As every leader in Australia focuses on all the challenges of COVID-19 , we also need to take time to create our best possible future. Now is the perfect moment, when everyone expects disruption, to start creating the firm you’ve always dreamt of leading. And there is plenty of opportunity. In a 2019 MIT CISR global survey of over 1,300 firms,[foot]MIT CISR 2019 TMT and Transformation Survey (N=1311), data collected in 2019–2020. MIT CISR collaborated with ADAPT, an Australian IT events, research, and advisory practice, to acquire data from Australian firms (N=131), a subset of the global sample. In the global sample, 917 firms self-reported a net profit margin, which correlated significantly with actual profit margin at the p<.01 level. Net profit margin was compared to industry. Each dimension was calculated using four measures. Findings also draw from 2020 discussions, based on this data, with senior Australian business leaders.[/foot] only 3 percent of Australian firms were “Future Ready,”[foot]See introductory MIT CISR research on Future Ready firms in P. Weill and S. L. Woerner, “Future Ready? Pick Your Pathway for Digital Business Transformation,” MIT Sloan CISR Research Briefing, Vol. XVII, No. 9, September 2017, https://cisr.mit.edu/publication/2017_0901_DigitalPathways_WeillWoerner.[/foot] compared to 22 percent of firms overall. In this briefing, we share the insights from this research and propose actions to make your firm Future Ready.

Australian Firms Need to Become Future Ready

Abstract

Becoming a future-ready digital organization is challenging. In our study of 1311 firms globally, we found that just 22% of large firms had tackled the disruptive changes—what we call organizational “explosions”—needed to achieve great customer experiences while maintaining operational efficiency. This has proved even harder for Australian firms—just 3% were future ready. In particular, Australian firms appeared to struggle with tough organizational issues like reassigning decision rights. The COVID-19 crisis has accelerated decision making around digital transformation, and there is a significant opportunity for Australian firms to progress faster along pathways to becoming future ready. This briefing explores our data on 131 Australian firms in our global study and frames the opportunities for success.

Crisis as Catalyst for Change

One of the few upsides of the COVID-19 crisis is that firms are proving that digital ways of doing business are effective. Gone are many of the previous objections: “it won’t work,” “we’re not ready,” “customers don’t want it,” “it won’t be as good,” and “it’s not secure.” Shayne Elliott, CEO of ANZ, summed up the opportunity: “Great companies will harness it and most will strip back to the old ways. Time will tell which one we are, but we know which one we want to be.”[foot]James Thomson, “ANZ bids good riddance to bureaucracy,” The Australian Financial Review, 14 May, 2020, https://www.afr.com/work-and-careers/leaders/anz-bids-good-riddance-to-bureaucracy-20200512-p54s96.[/foot]

Australia Trails in Transformation

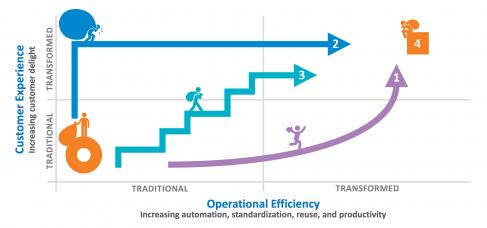

For three years MIT CISR has been measuring firms’ progress towards being Future Ready. A Future Ready firm has achieved step changes, relative to its competitors, in both customer experience and operational efficiency, typically using technology. Future Ready firms can simultaneously cut cost and generate new revenue. They monetize their data ethically, and dynamically partner with small and large firms alike to add value. They reuse digital business services to quickly provide customers with more tailored options, and they can either lead or participate in digital ecosystems.[foot]P. Weill and S. L. Woerner, “Future Ready? Pick Your Pathway for Digital Business Transformation.”[/foot] But most firms start the Future Ready journey in the pre-transformed state of “Silos and Spaghetti,” with complex landscapes of processes, systems, and data, and only outperform via the heroics of their people. This is not a sustainable model.

