Since 1997, MIT CISR has been measuring IT investment and the resulting IT portfolios,[foot]This research briefing is part of a series on IT portfolios; “Managing the IT Portfolio (Update Circa 2003)” (March 2003) introduced the concept of the IT Portfolio and its four asset classes. For purposes of this analysis, we use two asset classes: infrastructure investment, one of the four original classes; and applications, comprising the other three original classes—strategic, informational, and transactional investments. Other research briefings in this series identified the returns from each IT asset class (“Managing the IT Portfolio: Returns from the Different IT Asset Classes,” March 2004), demonstrated the impact of IT savvy on financial performance (“IT Savvy Pays Off,” October 2004), illustrated the differences between high and low IT savvy via two case studies (“IT Savvy: Achieving Industry Leading Returns from your IT Portfolio,” July 2005), discussed how to become more IT savvy (“Becoming More IT Savvy and Why It Matters,” March 2007), identified the importance of what’s new in the portfolio (“Managing the IT Portfolio (Update Circa 2008): It’s All about What’s New,” July 2008), and investigated what happened to IT infrastructure (“Managing the IT Portfolio (Update Circa 2009): Infrastructure Dwindling in the Downturn,” August 2009).[/foot]and within the last few years we’ve shifted the emphasis from IT to digital investment and portfolios. Never before have we seen investment in infrastructure produce such significant impacts, in areas including data, cloud, APIs, and IP-addressable assets. We are in the middle of a digital transformation of most businesses, and in our research we have found that more investment in digital infrastructure is correlated with several desirable outcomes, including more revenues from innovation and higher margins.

Succeeding at Digital Requires More Infrastructure

Abstract

We are in the middle of a digital transformation of most businesses, and in our research we have found that more investment in digital infrastructure is correlated with several desirable outcomes, including more revenues from innovation and higher margins. In this briefing we share our most recent digital investment survey results, examining the recent increase in infrastructure investment, digging into the data to understand why infrastructure is so important for success in 2016, and identifying the practices top-performing companies use to manage and drive value from infrastructure.

In this briefing we share our most recent digital investment survey results,[foot]MIT CISR 2015 CIO Digital Disruption Survey, N=413.[/foot] digging into the data to understand why infra- structure is so important for success in 2016, and examining the practices top-performing companies use to manage and drive value from infrastructure.

Digital Portfolios: Infrastructure vs. Applications

Digital portfolio management is a tool that MIT CISR has found can help executives assess investment enterprise wide. The digital portfolio includes total digital spending in the enterprise—operating expenses plus capital depreciation—including all IT, technology, services, digitized information, outsourcing, and people dedicated to IT. In this analysis of a portfolio with two asset classes, infrastructure and applications (see figure 1), infra- structure provides the foundation of shared IT and digital services used by multiple applications (e.g., servers, networks, laptops, customer data- bases) and excludes applications. Applications are all other digital investment that uses the infrastructure.

More investment in digital infrastructure is correlated with desirable outcomes that include more revenues from innovation and higher margins.

