A data-driven company pervasively creates, integrates, and liberates analytics knowledge to help people and processes continuously work smarter. Becoming data driven requires much more than hiring data scientists and rolling out dashboards and visualization tools; it requires building an enterprise capability that can regularly generate innovative new analytics-based work practices and scale best practices across the company. Companies with a data-driven capability are more likely to maximize returns from data—and to produce unique knowledge that creates competitive advantage.

Accelerating Data-Driven Transformation at BBVA

Abstract

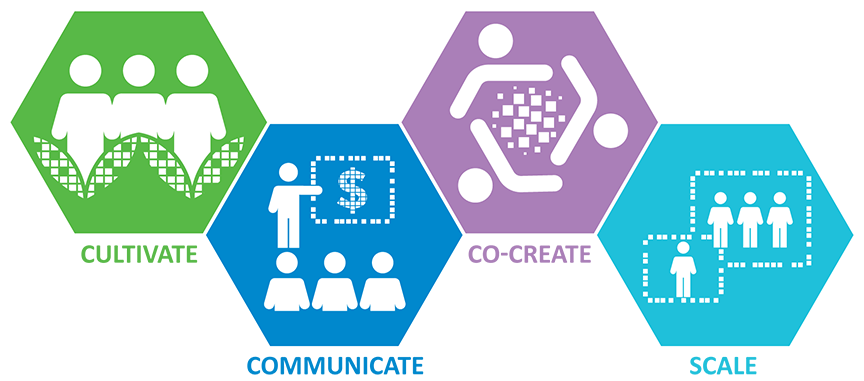

This briefing describes four key activities that help companies become data-driven: (1) cultivating a community of contemporary data science talent; (2) communicating data’s value proposition enterprise-wide; (3) co-creating new data-driven work practices; and (4) scaling data-driven best practices. These activities are illustrated using the case of BBVA, a global financial group that established a data science center of excellence (CoE) in 2014 as a wholly owned subsidiary called BBVA Data & Analytics. By 2017, the CoE had helped BBVA build an enterprise capability that regularly generates innovative, new analytics-based work practices and that scales best practices across the company.

Building a data-driven capability involves a multifaceted approach that requires time. In effect, companies must accomplish four significant activities:

1. Cultivate a community of data science talent that can effectively craft data experiments, generate actionable insights from sophisticated algorithms and techniques, and build visualizations that communicate compelling stories.

2. Communicate data’s value proposition across the company by establishing a common way to talk about data and by clarifying the benefits of data-driven behaviors, tools, and mindsets.

3. Co-create new data-driven work practices between data science talent and other employees at the company and its external partners.

4. Scale data-driven best practices to promote broad use of data by employees and processes to generate economic value.

In this briefing, we share an award-winning MIT CISR case study of BBVA.[foot]E. Alfaro, J. Murillo, F. Girardin, B.H. Wixom, and I.A. Someh, “BBVA Fuels Digital Transformation Progress with a Data Science Center of Excellence,” MIT Sloan CISR Working Paper No. 430, April 2018. The paper was the winner of the 2018 Best Paper Competition from the Society for Information Management.[/foot]

The case was extraordinary due to the speed with which the company built its data-driven capability. We believe BBVA’s secret sauce was its ability to concurrently execute and coordinate the above four activities.

BBVA BUILDS A DATA-DRIVEN CAPABILITY

In 2018 Banco Bilbao Vizcaya Argentaria, S.A. (BBVA) was a global financial group with €691 billion in total assets, headquartered in Madrid and operating in more than thirty countries. BBVA’s 132,000 employees served 72 million customers in the areas of asset management and retail, private, and wholesale banking. Over the preceding decade, BBVA leadership had invested heavily in digital transformation activities and had received accolades for its efforts, including recognition from Forrester Research in 2017 for the best mobile banking app in the world[foot]“BBVA, the best mobile banking service in the world,” July 13, 2017, on the BBVA website.[/foot] and the best online service in Europe.[foot]“BBVA leads in online banking services in Europe,” December 14, 2017, on the BBVA website.[/foot]

