Ecosystems are essential to achieving organizations’ most challenging strategic goals. In polling of executives attending a recent MIT CISR event,[foot]At MIT CISR’s Annual Research Forum in November 2023, we asked executives what percentage of their companies’ most challenging goals are shared by others (N=73) and how their companies primarily seek to govern the pursuit of industry-spanning shared goals (N=61).[/foot] 92 percent of respondents indicated that some or most of their organizations’ most challenging strategic goals are shared by others, suggesting that the organizations would benefit from developing or participating in ecosystems. Yet many organizations (in our poll, 66 percent of respondents) look primarily to governance by a single leader—the common approach for companies opening internally developed platforms to external participants—to govern industry-spanning ecosystems developed to achieve such goals.

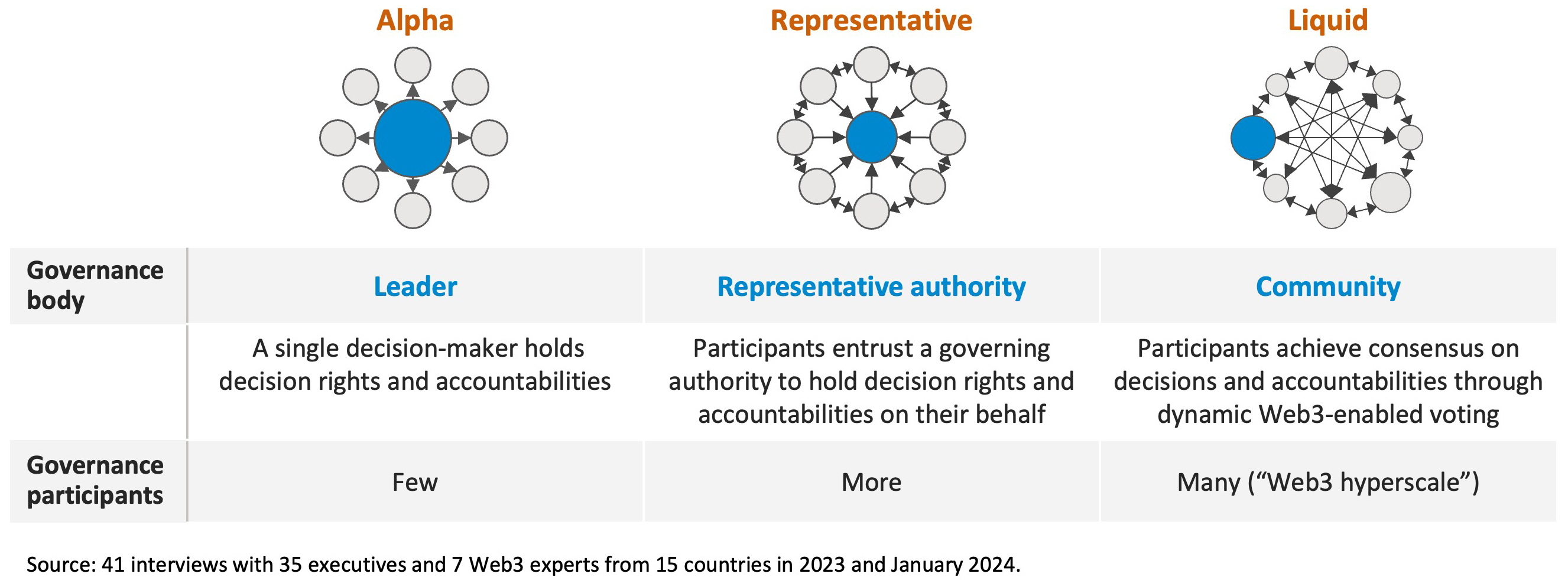

To identify the governance issues pertinent to ecosystems, we interviewed executives in a variety of industries, asking how successful ecosystems are governed, how governance impacts value from ecosystems,[foot]Learn more about value from ecosystems in Stephanie L. Woerner, Peter Weill, and Ina M. Sebastian, Future Ready: The Four Pathways to Capturing Digital Value (Boston, MA: Harvard Business Review Press, 2022, https://cisr.mit.edu/publication/future-ready-four-pathways-capturing-digital-value); and Ina M. Sebastian, Peter Weill, and Stephanie L. Woerner, “Driving Growth in Digital Ecosystems,” MIT Sloan Management Review, August 18, 2020, https://sloanreview.mit.edu/article/driving-growth-in-digital-ecosystems/.[/foot] and how organizations are using recent innovations, such as Web3, to govern ecosystems.[foot]The authors conducted forty-one interviews with thirty-five executives and seven Web3 experts from fifteen countries—US, Mexico, Australia, New Zealand, Singapore, Malaysia, UK, Germany, Switzerland, Poland, Turkey, Denmark, UAE, Ukraine, and China—in 2023 and January 2024. Industries included financial services, manufacturing, agriculture, ocean shipping, automotive, information technology, and government. The sample comprised twenty-one companies and eight not-for-profit organizations ranging from less than 10 to over 400,000 employees. Interviewee roles included CEO, CIO, chief strategy officer, chief product and supply chain officer, chief data officer, heads of policies and government affairs, engineering, digital assets and blockchain, and researcher.[/foot] Our research determined that effective governance of ecosystems, like good corporate governance, is key to growing value. In this briefing, we introduce three governance approaches for digital ecosystems, and discuss when ecosystems should adopt more decentralized governance approaches to grow value.