In many firms, the downturn has put severe pressure on all budgets and IT is no exception. However, in a global survey of 1541 firms, we found that 43% of firms in the study increased their IT budgets, 19% reduced budgets and the rest stayed about the same.[foot]This briefing draws on data from the Gartner Executive Programs 2009 CIO Survey. MIT CISR collaborated on the design of some questions in this survey.[/foot]

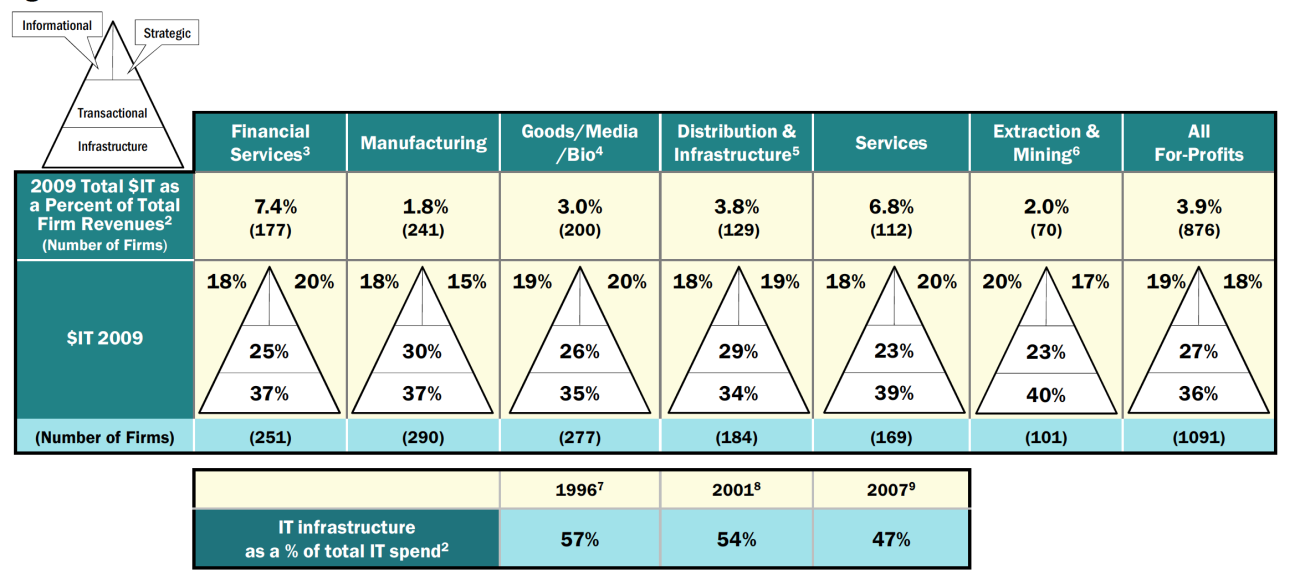

There is significant variation among industries and geographies. For instance, one oil company we talked to cut its IT budget by 40% and in financial services, the average IT budget is down 11%. IT budgets, however, are up 14% in Brazil and 20% in India. The good news across the world is that IT infrastructure comprises an ever-decreasing percentage of the IT budget, giving IT organizations additional new investment opportunities. Effectively managing these opportunities and pressures on IT budgets requires an enterprise-wide view.

One tool that can help executives take an enterprise-wide view is IT portfolio management. Portfolio management uses a familiar language, based on financial portfolio management. More importantly, it provides a common vehicle for prioritization and consolidation across the entire business. Using the MIT CISR IT portfolio framework, this briefing presents 2009 benchmarks for IT portfolios from the Gartner Executive Programs 2009 CIO survey. The briefing highlights how infrastructure is rapidly shrinking and where the freed up IT budgets are being spent.

IT Spending in 2009

Just as investors address their objectives for risk and return using portfolios of financial investments, firms use IT portfolio management to better enable their management teams to match IT investments to their strategic objectives. To effectively manage any portfolio, all investments must be included. The IT portfolio encompasses total IT spending in the enterprise (operating expenses plus capital depreciation) including all technology, services, digitized information, outsourcing, and people dedicated to IT. The average firm is spending 3.9% of revenues on IT in 2009 (see Figure 1). Average IT spending varies significantly by industry with extracting and mining firms allocating 2% of revenues to IT whereas banks spend 7.4%.

Four Asset Classes

Our research has found that executives have four different management objectives for investing in IT:

- Transactional—cut costs or increase throughput typically by automating the repetitive transactions of the firm (e.g., billing system or insurance renewal);

- Informational—provide information for any purpose including to account, manage, control, report, communicate, comply, or analyze (e.g., sales analysis, six sigma, government reporting);

- Strategic—gain competitive advantage or position in the market place (e.g., iPhone’s app ecosystem);

- Infrastructure—provides the foundation of shared IT services used by multiple applications (e.g., servers, networks, laptops, customer databases—excludes applications).

Spending to achieve the four management objectives becomes an IT portfolio with four asset classes. Infrastructure is the base of the portfolio, providing IT capability to support the applications above (see Figure 1). In 2009 the average firm in our study allocated only 36% of its total IT spending to infrastructure. Transactional systems use the IT infrastructure and account for 27% of IT spending. The informational and strategic systems typically build on both the transactional and infrastructure capability, accounting for 18% and 19% of IT spending, respectively. Any particular project or system can span more than one management objective depending on the combination of its strategic goals and the installed IT.