It’s not surprising that companies often fail to realize expected value from data initiatives. MIT CISR research[foot]Research in this briefing is based on twenty longitudinal MIT CISR case studies and twenty-six interviews conducted in 2013 with executives responsible for data at large Fortune 300 organizations.[/foot] identified nearly one hundred different obstacles that organizations encounter as they attempt to transform data into insights and then into actions that drive business benefits. Fortunately, the research also identified what keeps organizations on track for receiving expected benefits. This briefing describes how companies can position themselves to “win the data race.”

Winning the Data Race

Abstract

Companies are racing to transform data into insights and then into actions that drive business benefits, but countless obstacles can hamper progress along the way—or even stop efforts completely. MIT CISR research has identified three sets of practices that facilitate movement along the data racetrack: user-centric development, hybrids, and internal marketing. This briefing describes how the big winners will be organizations that adopt these practices while solving specific, important business problems and building capabilities incrementally by circling the track a number of times.

From Data to Insight to Action

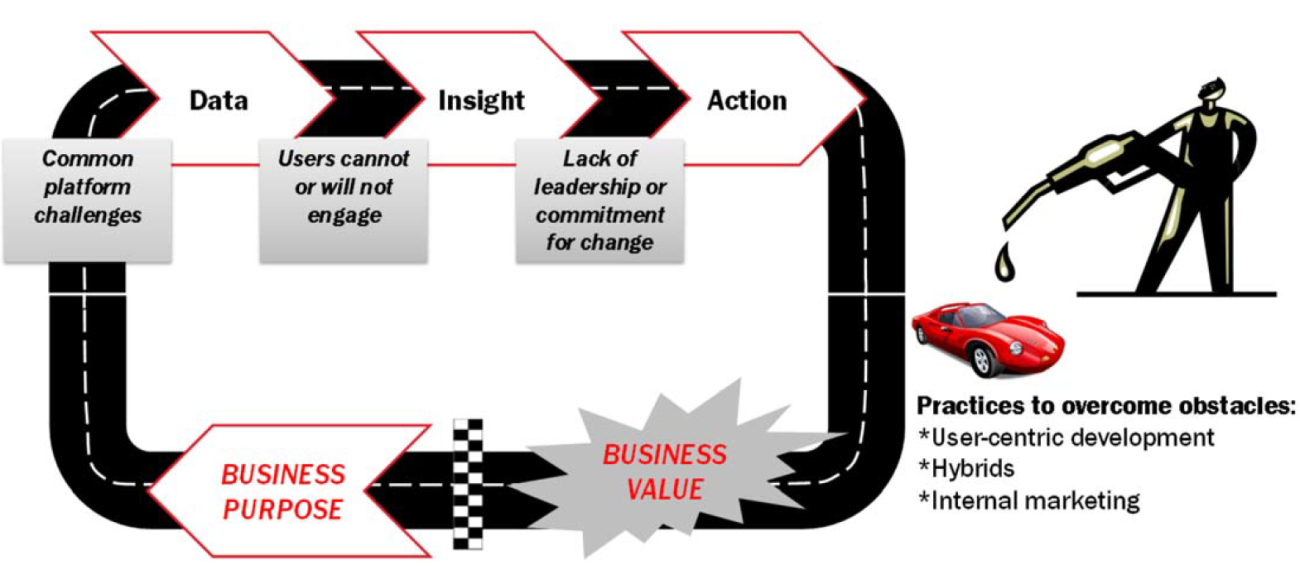

It’s commonly accepted that data initiatives such as big data and business analytics require three distinct steps: (1) establish a data platform, (2) generate meaningful insights from the platform, and (3) take actions based on insights, usually in the form of business process and organizational changes. IT leaders routinely attempt to move through these steps sequentially, intent on first developing a solid data platform as a base for useful insights and actions. At the same time, they face tremendous speed-to-market pressures to achieve some urgent data-based business objective quickly. The result is a data race. This data race is very hard to win, particularly because of the countless obstacles that can hamper progress along the way, or even stop the race completely. Figure 1 highlights the potential obstacles.

Obstacles to realizing value from data initiatives include (1) missing or broken business processes, (2) business users who cannot or will not engage, and (3) a lack of leadership or commitment for change.

