For many companies today the most important goal is growth. Since 2018, MIT CISR has been studying how partnering affects growth, and we’ve found that companies can grow faster with partnerships than alone. For example, Bayer Monsanto has digitally partnered with more than fifty companies[foot]Liam Condon, “Shaping the Future of Agriculture” (Capital Markets Day presentation, London, December 5, 2018), https://www.investor.bayer.com/securedl/16642. [/foot] in its subscription service called Climate FieldView, which allows growers to visualize and optimize their crop yields by consolidating and managing data from different sources.[foot]Climate FieldView website, The Climate Corporation (a subsidiary of Bayer), https://climate.com.[/foot] The partner services available on the platform — such as satellite imaging, soil assessment, and drone mapping — seamlessly integrate data into management reports.

Partnering to Grow in the Digital Era

Abstract

For many companies today the most important goal is growth. Since 2018, MIT CISR has been studying how partnering affects growth. We found that companies with both higher Partnering Readiness and Partnering Strength have greater firm performance and ecosystems with higher market share. In this briefing, we identify how high-performing companies are building Partnering Readiness and Partnering Strength, and describe how Fidelity Investments is building these partnering capabilities to drive more value for its customers with digital partners.

Companies with both higher Partnering Readiness and Partnering Strength have greater firm performance and ecosystems with higher market share.

The reach of the Climate FieldView digital agriculture platform has grown fast, from five million paid acres in 2015 to sixty million paid acres in 2018 in the US, Brazil, and Europe. The growth target for 2019 is ninety million paid acres.[foot]“Shaping the Future of Agriculture.”[/foot]

Companies have partnered for years, but digital partnerships in ecosystems differ from traditional partnerships. The traditional partnering model concentrates on a few deep, tightly integrated, exclusive partnerships, supported by personal relationships that build trust over time. Traditional partnerships will continue to exist and be important for both traditional and born-digital companies—but they don’t scale due to the high investment needed to make them successful.

Companies digitally partner in ecosystems, working together via digital connections, to provide customers more value. Many ecosystems are led by an ecosystem driver such as Amazon, Tencent (with its WeChat app), or Bayer[foot]For more information on ecosystem drivers and the ecosystem opportunity, see Peter Weill and Stephanie L. Woerner, “Thriving in an Increasingly Digital Ecosystem,” MIT Sloan Management Review, June 16, 2015, https://sloanreview.mit.edu/article/thriving-in-an-increasingly-digital-ecosystem/.[/foot]; other ecosystems are consortiums such as the global airline alliances. Digital partnerships are plug-and-play, with less overhead than traditional partnerships—think of digital marketplaces and app stores that offer products and services by many partners. As companies start to grow with digital partners, they are moving toward participating in ecosystems and away from value chains.

Ecosystems grow faster when companies that join have strong capabilities to play in a digital ecosystem—which we call Partnering Readiness; and when partners make effective agreements about how the partnerships will provide customers value, what data they will share, and how to divide up benefits and responsibilities—which we call Partnering Strength. We found that companies with both higher Partnering Readiness and Partnering Strength have greater firm performance and ecosystems with higher market share. In this briefing, we identify how high-performing companies are building Partnering Readiness and Partnering Strength, and describe how Fidelity Investments is building these partnering capabilities to drive more value for its customers.[foot]Findings are based on ongoing MIT CISR research on ecosystems that includes the MIT CISR 2017 ecosystem survey (N=158) and interviews in 2018 (with 48 executives at 24 companies) and 2019 (with 21 executives at 13 companies).[/foot]

Companies and Ecosystems Grow Faster with Partnering Capabilities

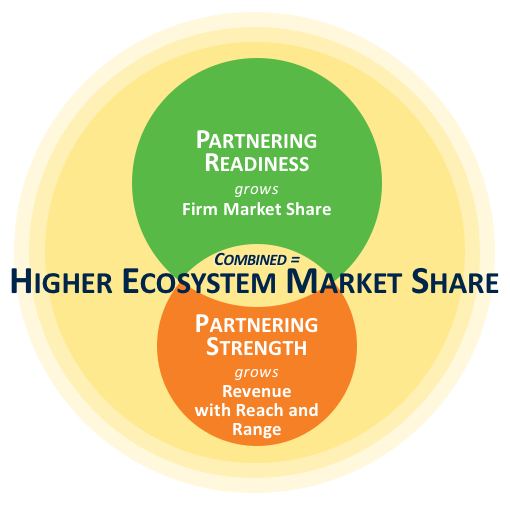

Our research shows that the capabilities of Partnering Readiness and Partnering Strength drive growth in different ways (see figure 1).