In February 2014 BBVA established a wholly owned subsidiary called BBVA Data & Analytics (D&A) to serve as BBVA’s data science center of excellence; BBVA physically located the subsidiary in a building in Madrid separate from the bank. D&A was initially expected to fund itself by producing and selling in external markets new products or services drawing from BBVA data, such as anonymous, aggregated payment data. However, BBVA leaders quickly realized that D&A’s techniques and analytics could (1) generate large financial value via internal improvements to operations, and (2) be used to create meaningful digital product features and customer experiences—key to bank digital transformation efforts. Thus, over time D&A’s data monetization strategy broadened to include internal BBVA projects.

Cultivate a Community of Data Science Talent

BBVA’s strategy to cultivate contemporary data science talent combined recruitment, development, and retooling efforts. The company thoughtfully recruited new talent as data scientists for D&A. The subsidiary grew an initial staff of six data scientists to fifty over three years. Hiring each data scientist took three to six months, involving deep assessment of the candidate’s soft and hard skills by technologists and human resources specialists. As many as ten D&A staff participated in the interviews and influenced the hiring decision.

The head of Human Resources managed a custom development program to develop and retain D&A staff. The program offered non-financial benefits such as learning opportunities, flexible work environment features, and meaningful, challenging work. This “emotional salary” contributed to each data scientist’s competence, autonomy, and sense of belonging. Data scientists were required to spend about half of their time at the D&A offices, which fostered a community among peers. Every two weeks the entire D&A group convened to share wins and lessons learned.

Data are the cornerstone for creating opportunities.

CARLOS TORRES, CEO, BBVA

BBVA retooled employees who had previously mined data[foot]Traditional data mining activities were based on demographics, often purchased, and unlinked to BBVA products. Most data mining models were very basic, and the models rarely addressed behavioral or attitudinal questions.[/foot] for business units such as Credit Risk and Marketing. D&A collaborated with BBVA’s training organization to design and deliver several programs, such as a three hundred-hour project-based course called “From Data Mining to Data Science.” During this program, students visited D&A headquarters for three to four months of part-time coursework before returning to their business unit to complete projects. D&A data scientists taught the course and also served as project mentors. By the end of 2017, two hundred fifty students had graduated from the course.

Communicate Data’s Value Proposition

BBVA leadership believed that becoming data driven required engagement—and change— from the entire company. Leaders knew, however, that capturing employee attention across BBVA’s traditional, hierarchical organization would require communicating why data and being data driven mattered.

To identify data’s value proposition, D&A developed an economic impact framework that reliably and credibly recorded BBVA’s returns from data. The framework classified D&A projects according to their intended economic goals, such as increased revenues or reduced costs. Business units were accountable for measuring and achieving the appropriate kind of value for each project they sponsored. A director of finance and operations managed the project portfolio and helped business unit leaders create appropriate measurement metrics and methodologies and validate results. Initially, the framework helped D&A manage its profits and losses because the subsidiary was expected to break even each year. Ultimately, the framework contributed to BBVA’s understanding about how much and in what ways data helped the bank make money.

To communicate data’s value proposition, BBVA management committed to what was then a radical idea: teaching all company employees about data-driven transformation and concepts such as artificial intelligence and big data. For the majority of BBVA employees, who required only a baseline understanding, D&A produced a combined live and virtual event called Brainstorm@BBVA in January 2017. 18,000 attendees watched leaders showcase actual BBVA data science applications and their impact on digital sales, process automation, and customer engagement. For employees who needed deeper data science understanding, D&A launched a series of small-group classes about data science technologies and their implications: “Machine Learning for Designers,” “Machine Learning for Executives,” and “How Algorithms Shape our World.”

