Typically, when reach plus range is the dominant digital partnering strategy, a mutually reinforcing relationship occurs between the two as companies create one-stop shops that meet more needs for more customers. The increasing range of partner products on the Climate FieldView platform has supported more and better agronomic recommendations, and new types of companies have started to use it—opening the door to new customers. For example, Climate partners with crop insurance company Farmers Mutual Hail, increasing the reach of FieldView to FMH’s customers by enabling farmers to connect their field data to FMH for simplified crop insurance reporting.[foot]“The Climate Corporation partners with Farmers Mutual Hail, simplifies crop insurance reporting to US farmers,” November 19, 2018, https:// climate.com/newsroom/climate-corporation-farmers-mutual-hail.[/foot]Successfully building an ecosystem such as this and then achieving growth requires sophisticated data sharing and analytics, and seamless and curated customer experience.

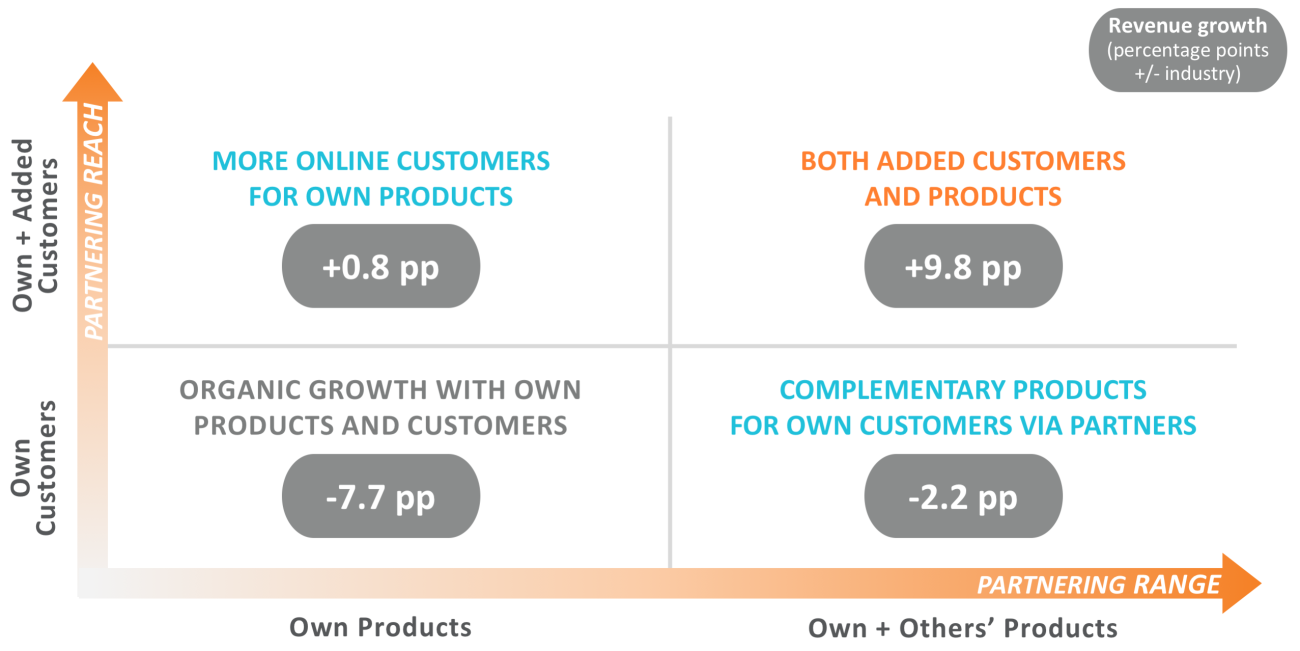

Strategies that are reach- or range-dominant should not be discounted, as they are also associated with higher performance. We found that companies had average revenue growth of 0.8 percentage points above industry average when focusing on increasing reach via partners—a good way to start your digital partnering efforts. But executives were concerned about commoditization of their companies’ products, and also that limited access to customers and data would restrict opportunities for creating more value.

Meanwhile, companies that focused on growing by range alone had average revenue growth of 2.2 percentage points less than industry average—but this is still much higher growth than companies that did not digitally partner. Value capture is a challenge with revenue growth in a range-dominant strategy. Many executives we talked with mentioned that increasing range has been important for meeting customer expectations for more choice, and customers are often delighted with the unique value provided by partners—but improving customer experience has not necessarily meant a big increase in revenue. It may be that the extra services are seen as part of an existing subscription, or they may have been offered for free or at a minimal cost.

Companies that digitally partner to increase either reach or range often shift their growth trajectory. As PayPal has grown, the company has added partners to diversify its offering and become “stickier” with current customers. PayPal Business customers can choose partner products in a variety of categories, including building an online store or marketplace, accepting payments in physical stores, or getting invoicing and accounting tools. The PayPal developer website lists 140 solution provider partners with digital connections to PayPal.[foot]“Solution Providers,” https://www.paypal.com/us/business/platforms-and-marketplaces/directory.[/foot] Similarly, Fidelity added its Wealthscape Integration Xchange storefront, where wealth management firms choose for their customers from partner offerings that seamlessly complement Fidelity’s banking services.