Digitally enabled business transformation is not primarily about technology— it’s about change. And it is not whether that change will come, but a question of when and how.

In the new digital economy, many companies won’t succeed by merely tweaking the management practices that led to past success. To thrive in a digitized universe, businesses of all sizes will need to reinvent themselves and substantially change their organizations. Yet leaders often lack a common language to assess the degree of threat that digital disruption poses to their business, and—more importantly—the language to create a compelling vision for their company’s success.

Since 2012, we have been studying top financial performers via field-based research and through both executive education and workshop facilitation with senior management teams and boards of directors. We have conducted interviews with over fifty companies and collected responses to six surveys from more than a thousand companies.[foot]This research draws from several MIT CISR projects: Digital Business Models (2011–2013), The Next-Generation Enterprise (2012–2016), Digital Disruption (2014–2016), Mobile Apps (2013–2014), Boards (2014), Internet of Things (2015), and Digital Workplace (2014–2016); and surveys: Board survey (N=83), Digital Business Models survey (N=118), Next-Generation Enterprise survey (N=200), Digital Disruption survey (N=413), Mobile Apps survey (N=334), and Digital Workplace survey (N=313).[/foot]

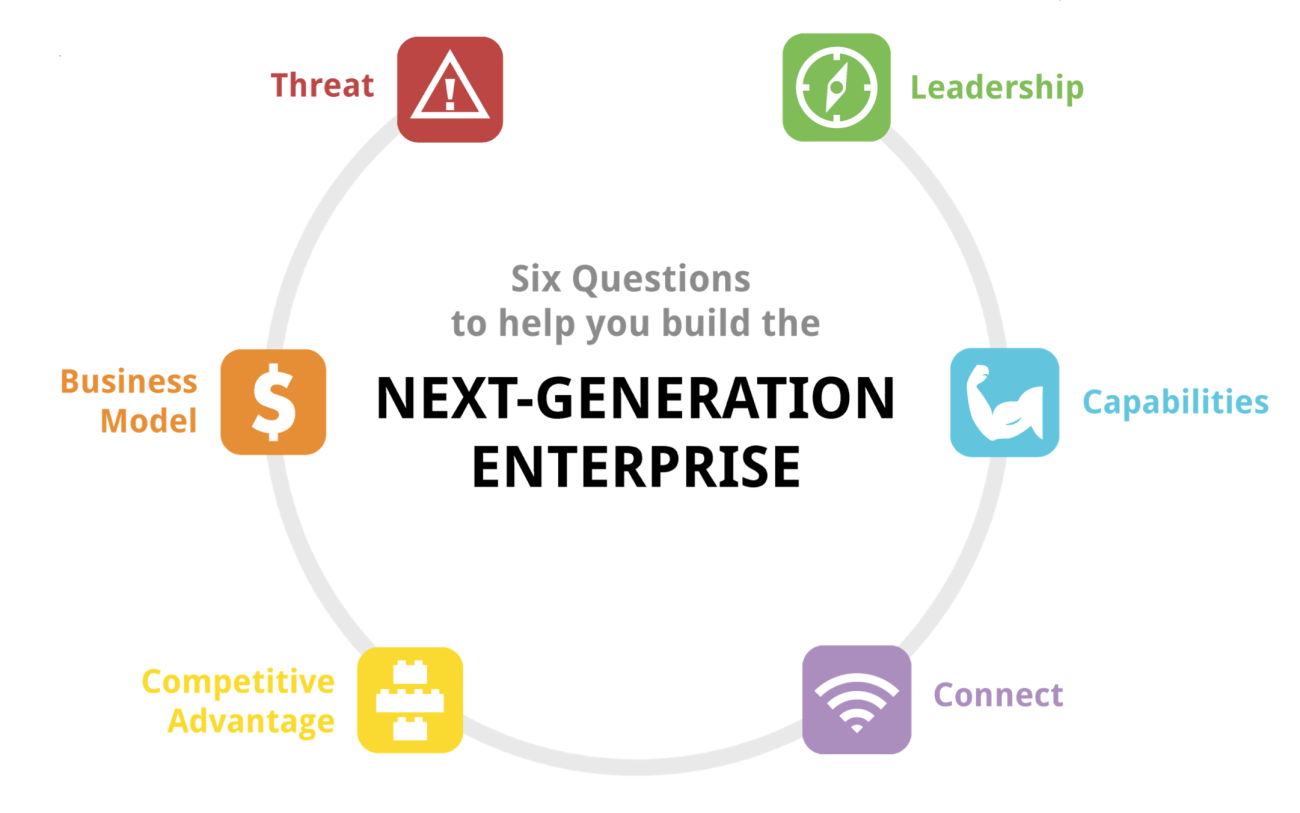

In this briefing, we identify six key questions to help executives as they develop a company’s transformation strategy, and provide an overview of the actions required for success. The briefing derives from our May 2018 book, What’s Your Digital Business Model?: Six Questions to Help You Build the Next-Generation Enterprise.[foot]Peter Weill and Stephanie L. Woerner, What's Your Digital Business Model?: Six Questions to Help You Build the Next-Generation Enterprise, (Cambridge: Harvard Business Review Press, 2018).[/foot]