, who set the rules; and participants, who adopt and perhaps help improve those rules. The rules are supported by collaboration practices and contracts, which specify participants, processes for setting prices, IP and data ownership, payments, security, etc.

Including a greater number of participants creates a vibrant ecosystem that can increase innovation and consumer choice through increased diversity, allowing participants to draw from a broader range of experiences. A number of studies suggest ecosystems are an attractive business model. For example, companies that operate in an ecosystem-type environment (e.g., more networked, with more shared information and feedback loops) have been gaining market share over more traditionally managed firms, which generally model themselves on mechanical systems (e.g., linear value chains). Firms in an ecosystem show market returns of 3% above the S&P 500 over the 1996–2006 time period.[foot]http://www.lampindex.com/2007/08/[/foot]

Value Chains Versus Ecosystems

Most companies today don’t operate in an ecosystem, but instead control or participate in a more linear value chain as described by Michael Porter circa 1980. We think that’s changing, as increased digitization of business is enabling consumers and companies to seek out the benefits of ecosystems. Think of Walmart as a historically quintessential example of a value chain and Amazon as the contemporary example of an ecosystem. Amazon’s ecosystem offers more choice to customers and enables faster innovation. Higher consumer value is created via a market with different vendors offering similar products—often at different prices or service levels—and customer reviews such as a star rating providing fast feedback to all participants. Sales data and customer reviews give providers useful information to improve their products and services. The consumer gets greater choice and is more informed in the purchase decision about prices, quality, and actual customer experience.

Knowing Your Consumer

Ecosystems should coalesce around the needs of specific consumers (e.g., the retail customer online or the business customer for financial services such as foreign exchange). Knowledge of your end consumers came up repeatedly in our interviews and discussions with companies. Do you engage them in episodic, disconnected transactions, like Walmart and most physical retailers who often don’t know who their consumers are and what they buy elsewhere? Or are your interactions more like Amazon’s: continuous, collaborative engagements with consumers, coupled with a lot of knowledge of their purchase and search habits? The consumer is the individual (B2C) or organizational unit (B2B) that actually consumes (and often buys) the goods and services you produce. Deep knowledge of your end consumer includes:

- Name and address, demographics, IP address

- Purchase history with your company and with other companies

- Business (B2B) or personal (B2C) goals

Ecosystems should coalesce around the needs of specific consumers, such as the online retail customer or the business customer for financial services.

When the Commonwealth Bank of Australia (CBA) thought hard about its mortgage business, it realized a customer’s personal goal is not to get a mortgage—it’s to buy a house. So CBA created a smartphone app that allows a user to point a phone at a house of interest to review its sale price history and those of the houses to its left and right. Prospective home buyers become more informed about house prices in their target areas and, as app users, a hot source of mortgage leads for CBA. Happily for CBA, the mortgage acquirer becomes a long-term customer of the bank—the best kind. The mobile app combines location with licensed information of the actual selling prices of property, closing dates, and estimated current values. Consumers have made over 1.2 million property searches to date, and CBA estimates the app’s ROI is 109%.