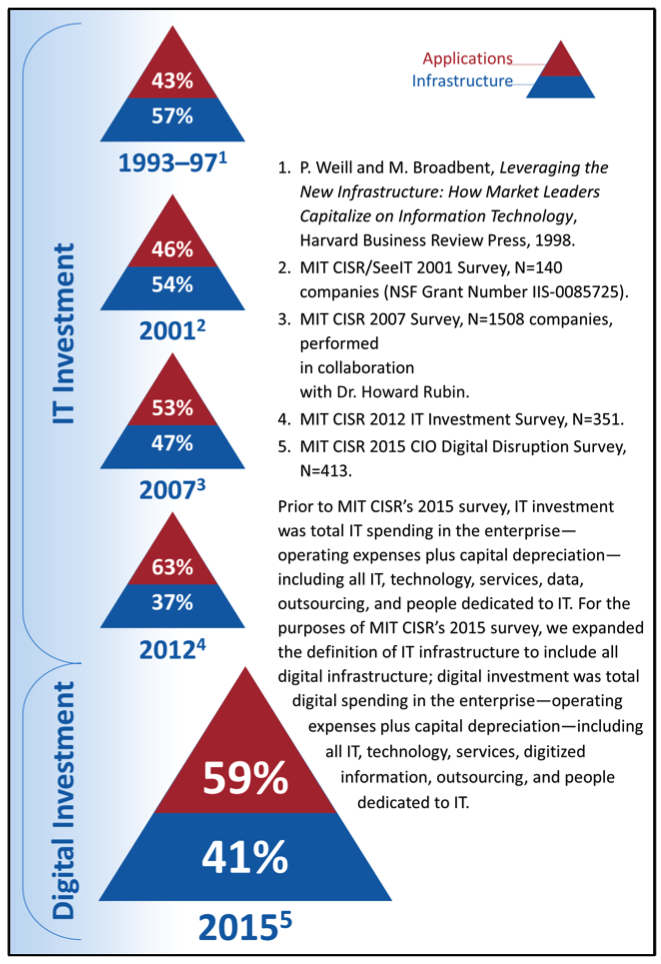

Figure 1 shows an interesting trend in infrastructure in the twenty years leading up to 2012. Using a consistent definition of IT infrastructure, the average company’s investment in infra- structure steadily declined, falling from an average of 54% of IT investments in 1993–97 to 37% in 2012. This reduction in infrastructure spending was driven by a number of factors including:

- Increase in digital power per dollar (e.g., Moore’s Law)

- Cloud-based services

- Infrastructure consolidation (e.g., data center

- consolidation, server virtualization)

- IT outsourcing (to service providers with bet- ter economies of scale)

- Business process outsourcing (in instances when the infrastructure supporting the business process is no longer needed within the company)

But from 2012 to 2015 the trend in infrastructure investment reversed, increasing by 11% [foot]Actually a 10.8% increase in infrastructure investments, i.e., 41% - 37% = 4% and 4%/37% x 100 = 10.8%.[/foot] (see figure 1). This is possibly in part because for our 2015 survey we expanded the definition of IT infrastructure to include all digital infrastructure to reflect the digital era But we think most of the increase occurred because companies have recognized a need to become more connected. Virtually every company we talk to is focused on becoming more digital, primarily in three areas: customer experience, internal operations, and business design (i.e., being part of a larger digital ecosystem that involves complementors and even competitors). Every company is virtualizing traditional infrastructure and spending more on infrastructure capabilities such as IP-addressable assets, identity management, API development, master data management, and data storage.

Figure 1: IT/Digital Portfolios, 1993–2015

The move to digital creates a great need for more infrastructure—and the drivers are a healthy combination of opportunity and threat. Top-performing companies (companies with net margins in the top quartile relative to their industry average) spend 55% of their digital budget on infrastructure, com- pared to bottom-performing companies (companies with margins in the bottom quartile in their industry), which spend only 37% (see figure 1). Top-performing companies both have the funds to invest in infrastructure and are seeing the impacts of investment on their profitability—a positively reinforcing spiral. Threat drives investment in infrastructure as top- (bottom-) performing companies anticipate that 49% (19%) of their revenues will be under threat from digital disruption in the next five years.

The Key Infrastructure Capabilities

A big area of infrastructure investment currently is connectivity—connecting disparate systems, assets, services, and data. Two important areas of connectivity differentiation we’ve seen are APIs and IP-addressable assets (see figure 2).

For services companies like healthcare and banking, deploying APIs is a strategy critical to improving the customer experience. APIs—application programming interfaces—make existing systems more easily accessible for use both inside the company and externally by partners and customers. For example, Aetna’s strategic goal was to build a healthier world. Developing an attractive destination for health and wellness needs was a key part of realizing this goal.[foot]See P. Weill, S.L. Woerner, and R.E. Samuel, “Aetna: Building a Healthier World via a Digital Eco- system,” Vol. XV, No. 11, November 2015.[/foot] The initiatives to achieve this included developing a clear vision, integrating a series of acquisitions and partnerships, and opening up Aetna’s business capabilities for connection. The IT group led a program to service-enable many of Aetna’s key business capabilities via APIs so that internal col- leagues and external affiliates could use them for innovation and service provision. The goal of enabling API integration at Aetna is to create a delightful and intuitive experience for the customer, bringing together Aetna’s traditional plan offerings with consumer wellness offerings.

