The Enterprise IT Operating Model

An enterprise IT operating model describes the ways the enterprise organizes to create value from IT—the accountabilities, processes, platforms, metrics, and behaviors. The model describes the roles of the IT unit and the business units and how they collaborate. An effective enterprise IT operating model in the AI era enables the enterprise’s most valuable components and capabilities to innovate and grow, and scales the use and reuse of data and AI. It also manages risks such as cyber threats, privacy breaches, supplier demands, and competitive threats from new business models. A great operating model ensures continuous value creation and helps build a digitally savvy workforce for the future.

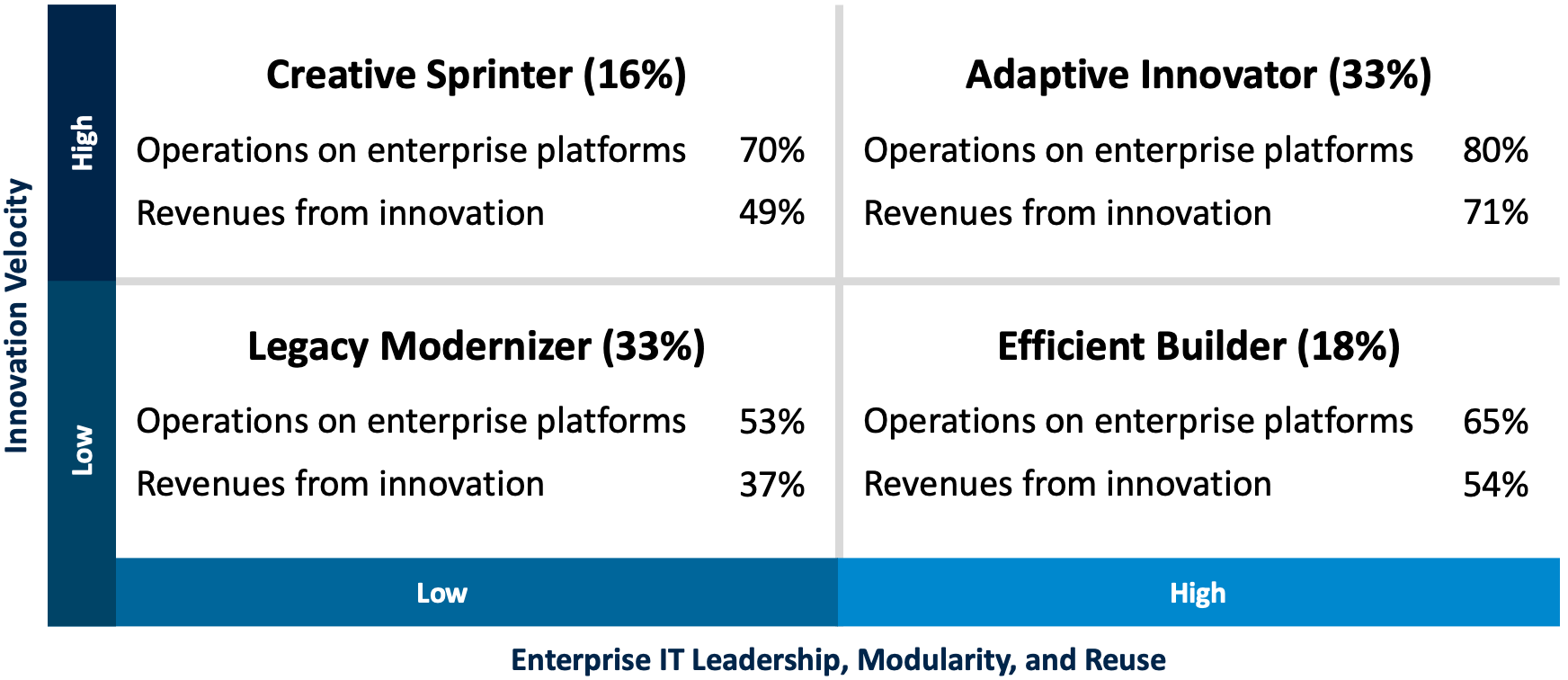

We identified two dimensions of an enterprise IT operating model (see the figure).[foot]We derived dimensions of the 2x2 model from analysis of 39 interviews conducted in 2024 and 2025 with 30 companies. We conducted summarization and synthesis analyses of transcripts of the interviews using a secure MIT instance of OpenAI’s GPT-5 model, asking for two dimensions underlying the impetus for change. Using data from the MIT CISR 2025 Real-Time Business Survey (N=152), we identified variables that represented facets of the two dimensions. Percentages of enterprises in each quadrant came from the same survey and represent the dominant enterprise IT model. We developed case vignettes using interview data, public data, and researcher interpretation.[/foot] The horizontal dimension—Enterprise IT Leadership, Modularity, and Reuse—captures the enterprise effectiveness of use of digital, data, and technology; leadership can be at the enterprise or business unit level or both. Being low on this dimension reflects local decision-making with little reuse of technology, data, and lessons learned. Being high on this dimension reflects strong enterprise IT leadership; the creation of reusable platforms, modules, and data; and the right balance of local and enterprise-wide capabilities.

The vertical dimension—Innovation Velocity—represents the impacts from current challenges to resilience, decision-making speed, and the enterprise’s emphasis on innovation, and reflects the speed of change in the business environment (largely driven by the threats and opportunities from AI).[foot]For more information on the increasing speed of change, see Charles H. Fine, Clockspeed: Winning Industry Control in the Age of Temporary Advantage (New York: Basic Books, 1998).[/foot] Enterprises with relatively more stable business environments need less innovation velocity. They can use multiyear planning to incrementally improve the enterprise through steady innovation and cost reduction. Enterprises responding to rapidly changing environments require fast-changing business models with higher innovation velocity, shorter planning cycles, and more of their people focused on innovation.

Combining these two dimensions in a 2x2 model yields four enterprise IT operating models: Legacy Modernizer, Creative Sprinter, Adaptive Innovator, and Efficient Builder. Each model requires different leadership and governance and, on average, delivers different outcomes.