Options for the Next Generation Enterprise

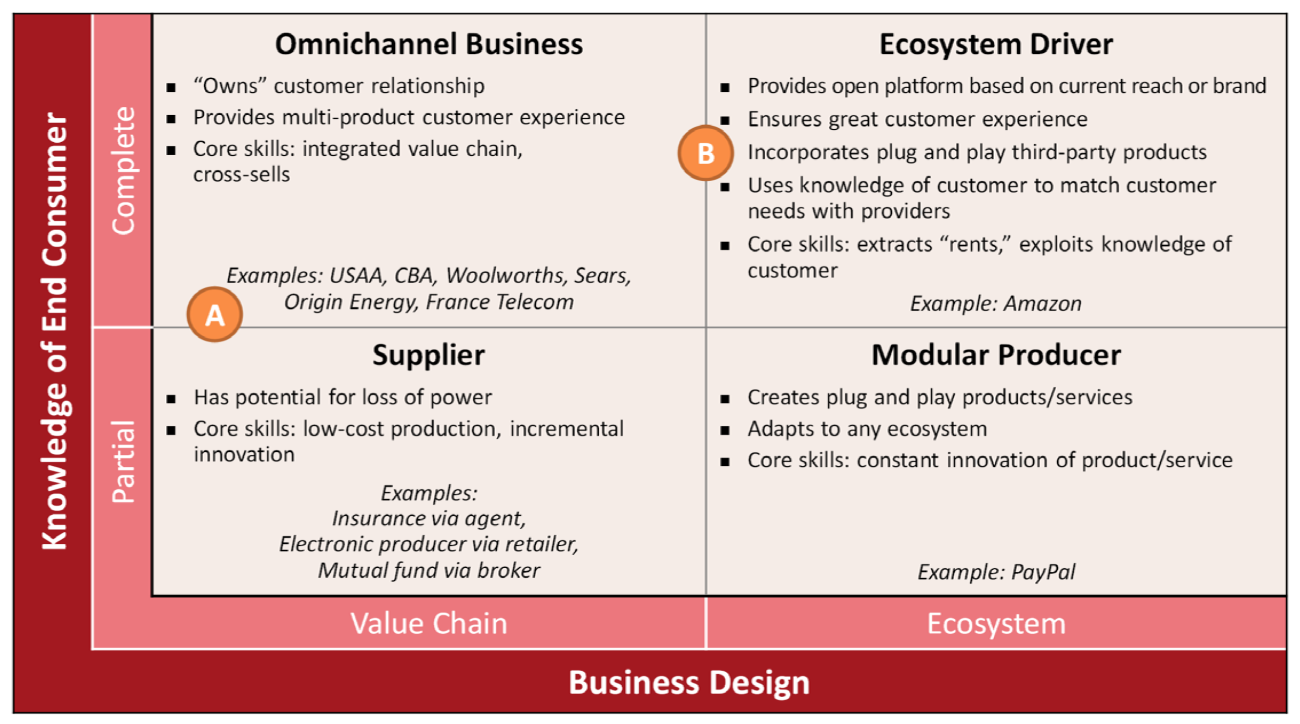

Organizational leaders have to make two choices, creating four distinct business models with associated capabilities and relationships (see figure 1). The horizontal axis of the 2x2 is the business design, with value chain and ecosystem as the two clearest options on a continuum. The vertical axis is the depth of knowledge of your end consumer. We see all four as viable business models today, each with distinct opportunities and challenges.

Suppliers have at best a partial knowledge of their end consumer, and typically operate in the value chain of another, more powerful company. Companies that sell insurance via independent agents, electronic goods like TVs via retailers, or mutual funds via brokers are generally suppliers. As enterprises continue to digitize, suppliers could lose more power and be pressured to continually reduce prices, perhaps resulting in industry consolidation. P&G—a prime supplier in many other firms’ value chains—feels this potential loss of power. To gain more leverage, P&G has recently begun a campaign to learn more about and connect directly with its more than four billion consumers worldwide, using a variety of branding, social media, and data-based approaches, effectively moving up the 2x2.

Omni-channel businesses provide customers access to their products across multiple channels, including physical and digital channels, giving customers greater choice and a seamless experience. CBA, Tesco, Walmart, and many others aspire to be omni-channel businesses controlling an integrated value chain and a strong claim to “own” the customer relationship. The challenge is to move up the vertical axis of the 2x2, increasing knowledge of the end consumer and his or her goals, and reducing customer churn. Many firms we talked to mentioned big data analytics, social media, mobile apps, and measures of customer experience like Net Promoter Score (NPS) as avenues for increasing their understanding of the end consumer.

Amazon and other ecosystem drivers provide an open platform with interfaces that allow partners to integrate into the platform and increase value creation. They ensure a great customer experience and offer many plug and play third-party products and services. Like omni-channel businesses they also aspire to “own” the customer relationship by increasing their knowledge of their end consumers. Ecosystem drivers extract rents from users of their ecosystem—both consumers and plug and play participants—and rely on brand strength to build reputation and usage.

PayPal and other modular producers provide plug and play products or services that can adapt to any number of ecosystems. To survive they have to be one of the best producers in the narrow definition of their modular activity (like payments). To thrive they have to constantly innovate their products and services to ensure they’re among the best options available. In digital ecosystems it’s usually easy to switch from one modular producer to another, e.g., use a credit card rather than PayPal.

How to Prepare for an Ecosystems Future

We believe that the greater the impact of digitization on your business, the more urgent the case for buying strategic options for the future. To what extent are your products and services 1) digital, 2) electronically specifiable and searchable, 3) easily augmented by valuable data, and 4) at risk of being disrupted by enterprises in other industries offering services competing with yours who have existing relationships with your customers? If the answer to these questions is to a greater extent, you face more threat from digitization and need to have one or more breakthrough initiative projects running to test—and buy the option for—future business models.

For example, France Telecom has a high threat from digitization and has launched a peer-to-peer mobile payment ecosystem, Orange Money, the convergence of a telco and a bank. It provides mobile phone services as well as the ability to deposit, withdraw, and transfer money and pay bills. With more than five million customers in eleven African countries, Orange Money is already a successful strategic experiment. In our framework, Orange Money is moving France Telecom from point A to point B (the orange circles in figure 1). Orange Money resembles an ecosystem more than a value chain as it involves multiple partners that sell the product and perform the backend transactions. Orange Money also provides France Telecom with more intimate knowledge of its end consumers’ daily habits and goals, particularly if this is the first “banking” product they have ever used, as it is for many Orange Money customers.

We leave you with three important questions to ponder. How strong a threat could digitization be to your business? If the threat is moderate to high, what breakthrough initiatives is your enterprise pursuing to (re)invent your future? And where should those initiatives be on the 2x2?

Figure 1: Options for the Next Generation Enterprise

Orange Money

Point A: France Telecom in Africa operates alone and offers a commodity: mobile bandwidth. France Telecom may not know its customers—they anonymously buy time in incremental amounts—and does not know their goals.

Point B: France Telecom creates Orange Money, a service that couples banking with mobile phone services. Customers must set up an account, so are no longer anonymous. France Telecom works in partnership with regional banks to offer service, and has a window into transactions so it can begin to infer customers' goals.

© 2013 MIT Sloan CISR, Weill and Woerner. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.