Digitization is no longer the purview solely of the IT unit. Every part of the organization is being digitized and every budget is involved. Every executive is thinking more digitally today and making investments in technologies ranging from mobile apps to robotics. An MIT CISR survey revealed that, on average, 39% of total digitization spending is initiated by IT. The remaining 61% is spread across every other budget in the enterprise. But investments are only the first step. Most departments making these investments must connect assets to corporate networks and systems, and they require help to manage the digital environment and use the data it generates to run the company. And of course, the enterprise wants to secure its digital boundaries and manage its digital risk.

Managing Total Digitization at Teck Resources

Abstract

Digitization is no longer the purview solely of the IT unit. Every part of the organization is being digitized and every budget is involved. Our research on total digitization examines how large enterprises coherently manage the rapid digitization of their resources to maximize value in a digital economy. In this briefing, we focus on Teck Resources, a diversified Canadian mining company, and how it effectively manages total digitization. We also introduce the Total Digitization Heat Map, which displays on one page the approach and budgetary concentration of a firm’s digitization investments, as a first step to effective management.

At Teck Resources, local ownership of decision rights led to technological islands of digitization, and company growth added to the complexity.

Our research on total digitization examines how large enterprises coherently manage the rapid digitization of their resources to maximize value in a digital economy. In this briefing, we focus on Teck Resources, a diversified Canadian mining company, and how it effectively manages total digitization. We also introduce the Total Digitization Heat Map, which displays on one page the approach and budgetary concentration of a firm’s digitization investments, as a first step to effective management.

Three Approaches to Managing Total Digitization

In the May 2013 MIT CISR research briefing,[foot]P. Weill and S.L. Woerner, “Managing Total Digitization: The Next Frontier,” MIT CISR Research Briefing, Vol. XIII, No. 5, May 2013, https://cisr.mit.edu/publication/2013_0501_ManagingTotalDigitization_WeillWoerner/[/foot] we described three approaches to managing the move to total digitization:

- Convergence brings all digitization investments together, typically under a single executive. Companies using a convergence approach will, wherever possible, organizationally consolidate key assets like people, data, infrastructure, skills, and management processes.

- Coordination leaves organizational structures unchanged but adds mechanisms to connect digital capabilities across all groups. Coordination avoids the disruption caused by reorganizing. Instead, coordination mechanisms such as committees or architectural reviews of project proposals help areas work together to achieve enterprise-wide goals like improved customer experience or asset utilization.

- Separate Digital Innovation Stacks are organized to increase innovation through local management. Each of the local stacks, such as the different product groups, business units, or geographies, is left alone to maximize its own local responsiveness, thus forgoing both the overhead and benefits of coordination.

Every company’s leaders must determine how these different approaches to total digitization can help them achieve enterprise goals.

Teck Resources Limited

Teck Resources owns or has interests in thirteen mines and one metallurgical refinery, and has investments in several oil sands developments. Teck is the largest producer of steelmaking coal in North America and the third largest zinc producer in world. In 2012, Teck had a net profit margin of 8.6 and ROIC of 2.2%—well above the industry average. In 2013, the industry was affected by commodity price decreases. Metallurgical coal prices plummeted from $330 per metric ton in January 2011 to $115 in July 2014, causing Teck’s revenues to drop from the previous year’s $10.4 billion to $9.1 billion. Responding to this type of business cycle demands extraordinary agility and coordination across mines.

In the mining industry, the general manager of each mine is historically (and by law in most countries) the “master and commander,” with complete discretion to make all decisions relating to operations and mine safety. At Teck, this led to technological islands of digitization, with each of its thirteen mines and four offices constituting a separate island. Growth through acquisition added to the complexity. For example, Teck had twelve ERP systems, forty-two HR-related systems, and many different mining systems on trucks and other heavy equipment. Figure 1 shows the nine distinct systems and at least five different screens with which a shovel operator needs to interact in a separate stacks environment.

Figure 1: Shovel Cab at Phelps‐Dodge Morenci Mine

Over the past seven years, the IT unit at Teck has led the charge to move from separate digital innovation stacks to coordination, and is now pushing on toward convergence. The first step was to consolidate all of trucks’ computers into a single computer that runs all the applications. The second step will be to consolidate all of the screens to a single screen (figure 2 shows a proposed standard). This second initiative is far more complex, requiring both the equipment vendors and the mining teams to work together on the design. The initiative is funded by a consortium of companies under the umbrella of the Global Mining Standards and Guidelines Group.[foot]http://www.globalminingstandards.org/workinggroups/situational-awareness/research-project/[/foot]