- To grow your market share in an ecosystem, Partnering Readiness is most important; you need to differentiate your company and develop a unique value proposition.

- To grow your revenue in an ecosystem, Partnering Strength is most important—it supports growth by helping you increase reach (more customers) and range (more products and services) through more digital partners.

- To grow your ecosystem market share, Partnering Readiness and Partnering Strength are equally important. For an ecosystem to thrive, both the participants and their partnerships have to be strong.

Figure 1: Companies and Ecosystems Grow Faster with Partnering Capabilities

Source: MIT CISR Ecosystem Survey (N=158). Regressions of Partnering Readiness and Partnering Strength. With company market share, Partnering Readiness significant. With revenue growth, Partnering Strength significant. With ecosystem market share, Partnering Readiness and Partnering Strength significant. Size of shapes indicates strength of the relationship. Partnering Readiness measured on the company level using 9 survey items. Partnering Strength measured at the ecosystem level using 6 survey items. Ecosystem market share and company market share are significantly correlated. Company market share and revenue growth are significantly correlated.

Partnering Readiness Enables Companies to Join Ecosystems

Partnering Readiness is a set of capabilities that enables a company to become a strong participant in an ecosystem.

- Distinctiveness: Identify partners to help build your distinctiveness in an ecosystem. Companies build distinctiveness in a number of ways, like developing a strong brand, market-leading offerings, and customer experience. Digital partners help you become a go-to destination.

- Value proposition: Create new, unique value for your customers with your digital partners, including ease of use (such as in payments or logistics), better pricing, product choice, advice and tools to make better decisions, and complete solutions and experiences.

- Organizational readiness: Reevaluate processes that were optimized for traditional partnerships (such as procurement and legal processes). Equally important, drive your company’s digital transformation. In our research, high-performing companies have deeper knowledge of their customers, fewer silos, more pervasive adoption of agile methodologies, and stronger data analytics.

- Openness: Share your company’s core capabilities via APIs to scale digital partnerships to achieve growth. In our survey, 30 percent of companies had an open approach (sharing a substantial number of core capabilities externally), and 34 percent were opening up.[foot]MIT CISR Ecosystem Survey (N=158). Openness based on percentage of enterprise core capabilities service-enabled with APIs and used externally: Closed (0 to 5%), Opening up (6% to 34%), Open (>=35%).[/foot]

Partnering Strength Enables Partnerships to Thrive in Ecosystems

Partnering Strength is a set of capabilities that enables a company to coordinate effectively with digital partners.

- Joint goals: Clarify who creates what value. To create more value for customers with choice and scale, governance shifts from building long-term exclusive partnerships to enabling many plug-and-play partners, often competitors, in an ecosystem.

- Sharing benefits: Clarify who captures what value. For many companies in our research, customer stickiness, customer engagement, and visibility are important shared benefits in digital partnerships, in addition to revenue. Digital partnering helps drive company growth, but our research shows the ecosystem grows faster than any of the participants.[foot]We argue that the ecosystem grows faster because of indirect network effects.[/foot]

- Sharing information: Negotiate who gets what information and how it is shared digitally. Digital partnerships build on expertise gained from traditional partnerships, but surpass traditional partnerships’ scale and scope with automation, self-service models, and data, which help digital partners add value.

