Few firms are capitalizing on the potential benefits of data at the same rate as they are amassing data. Today, most organizations are accumulating new data from sensors, mobile devices, and emergent data sources and adding it to largely untapped reservoirs of transaction data and master files. In the worst cases, data breaches have made data more of a liability than an asset. How can business leaders ensure a worthy return on a company’s data investments? Our research suggests that leaders must clarify exactly how they intend to profit from the data deluge and align competencies with their intentions.

Profiting from the Data Deluge

Abstract

Executives who intend to profit from the data deluge must understand that companies can create direct bottom-line impact from their data in three ways: (1) improving internal business processes and decisions, (2) wrapping information around core products and services, and (3) selling information offerings to new and existing markets. Although companies may choose to pursue multiple approaches, the approaches differ radically in the types of capabilities and commitments they require. This briefing describes improving, wrapping, and selling—and how a firm can generate a return from whatever data initiatives it pursues.

Leaders must clarify exactly how they intend to profit from the data deluge and align competencies with their intentions.

Companies can create direct bottom-line impact from their data in three ways: (1) improving internal business processes and decisions, (2) wrapping information around core products and services, and (3) selling information offerings to new and existing markets. These approaches differ radically in the types of capabilities and commitments they require. But each is a viable choice for how a firm can make money from data. This briefing describes improving, wrapping, and selling—and how a firm can generate a return from whatever data initiatives it pursues.

Improving With Data

Improving business processes and decisions with data is the least glamorous but potentially most straightforward alternative for generating value from data. Executives often underestimate the financial returns that can be generated by using data to create operational efficiencies. Companies do this by putting data and analytics in the hands of employees who are positioned to make decisions, such as those who interface with customers, oversee product development, or run production processes. This extends to supply chain or ecosystem partners who contribute key resources or services to the firm. With data-based insights and clear decision rules, people can deliver meaningful service, better address customer demands (or choose not to), and optimize production. The resulting value can be striking:

- UPS is providing its drivers with optimal routes powered by new algorithms, expected to result in up to $400 million in annual savings by 2017.[foot]Steven Rosenbush and Laura Stevens, “At UPS, the Algorithm Is the Driver,” The Wall Street Journal, February 16, 2015, http://www.wsj.com/articles/at-ups-the-algorithm-is-the-driver-1424136536[/foot]

- The University of Iowa Hospitals and Clinics supplies patient data and predictive analytics regarding risk of surgical infection to doctors so that they can minimize the risk by altering medications or wound treatment.[foot]Rachael King, “Analytics Predict Which Patients Will Suffer Post-Surgical Infections,” The Wall Street Journal, February 11, 2015, https://www.wsj.com/articles/BL-CIOB-6267[/foot] Resulting changes in medical practices have reduced the rate of infections in patients who have colon surgery by 58% over a two-year period.

- Columbia Sports has increased the share of goods delivered on-time, in-full from 28% to 78% by using supply chain analytics software that informs decisions, enabling staff to respond effectively.[foot]Clint Boulton, “Columbia Sportswear Boosts Profit With Focus on Supply Chain,” The Wall Street Journal, May 8, 2015, https://www.wsj.com/articles/columbia-sportswear-boosts-profit-with-focus-on-supply-chain-1431121627[/foot] The analytics help diagnose the root cause of an issue, such as the ship delay at a port behind a product delivery delay.

These impressive results do not transpire from single “aha” moments; instead, they demand significant—and sometimes painful—organizational changes. Over time, as organizations work to increase efficiencies and improve decisions, they clean up data, hone reports and algorithms, grow talent, and change habits. In effect, they learn how to become evidence-based organizations.[foot]Prior MIT CISR research identified three sets of practices that help organizations build evidence-based decision-making cultures. B. H. Wixom and C. M. Beath, “Winning the Data Race,” MIT Sloan CISR Research Briefing, Vol. XIV, No. 3, March 2014, https://cisr.mit.edu/publication/2014_0301_DataRace_WixomBeath[/foot]

Past MIT CISR research identified that companies reap the greatest returns from improving when data is used pervasively throughout the firm to take action.[foot]Jeanne W. Ross, Cynthia M. Beath, and Anne Quaadgras, “You May Not Need Big Data After All,” Harvard Business Review, December 2013, https://hbr.org/2013/12/you-may-not-need-big-data-after-all[/foot] In many cases, companies can incentivize employees and mandate that they use data to solve problems and succeed at their jobs. Increasingly, companies are identifying decisions that should simply be automated, thus freeing employees for activities that require human input.