The obstacles to establishing a data platform range from data quality issues (e.g., inaccurate data, missing data) and data integration challenges (e.g., lack of unique identifiers, inaccessible source systems) to politics and regulation. The root cause of many platform obstacles is missing or broken underlying business processes. For example, the U.S. Securities and Exchange Commission[foot]B. Wixom and J. Ross, “The U.S. Securities and Exchange Commission: Working Smarter to Protect Investors and Ensure Efficient Markets,” MIT Sloan CISR Working Paper No. 388, November 2012, https://cisr.mit.edu/publication/MIT_CISRwp388_SEC_WixomRoss[/foot] found that a big contributor to its failure to detect the Bernie Madoff Ponzi scheme for so long was that the numerous tips citizens sent in went to so many different people that no one (and no system) recognized a pattern of concerns. To protect against similar oversights in the future, the SEC first had to create a single data repository for tips, complaints, and referrals (TCR) to identify securities fraud. Then the SEC had to spend significant time establishing a TCR business process with new roles, supporting systems, and policies and procedures to both generate and process data that would be useful to the kinds of analytics capable of identifying potential fraud.

A second set of obstacles can prevent companies from generating insights from data, even in the presence of a powerful data platform. Here the issue most often is business users who cannot or will not engage with data analysis. Users cannot engage when they lack proper analytics skills and tools, when they don't have time to build trust in the analysis process, or when they don't understand the data. Users will not engage when they lack vision of what insights are possible or a compelling business reason for getting involved with analysis. Analytics provider comScore[foot]B. Wixom, J. Ross, and C. Beath, “comScore, Inc.: Making Analytics Count,” MIT Sloan CISR Working Paper No. 392, November 2013, https://cisr.mit.edu/publication/MIT_CISRwp392_comScore_WixomRossBeath.[/foot] needs its clients to engage with its products and services to ensure the sustainability of its business model. To help clients engage, comScore found it needed to create an organizational unit dedicated to supporting the consumability of its data.

Even with brilliant insights in hand, a third set of obstacles can impede the realization of benefits from insights. Many of these obstacles are rooted in a lack of leadership or commitment for change. Many companies fail to appreciate the new roles, policies, processes, and systems that accompany acting on insights. A retailer from our research, for example, discovered that a change to its markdown cycle—lengthening by two weeks the time before clothes were put on sale—would significantly improve its bottom line. The insight was never acted on, however, because there were too many process and system changes that would need to occur—and there was no business leader willing to champion the transformation.

We have identified three sets of practices that work to overcome obstacles in organizations driving value from their data initiatives, facilitating movement along the race track.

User‐centric Development: Actively Engage Users to Develop Tools and Services

First, companies can embrace user-centric development. Development approaches that actively engage users will give them “skin in the game”: agile methodologies, co-location, business unit hires in the IT unit, or data/analytics groups within business units, such as a marketing analytics group that reports to the marketing department, either directly or via matrix. When business users help develop data tools and services firsthand, it's much more likely that the company will invest in data that matters, that business requirements will propel analysis, and that required changes will be feasible and desired.

The big winners of the data race will be those organizations that embark on data initiatives to solve specific, important business problems and build capabilities incrementally.

At contemporary clothing retailer GUESS?,[foot]B. Wixom and A. Quaadgras, “GUESS?, Inc.: Engaging the Business Community with the ‘New Look’ of Business Intelligence,” MIT Sloan CISR Research Briefing, Vol. XIII, No. 8, August 2013, https://cisr.mit.edu/publication/2013_0801_GUESS_WixomQuaadgras[/foot] for example, the development team shadowed business users at meetings and store visits to understand their decision-making needs and work habits. The shadowing revealed that users were engaged with and interested in “best seller” information and decisions. Although the development team knew that there was potential for myriad other data, insights, and actions—such as those associated with sentiment analysis of social media data—it focused its efforts on tools and services related to best sellers, which ultimately led to business changes that reduced markdowns and stockouts.

Hybrids: Proactively Develop Business‐savvy IT People and IT‐savvy Business People

Companies that make it around the race track typically have “hybrids” on staff. These people have a healthy combination of business and technology skills. Hybrids can be incredibly business-savvy IT people, technically adept business users, or a group of employees that collectively displays both kinds of skills. Companies can develop a hybrid workforce through hiring practices, employee rotations and movement across and within IT and business units, and the identification and development of “power users.” User-centric development also helps build hybrids. Hybrids are critical for the data race: armed with technical skills and domain expertise, they can pinpoint the right data and identify insights that matter, then—with informed understanding of the company—lead others in new ways of working.