Fidelity Investments Builds Partnering Capabilities to Grow via Ecosystems

Asset management company Fidelity Investments is at the early stages of a bold strategy to grow by providing its customers with more value-added services through digital partnerships. The goal is to build a curated, trusted ecosystem that offers more choice, better prices, and one-stop solutions that address more and more customer needs, from banking to taxes to healthcare. The marketplace in Fidelity’s Personal Investments business went live in 2018 with digital partners in three categories—tax preparation,[foot]Marketplace partners for tax preparation, Fidelity Investments, https://dpcs.fidelity.com/prgw/dpcs/tax-information/.[/foot] student lending, and ID protection—and plans to scale based on customer interest. Fidelity’s Workplace business created Fidelity Health Marketplace for small and midsize businesses and their employees in 2016. Fidelity continues to expand the marketplace with more partner services like telemedicine.[foot]“Fidelity Health Marketplace® Expands Member Experience and Wellness Offerings for Small and Midsize Businesses,” Fidelity Investments, September 13, 2017, https://www.fidelity.com/about-fidelity/employer-services/fidelity-health-marketplace-expands-member-experience-and-wellness-offerings-for-small-and-midsize-businesses.[/foot] The institutional business makes more than 100 third-party technology solutions (such as for customer relationship management, financial planning, analytics, and portfolio management) available in the recently launched Wealthscape Integration Xchange storefront.[foot]“Fidelity Introduces Wealthscape Integration Xchange,” Fidelity Investments, October 16, 2018, https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/press-release/Fidelity-Introduces-Wealthscape-Integration-Exchange.pdf.[/foot]

The combination of Fidelity offerings and great partner offerings turns our omnichannel experience into an ecosystem for Fidelity customers.

Sue Gordana, Senior Vice President, Marketplace Strategy

In late 2017, Fidelity’s CEO launched eleven fast-track initiatives including the digital marketplaces and a strategy to API-enable enterprise core capabilities.[foot]From MIT CISR interviews with thirteen executives from Fidelity Investments in 2018; used with permission.[/foot] These initiatives have been fundamental to building Partnering Readiness and Partnering Strength at the company.

Fidelity’s Partnering Readiness includes the company’s distinctiveness, with market-leading offerings, scale and trust from its 28 million individual investors, more than 23,000 organizational customers in the workplace business, and more than 13,000 financial advisory firm customers. Fidelity’s value proposition is to provide more services to its customers through complementors. As the brokerage business transforms the mainframe environment to a cloud environment, Fidelity builds enterprise-wide capabilities for openness with one API store and API standards across the company to make them consumable to anyone internally or externally. To drive organizational readiness, senior executives lead the fasttrack initiatives with cross-business teams, overseen by the company’s Governance Board. The marketplace teams work closely with the brokerage technology team, which leads platform transformation, to build the marketplaces on the common API store. Fidelity described an ongoing culture shift toward partnering, agile teams, and democratization of data.

Fidelity’s Partnering Strength is based on joint goals to create choice and scale for Fidelity customers with unique new value propositions. Customers trust Fidelity to curate and govern the marketplaces effectively for the best-priced offerings and best value. At this early stage, Fidelity described sharing benefits as providing reach for digital partners with access to the large Fidelity customer base, while partners provide range for Fidelity, satisfying current customer interest in complementary services. The marketplace teams work on automating information sharing to achieve fast and easy onboarding and light integration, and sharing benchmarking data with partners to create better offerings.

How to Accelerate Growth with Partnering

Partnering will help you grow both revenue and market share in the digital era, but successful partnering requires both Partnering Readiness and Partnering Strength. Developing these capabilities is challenging and transformative. Digital partnering models are still evolving; many companies are experimenting with marketplaces and creating app stores and developer platforms with open APIs, but are finding it hard to attract the right digital partners. Value creation and value capture in digital partnerships are difficult for any company to get right. And if you are successful in building an ecosystem with your digital partners—who at times might be competitors—to help you grow, you have to be comfortable with the ecosystem growing faster than you or any individual partner.

Fidelity and many other high-performing companies across industries are building Partnering Readiness and Partnering Strength to drive growth in the digital era. Because these capabilities are transformational, the executive team and often the CEO are involved in leading the initiatives. We suggest that you identify who in your company is responsible for Partnering Readiness and Partnering Strength, and start measuring these capabilities as key drivers of growth.

© 2019 MIT Sloan Center for Information Systems Research, Sebastian, Weill, and Woerner. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.