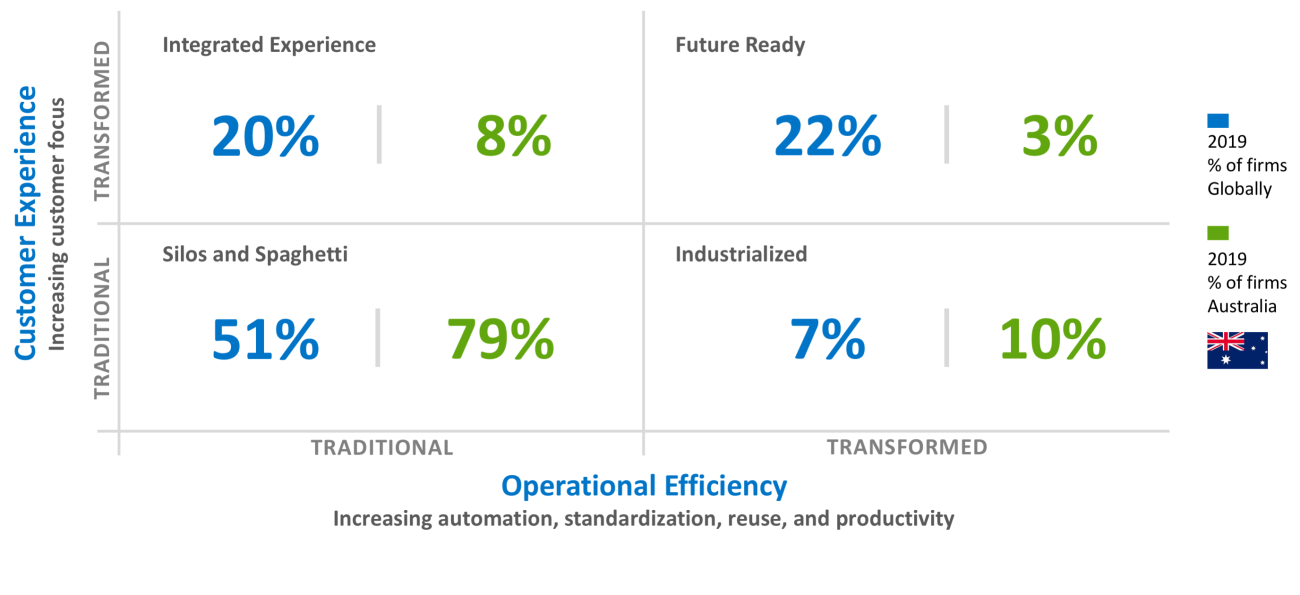

In our latest study, 22 percent of firms globally were Future Ready, and these firms had 19.3 percentage points higher margin and 26.6 percentage points higher growth than their industry average—huge premiums. But of the 131 Australian firms in the survey, only 3 percent were Future Ready, with 79 percent of firms still operating as Silos and Spaghetti. The average performance of these Australian firms was at least 3 percentage points lower than their global peers on both margin and growth (see figure 1).

Figure 1: Australian Firms Lag in Becoming “Future Ready”

Source: MIT CISR 2019 TMT and Transformation Survey (N=1311); Australian firms were a subset (N=131) of the global sample. MIT CISR collaborated with research and advisory firm ADAPT in surveying Australian firms. In the global sample, 917 firms self-reported a net profit margin, which correlated significantly with actual profit margin at the p<.01 level. Net profit margin was compared to industry. Each dimension was calculated using four measures.

Never in recent memory have leaders of Australian enterprises been more empowered to make the hard changes needed to become Future Ready. What we found statistically in our survey provides some insight into why Australian firms are lagging:

- Australian firms tended to be smaller than their global peers and have lower revenue growth and margins.

- Digital spend as a percent of revenues of Australian firms was about half that of global firms in the same industry.

- Australian top management teams spent 29 percent of their time on transformation, compared to 35 percent for top management teams overall.

- Australian firms, based on what they had proposed to their boards, were only 32 percent complete on their transformations to become Future Ready, compared to 50 percent complete globally. Yet Australian firms had achieved measurable results in 13 months, faster than the 21 months of firms globally. Australian executives we spoke with observed that their firms tend to go for easy fixes (e.g., building a mobile app) while attempting too many projects—and often not tackling harder underlying technical and cultural challenges.

- Australian firms’ employee experience was 7 percent worse than firms globally. This increasing reliance on worker heroics is not sustainable and ultimately slows transformation.

One of the biggest predictors in our study of stalled transformations was firms’ embarking on multiple pathways to transformation that were not well coordinated—often led by different parts of the enterprise. Concerningly, 20 percent of the Australian firms in our study were doing this, compared to only 10 percent of firms globally. This indicates a lack of alignment on a single vision by senior management and an unwillingness to prioritize and focus.