Beginning in 1994, CEO Gordon Bethune led a transformation of Continental Airlines[foot]Anderson-Lehman, Watson, Wixom, and Hoffer, “Continental Flies High with Real-Time Business Intelligence,” MIS Quarterly Executive, December 2004, http://www2.commerce.virginia.edu/CMIT/activities/MISQE%20final.pdf.[/foot] from its “worst to first” position in the U.S. airline industry, and then from “first to favorite."[foot]Fortune rated Continental Airlines the #1 most admired global airline from 2004–2009.[/foot] Bethune’s strategy was supported by data warehousing and real-time business analytics, which were used pervasively across the enterprise. A primary reason for the breadth of analytics usage was the large number of hybrid employees who had the willingness and ability to exploit data warehousing and real-time business analytics in ways that drove Bethune’s crystal clear strategic objectives. These hybrids took on many forms: analytics groups that were housed in non-IT business units, IT employees who were hired in from other business units, new employees who were hired for analytics skills, and power users with whom the IT unit regularly engaged on data-based projects. As a result, a continuum of analytics skills existed across Continental: IT employees had considerable business knowledge, and many people within other business units possessed excellent technical skills—in fact, enough knowledge to build their own data reports and perform their own analyses.

Internal Marketing: Aggressively Market and Sell the Value of Data

Companies that race along the track aggressively market as they go: value from business analytics and big data initiatives is proactively prioritized, tracked, and “sold” internally. Realized value can be communicated using company videos, newsletters, knowledge-sharing portals, clever marketing campaigns, and “dog and pony shows.” Some companies use project retrospectives to identify actual value after projects are launched. Internal marketing creates awareness about the business value that investments in data can produce and helps people throughout the organization understand how to identify data, analyze it, and adopt changes that are required to generate value from new insights.

At the U.S. railroad Norfolk Southern,[foot]Wixom, Watson, and Werner, “Developing an Enterprise Business Intelligence Capability: The Norfolk Southern Journey,” MIS Quarterly Executive, June 2011, https://aisel.aisnet.org/misqe/vol10/iss2/3/.[/foot] over twenty-five business units meet monthly to share their data experiences with the objective of promoting data as an enterprise resource. At each meeting, a subject matter expert makes a presentation on existing data or an application, and as a result the group spearheads changes to the data platform (e.g., data quality improvements) and new forms of analysis (e.g., geospatial analysis). This leads to changes in how decisions get made within business units. For example, the Human Resource Planning group applied geospatial analytics when making strategic decisions that involve employee locations because of capabilities described by Engineering at a past meeting.

Racing Around the Track to Drive Business Value

The big winners of the data race will be those organizations that embark on data initiatives to solve specific, important business problems and build capabilities incrementally by circling the track a number of times. Several years ago, for example, Hertz Corporation entered a big data race to interact with rental car customers in highly individualized ways using real-time mobile data, with the intent to increase customer satisfaction. For the first iteration, Hertz created an organizational unit with focused goals, and partnered with vendors and service providers to fill in capability gaps. At the same time, the company began to architect a long-term data platform and build internal analytics skills. This approach led, in a relatively short time, to a successful pilot of Hertz CarfirmationsTM, a text-messaging service that helped Hertz earn a number of prestigious Car Rental Industry Awards in 2013.[foot]Hertz was recognized in Travel + Leisure’s World’s Best Awards 2013, Frequent Business Traveler’s 2013 GlobeRunner Awards, and Executive Travel ’s 2013 Leading Edge Awards, according to a company press release on July 31, 2013 [/foot]

As Hertz and other companies featured in this briefing illustrate, there will be little value from taking a single lap around the track. Big value comes from accelerating the number and speed of the laps, whereby positive experiences—combined with user-centric development, hybrids, and internal marketing—refuel the organization for subsequent laps. Hertz, for example, has only begun its race, but it has a high chance of winning given the lead it gained. Ultimately, the “Data Cup” will go to organizations that evolve from the ongoing use of analytics to address business needs to the development of a culture of evidence-based decision making.

Figure 1: The Data Race—Overcoming Obstacles to Drive Value from Data

© 2014 MIT Sloan CISR, Wixom and Beath. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.