Wrapping With Data

Commoditization pressures and shifting consumer expectations are inspiring many companies to generate value through data by enriching core products and services with information, a phenomenon that we call wrapping. Companies wrap offerings with data to differentiate them and to add value to customers, which increases product-related outcomes that include price, sales, and loyalty. FedEx was an early exemplar of wrapping when it introduced package tracking as a free service in the 1980s. Now, examples of wrapping abound:

- CapitalOne provides advanced reporting on credit card transactions to its customers, including a map that shows exactly where a transaction occurred. The map can help customers identify fraudulent transactions.

- Johnson & Johnson provides its OneTouch Verio®Sync Meter customers with historical reporting on their blood glucose levels, along with tools to help with pattern identification and interpretation. The reporting is intended to help customers better manage their diabetes conditions.

Like with improving, a product or service wrapped with data or analytics does not produce value on the data alone. Rather, whether a credit card or health monitor, wrapping amplifies the value of a core product or service by making it more useful, easier to use, and more enjoyable to experience.

When companies wrap, they are delivering data to customers as a product feature and therefore need to establish competencies in delivering information that meets the standard the company has for product quality. Companies must create features and experiences that are effortless to adopt and obviously beneficial.

Selling Data

With selling, data-based products or services generate revenues independent of non-data offerings. Information businesses like LexisNexis, the Nielsen Corporation, and TransUnion have been selling data successfully for decades. These businesses grew by using analytics to solve important business problems for their customers (e.g., refine their customers’ supply chain optimization or revenue management). As data proliferates, more companies see opportunities to solve others’ problems with their data. In these cases, companies expect to sell any of raw data, prepared data, reports, analytics, and analytics-based consulting services or process outsourcing to existing customers or new markets. The hype around data monetization and the success of high-profile platform businesses like Uber have spotlighted selling for firms’ strategic leaders.

Selling may seem to be a good fit for companies that have deep domain expertise, an engaged customer base, and factory-like data capabilities. Companies with an incumbent business model, however, have a tendency to impose the practices and values of their existing business on their information business. This invariably creates high overhead costs, regulatory constraints, unrealistic P&L expectations, bureaucratic processes, rigid data use terms, or conservative talent management practices, any of which can constrain a new information business in the marketplace. Companies need to allow their information businesses to pursue a unique business model without interference.

Since 2013, MIT CISR research has investigated what it takes to be a successful information business.[foot]MIT CISR researchers conducted seven in-depth case studies of information businesses and interviewed fifty-eight executives who represented thirty-four organizations.[/foot] We have identified unique capabilities, cultures, and sources of competitive value in these firms.[foot]See A. Buff, B. H. Wixom, and P. P. Tallon, “Foundations for Data Monetization,” MIT Sloan CISR Working Paper No. 402, July 2015, https://cisr.mit.edu/publication/MIT_CISRwp402_FoundationsForDataMonetization_BuffWixomTallon[/foot] Companies that intend to sell data or data-related services must appreciate that they will be competing against or partnering with companies for which this pursuit is a core competence. Such companies aggressively pursue unique product and service offerings that are of value to their customers:

- comScore’s CEO invests significantly in environmental scanning, M&A capabilities, and product innovation processes within the firm. Recognizing that competitors are constantly raising the bar, he considers a product obsolete once it hits the marketplace.

- Healthcare IQ believes that sustainable success requires that customers have strong analytics skills. Toward that end, the company has partnered with a local university to create an online MBA program whereby health professionals can apply analytics to work problems in an educational setting using Healthcare IQ tools and approaches.

- LexisNexis Risk Solutions considers ongoing technical advancement critical to remaining a leader in identity analytics. The company has created the HPCC open source community as a way to evolve its high-performance platform for big data applications.

These three companies have deep technical and market-based capabilities that have enabled their success. Companies intending to enter this marketspace will likely need similar competencies.