Co-Create New Data-Driven Work Practices

BBVA crafted innovative work practices by challenging D&A data scientists to solve problems inside and outside of the bank. Inside the bank, D&A data scientists worked with business units to co-create new ways of improving operations. For example, bank branch managers historically telephoned small- to medium-sized enterprise customers and promoted the “product of the month” suggested by a business intelligence report based on internal bank data and a set of simple business rules. D&A worked with BBVA Customer Analytics to build a dashboard that delivered individualized product recommendations to branch managers on demand.

The data scientists also worked on internal projects that used analytics to create meaningful digital product features and customer experiences. In one case, D&A collaborated with the Digital Transformation business unit to co-create a personal finance tool that automatically categorized a customer’s transactions into common budgeting categories (e.g., rent, food, entertainment). The categorizer was launched to customers in March 2016 as a digital banking service website feature and promoted as a way to help customers manage their personal budgets. By summer 2017, the categorizer had 1,000,000 unique monthly users in Spain, which represented about one-third of all users who connected monthly to the BBVA website; it was the most-used web feature after transfers.

Outside the bank, D&A data scientists pursued “social good” efforts. For example, in 2015 and 2016 the D&A collaborated with United Nations Global Pulse and with BBVA Bancomer, the main financial institution in Mexico, to investigate resilience against natural disasters. The team decided specifically to investigate economic activity associated with Hurricane Odile. To achieve this, the team analyzed transactions from payment systems and ATMs by more than 100,000 BBVA Bancomer clients and developed insights regarding Odile’s impact over time and geographic areas. Insights from the project were intended to help shape policies and programs for emergency response and reconstruction.

D&A’s co-creation efforts—both inside and outside of the bank—introduced new kinds of work practices into BBVA. This manifested in myriad ways, such as new ecosystem partnerships with governments, non-profits, and start-ups; experiments and AB testing; more and different data sets; sophisticated algorithms; and novel ways to evaluate customers (such as favoring associations that reflect a high-value lifestyle—like relationships with certain schools, clubs, or retail outlets—over earnings).

Scale Data-Driven Best Practices

D&A was incentivized to convert the best new work practices into tools and techniques that could be reused across the company; its performance metrics included both financial targets and long-term capability-building goals. Also, D&A data scientists were only partially funded by business units, which justified the scientists’ focus on strategic, long-term endeavors. In 2016, D&A introduced into business units eleven new tools and thirty-four new analytic solutions.

D&A used technology platforms to scale new enterprise capabilities. The data scientists built a development platform called Clarity that stored and documented code. Clarity served as a platform for BBVA customer analytics, in the sense that data scientists could create, document, and publish models and algorithms that produced customer attributes and metrics. Users could explore data models, find solutions to problems already solved, and design datasets. D&A created a community of practice (CoP) platform that supported asynchronous knowledge sharing for students graduating from BBVA’s data science training programs. And D&A moved BBVA data from business unit silos to enterprise data platforms in an effort it called “data rainmaking.” By 2017, this effort had released thirty-four new data subject areas for enterprise usage.

BBVA DRIVES OPPORTUNITIES TO RESULTS

By the end of 2017, D&A had launched more than forty data science projects for twenty-seven business units, which represented one-third of BBVA’s business units. One project led to a flagship commercial data product called Commerce360 for BBVA point-of-sale customers; in Spain, Commerce360 users generated twenty-five percent higher margins than merchants not using the application. D&A data scientists developed enterprise capabilities that included technical platforms, shared data sets, and a collection of machine learning algorithms. And in late 2017, BBVA established a Data Office, reporting to the CEO, to recognize data as a core BBVA competency. The move reflected the importance of data to BBVA, as described by BBVA CEO Carlos Torres: “Data are the cornerstone for creating opportunities.” [foot] Torres’s statement is from his keynote speech at the Money 20/20 Europe event in Copenhagen on June 26, 2017. Chris Semple, “Data are the cornerstone to create opportunities,” June 26, 2017, on the BBVA website.[/foot]

Figure 1: Four Activities to Build a Data-Driven Capability

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.