Chief executive Ross McEwan of National Australia Bank (NAB) said the bank has now “refreshed our longer-term strategic focus” and that “the need for improved accountability and reduced complexity is clear.” “Give them the tools and get out of the way,” he said.[foot]Julian Baijowski, “NAB chief vows IT will radically simplify, not complicate bank,” iTnews, 27 April, 2020, https://www.itnews.com.au/news/nab-chief-vows-it-will-radically-simplify-not-complicate-bank-547251.[/foot] NAB Chief Technology and Operations Officer Patrick Wright framed the issues: “Simplification is key to getting this right. So often transformations chase new things and new technologies only to end up replicating the complications of the past in modern day technologies. The proverbial red pen is your best friend as you transform.”

Grasping the Opportunity

We have found that C-level executives are adopting one of two attitudes. The first we describe as “my hair is on fire,” where firms make drastic cuts to budgets, often relatively equally across the firm. The second attitude is, “yes, times are tough, but this is a once-in-a-generation opportunity to create the kind of firm we’ve always dreamt of.” To bring their dreams to fruition, firms have to link their cost cutting to their Future Ready design.

I am very encouraged by our ability, in the most challenging of times, to bring the future forward. Leveraging our business agility and innovation efforts, our team developed the technological and operational platforms in under two weeks to deliver Westfield Direct, a contactless, drive-through “click-and-collect” service for our customers and retail partners.

Richard Webby, Chief Technology Officer, Scentre Group

We predict that those firms that seize the opportunity will have the best payoff in the next decade. But to cut costs while strategically pursuing the vision of a Future Ready firm requires an active approach to addressing organizational explosions.

Four Organizational Explosions

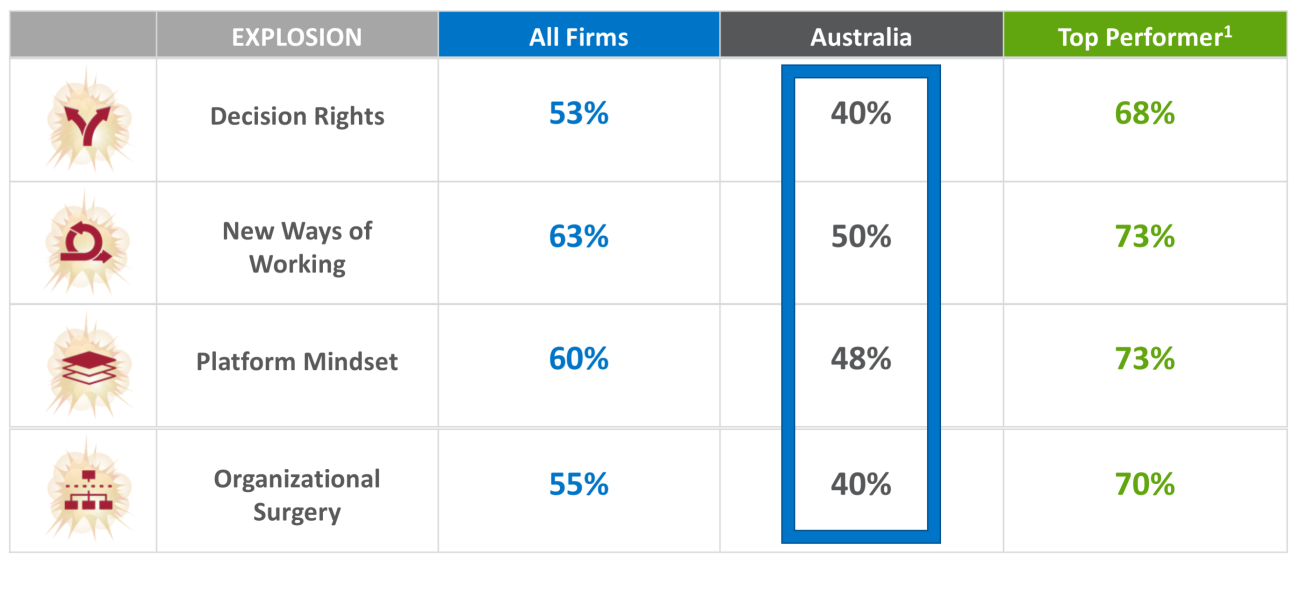

To become Future Ready, the firms we studied focused on four organizational “explosions” (see figure 2). We call them explosions because that’s how they feel. Firms are blowing up the way they used to do things to remove barriers, move faster, and increase effectiveness.