Improving, Wrapping, and Selling Are Fundamentally Different

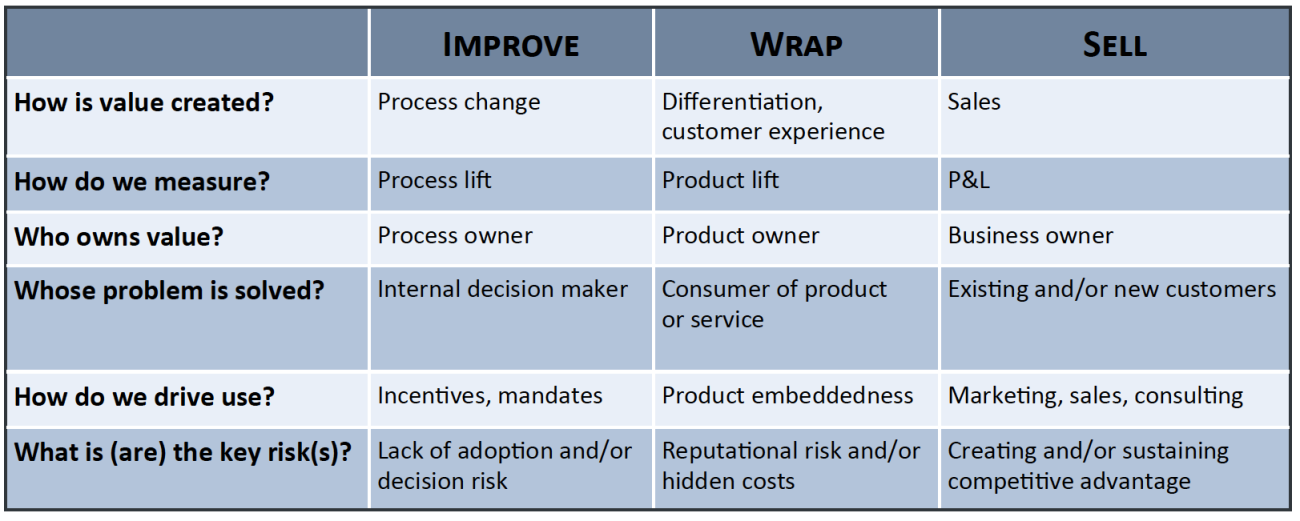

Improving, wrapping, and selling represent viable choices that companies can make to generate bottom-line value. Conceivably, a company can benefit from using all three approaches to drive value from data. As figure 1 shows, however, each approach requires distinctive competencies. Success in one approach does not position you for success in another.

Figure 1: Key Differences Between Improving, Wrapping, and Selling Data

For example, the success of improving depends on the leadership of process owners who define needed changes, recognize the opportunity for applying data tools, and ensure adoption of changes. In contrast, wrapping demands engaged product owners who can envision the value offered by information wrapped around or embedded in their products. They must be willing to engage with other parts of the company—like IT and operations—in ways that were not necessary when developing and selling the core product. Selling requires the appointment of a new LoB leader who is adept at executing the selling business model.

Similarly, the three approaches introduce distinctly different risks. The risks of improving are that the company fails to effectively adopt the required changes or that the decision-making process breaks in some way—e.g., decisions are made on poor assumptions or bad data—which leads to bad insights. Process owners can manage those risks by carefully tracking impacts and making course corrections, and by establishing training and coaching for people engaged in decision-making activities. The risks associated with wrapping are already familiar to product owners: that the accompanying information is either low quality and adversely affects the core offering, or that it adds more cost than revenue to the product’s profit formula. Product owners already know how to test and price their products; they will need to follow similar protocols for accompanying information. Finally, the risks associated with selling are the very risks of business failure that accompany any new business venture—accentuated by inexperience if a company is seeking new markets or customers with a new set of products and services. Information business owners must ensure that their business model is protected from incumbent business pressures and that it receives proper care and feeding.

The important thing to recognize is that, while the data deluge offers all kinds of opportunities to enrich your business, companies cannot assume that they are positioned to generate value from data. To profit from the data deluge, companies must purposefully establish strong leadership and dedicated resources for every initiative.

© 2015 MIT Sloan CISR, Wixom and Ross. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.