Figure 2: Prototype of a Converged Situational Awareness Screen

Total Digitization Heat Map

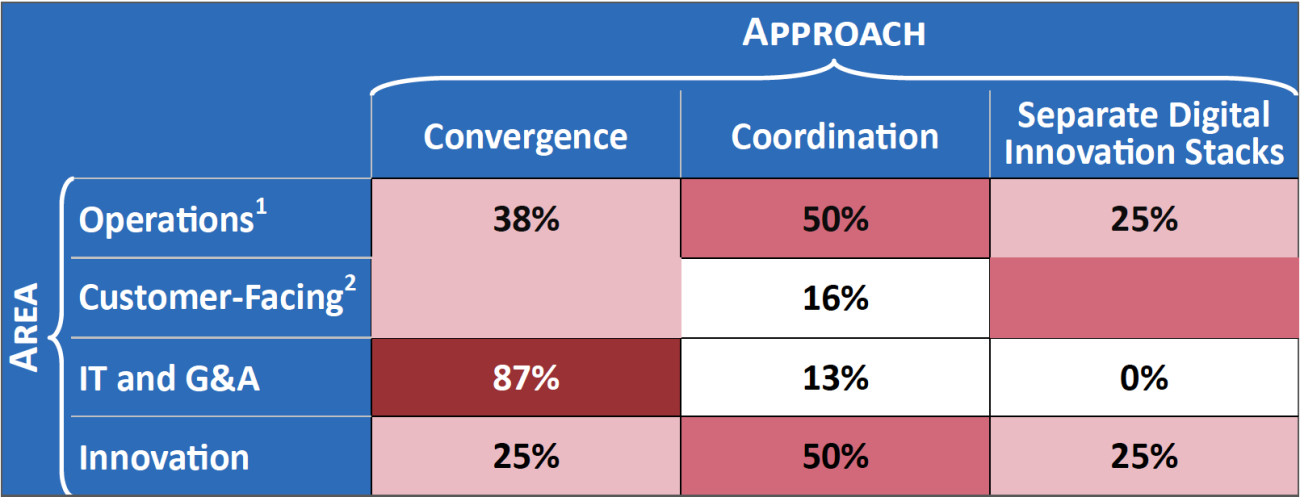

Most companies use more than one of the three approaches to manage subsets of their islands of digitization. We represent the combination of approaches used within a company on a total digitization heat map, showing on one page all of the company’s digitization investments in a year. Table 1 is the 2013 heat map for Teck Resources. Each row shows the percentage of investments made for convergence, coordination, and stacks in the various parts of the company. The darker the red shading, the more concentrated the investments in one of the three approaches. Operations at Teck—which includes all mining operations, engineering, and automation— was 50% coordinated and 38% converged with 25% stacks. In contrast, IT and G&A was 87% converged with 13% coordinated and no stacks. Innovation was 25% converged, 50% coordinated, and 25% stacks. Innovations included a truck-borne computer-aided dispatch system, a maintenance management system, and a tire pressure sensing system. By standardizing, Teck can develop deep knowledge of both the hardware and software bases as well as reduce the maintenance burden of operations.

Moving from Silos to Synergies

Moving from silos to synergies is a major organizational change, requiring a combination of top-down and bottom-up mechanisms. Four mechanisms were key to Teck’s success:

- Road Mapping: Develop an end-to-end model of mine to market. Realizing synergies requires a road map to the future that everyone can buy into. At Teck, roadmap discussions were held with the senior management team about critical systems such as ERPs, Operational Technology systems (mine to market), and Human Resource systems. The most successful roadmaps were created by a unified team of senior executives who identified the vision, timelines, and cost to converge systems across islands.

- Prioritization: Focus on fewer projects. Rather than letting one thousand flowers bloom, Teck focused on a few key projects with multiple layers of value. For example, the truck-borne standards system has not only improved safety but has also lowered operations cost. In addition, data from this system lets engineers define and monitor the achievement of optimal operational characteristics.

- Governance: Transition decision rights from local ownership to the enterprise. Teck moved to a common business case and capital allocation process across mines, replacing its site-based approach. The sites and the business units raise the requests, which are viewed together to best meet Teck-wide goals.

- Delivery: Move to a common process. Teck merged digital silos under one delivery agent and moved to a common, standard project delivery process. A project delivery process is not only common to digitization projects, but also the delivery of major capital mine and machinery builds.

What’s Next: Connectivity, Evidence, and New Skills

To meet cost and operational goals in a tough market, Teck is increasing connectivity by implementing end-to-end business processes. This is a big change and will involve identifying the key processes, measuring their effectiveness, and implementing a process management structure. The goal is to digitally connect all the major assets (such as mobile equipment) and provide managers with real-time operational data. This will allow Teck to progress to even more evidence-based management with increasing use of real-time data for decisions and accountability. These initiatives will require change both inside the IT unit and across the mines. For the IT unit, the change will mean building a world-class competency in business process and data management. For other executives at Teck, the changes will mean learning to manage differently in a connected and evidence-based environment.

Like Teck, every company will need to adapt to an increasingly digital world and to coherently manage total digitization. We suggest that the first step is to complete your company’s current and to-be total digitization heat maps. The to-be heat map should be driven by the business’s goals and what is achievable within the organizational culture. Then identify—as Teck has done— the management approach that will maximize the benefits of total digitization.

Table 1: Heat Map of Spend Distribution at Teck Resources

1 Operations = Operations + Engineering and Automation

2 Customer‐Facing = Customer‐Facing + Digital Products

© 2014 MIT Sloan CISR, Weill, Woerner, and Ruberg. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.