APIs are important for companies that deal in physical products and services, too. But perhaps even more important is adding IP addresses and capabilities to physical assets and products that allow a company to create new services and customer experiences. These IP-addressable assets include a myriad of products such as washing machines (e.g., Whirlpool), cars (e.g., BMW), tractors (e.g., Caterpillar), garbage cans (e.g., Ferrovial), machine tools (e.g., Tetra Pak), elevators (e.g., Schindler) and shipping contain- ers (e.g., Maersk). Top- (bottom-) performing infrastructure investors have made 48% (30%) of their assets IP-addressable now, and according to our survey, they plan to have 67% (48%) IP addressable in five years.

Federico Florez, the global CIO of infrastructure services provider Ferrovial, explains his company’s strategy around IP-enabling physical assets:

The number of sensors on physical assets will dramatically increase because of IoT. This is a great opportunity for Ferrovial and we are developing several applications that connect our infrastructure through sensors to increase efficiency and reduce costs. And with the new data we see and analyze we can forecast behaviors allowing us to start businesses and generate new sources of revenue.

—Federico Florez, Global Chief Information Officer, Ferrovial

|

Measure |

Top-performing Companies |

Bottom-performing Companies |

|---|---|---|

|

% of IT investment spent on infrastructure |

55% | 37% |

|

% of core capabilities that are service enabled via APIs for internal use |

51% | 27% |

|

% of IP-addressable assets |

48% | 30% |

Top-performing companies are companies with net margins in the top quartile relative to their industry average. Bottom-performing companies are companies with net margins in the bottom quartile relative to their industry average.

What Works Best for Managing and Governing Infrastructure?

MIT CISR has a long history of studying governance best practices in IT management.[foot]For example, see P. Weill and J.W. Ross, IT Governance: How Top Performers Manage IT Decision Rights for Superior Results by Peter Weill and Jeanne W. Ross, Harvard Business Review Press, 2004.[/foot]In our survey, we found that the following four practices seem to pay off: top-performing companies were statistically significantly more effective at these practices than bottom performers.

- Executive Committee education and focus: Digital transformation is an enterprise- wide effort requiring executive committee education and focus. We found that two areas really differentiated effectiveness of executive committees: focusing on creating and delivering digital products, and building enterprise- wide data capabilities. In the workshops on digital transformation that MIT CISR has conducted for executive committees, we see a switch flip when executives realize these two capabilities are critical, and that different investments, processes, and often organizational structures are required to achieve them.

- Simple but effective digital governance with consequences: We think of digital governance as decision rights and accountability around the key decisions important for digital transformation. Following up and reinforcing this governance is critical for success. Two important governance capabilities that differentiated top performers in our survey were related to measurement and learning. When it comes to measurement, having a performance dashboard that quickly highlights progress and performance impact and is shared across the company really makes a difference. On learning, it’s post-implementation reviews: virtually every MIT CISR study on getting value from technology has found that effective post-implementation reviews (actually, in-process implementation reviews as well) really differentiate top performers. Yet performing such reviews is difficult, disruptive, and politically challenging, and often done poorly.

- Customer orientation: One of the core promises of digital is better customer experience, which typically involves integrating organizational silos. Companies have tried different approaches to achieving this goal. We found that creating a single customer experience group is an important step. Rather than focusing on selling products, the US financial services company USAA created a customer experience group of customer support employees from all of the company’s product groups to target the life event needs of its customers with packaged and integrated services. For example, USAA can address the life event of a customer who wants to buy a car by combining several products, from finding and buying the car through financing and insuring it, all from a single interaction.[foot]J.W. Ross and C.M. Beath, “USAA: Organizing for Innovation and Superior Customer Service,” MIT Center for Information Systems Research Working Paper No. 382, December 2010.[/foot]

-

Evidence-based decision making: Digital transformation generates huge amounts of data. What differentiated the top-performing companies in our survey was how they use this data and change their culture to be evidence based rather than based on a gut feeling or experience. Whether companies used dashboards, visualization tools, incentives, or other techniques to support their decision making, the culture change was palpable. As a CEO of a Las Vegas-based casino is fond of saying, “there are two ways to get fired from this company—behave unethically or do an new customer initiative without a control group!”

In a digital world we’re going to see both increasing automation and improving customer experience. To get there will require significant investments in infrastructure supported by sophisticated management practices to extract the value. Today the biggest investors in infrastructure are top-performing companies, as they foresee their future becoming increasingly digital. Companies most under threat realize they have to invest to survive.

©2016 MIT Sloan CISR, Weill and Woerner. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.