- Changes in decisions rights, to clarify who has rights and accountability in decision making. For example, a common problem is when lines of business or geographies decide not only what they will do but how they’ll do it. This leads to replication, overspending, complex architectures that don’t connect, and local optimization, not to mention politics. Donna Vinci, COO at GenVis and former CIO of Bank of Queensland, explained, “At BoQ we realised we needed to simplify and move more quickly. [ …] Understanding the unintended consequences of existing decision rights and changing them to consider who had the decision right on ‘what’ vs. the decision right on ‘how’ was a pivotal improvement. Then we tracked the time to decision and the time to value to learn how we were doing."

Metrics to watch: time to decision, time to value - New ways of working, to change the culture through new methods such as agile methodologies, minimal viable products, co-creating with customers, capability creation, remote working, and journey mapping. Future Ready firms are constantly developing collective and individual digital capabilities, and leveraging these to learn how to work more effectively. The Reserve Bank of Australia (RBA) has been working on new ways to deal with cybersecurity issues. Investments in cyber cross-skilling, senior leadership cyber capabilities, cross-siloed agile cyber teams, and fast cycles of cyber innovation have enabled the RBA to build the talent and the mindset for digital transformation. Gayan Benedict, CIO of RBA, noted, “To be future ready we’ve extended our emphasis beyond systems and technologies to skills and capabilities. These provide us adaptiveness in the fast-moving security space. By necessity, we’ve become proficient at lifecycle planning for key skills. This ensures our talent development provide us a continuous stream of skilled staff.”

Metrics to watch: percentage of employees with digital credentials - A platform mindset, to identify the firm’s “crown jewels” and convert them into reusable digital services that connect organizational silos to enable real-time transactions, fast innovation, and easy partnering. Singapore-based DBS infused technology into the business by reorganizing into 33 platforms with 350 APIs.[foot]"DBS named ‘World’s Best Bank’ by Euromoney magazine | 繁體 | Bahasa," DBS Newsroom, 11 July, 2019, https://www.dbs.com/newsroom/DBS_named_Worlds_Best_Bank_by_Euromoney_magazine.[/foot] Business and technology teams are co-drivers, with KPIs for accountability and funding decisions and a single backlog for prioritization.[foot]S. K. Sia, P. Weill, and M. Xu, “DBS: From the ‘World’s Best Bank’ to Building the Future-Ready Enterprise,” MIT Sloan CISR Working Paper No. 436, March 2019, https://cisr.mit.edu/publication/MIT_CISRwp436_DBS-FutureReadyEnterprise_SiaWeillXu.[/foot]

Metric to watch: the percentage of core capabilities that are API-enabled both internally and externally - Organizational surgery, to remove complexity while pursuing better and cheaper multiproduct, multichannel customer experience. Insurance Australia Group (IAG) has created a new division focused on strategy and innovation to build a technological edge. The new division combines IAG’s strategy function with its Customer Labs division, established in 2015 to deepen customer insights through digital capabilities such as analytics and artificial intelligence. CEO Peter Harmer called the operating model changes “a logical step for IAG” as the business builds on its core insurance portfolios with new and different services for customers.[foot]“IAG makes changes at the top to ramp up digital focus,” insuranceNEWS.com.au, 5 February, 2020, https://insurancenews.com.au/daily/iag-makes-changes-at-the-top-to-ramp-up-digital-focus.[/foot]

Metrics to watch: customer experience, cost to serve customers

Figure 2: Australian Firms Lag in Dealing With "Explosions"

Source: MIT CISR 2019 TMT and Transformation Survey (N=1311). Australia firms (N=131). 917 firms self-report a net profit margin.

1 Top Performers are the top quartile of firms on net margin, adjusted for industry. Self reported net profit margin correlates significantly with actual profit margin at the p<.01 level.

Set Up for Success

Figure 2 shows that Australian firms have potential upside in all four explosions. The key question of where to start is easy: No matter which pathway you take to Future Ready, the first explosion to tackle is decision rights.

As we emerge from the COVID-19 crisis, every firm will be focused on a sustainable business model and growth. The work leaders put in now to become Future Ready will make it faster and cheaper to achieve stability and growth. How will you help lead your firm to become Future Ready?

© 2020 MIT Sloan Center for Information Systems Research, Weill, Dery, and Woerner. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.