The CIO as a Venture Capitalist

Abstract

We think there is a sea change coming for CIOs, and it will be about helping the company drive more innovation and growth. In this briefing we explore an emerging new role for the CIO: acting as a venture capitalist (VC). We found that the three approaches the CIO Venture Capitalist takes to increase innovation are Learn, Acquire, and Partner. By using these approaches, the CIO—and by extension, the IT unit—is able to help the rest of the company to incorporate and leverage the innovative capacity of new technologies created in startups and other enterprises.

We think there is a sea change coming for CIOs and it will be about helping the company drive more innovation and growth. Yes, the CIO will still be held accountable for smooth operations of IT systems—and in some companies, for digitization more broadly. And sure, CIOs will be asked to reduce the run costs in the IT budget this year and every year after. But innovation is becoming an increasingly important role of CIOs. We began this research in 2015 by interviewing CIOs about their innovation activities, and in the last quarter of 2015, MIT CISR surveyed 412 CIOs globally to understand the opportunities and challenges they face in a digital economy.[foot]2015 MIT CISR CIO Digitization Survey, N=412. Top (Bottom) Performers are top (bottom) 25% on Net Margin, self-reported and adjusted for industry by subtracting the industry average.[/foot] We found a startling difference between the CIOs of top-performing firms and bottom-performing firms. The CIOs of top-performing firms—firms with net margins in the top quartile relative to their industry average— spend 53% of their time on innovation. In stark contrast, CIOs of bottom-performing firms—firms with margins in the bottom quartile—spend only 19%. And the bottom-line impacts were clear: 49% of the top-performing firms’ revenues came from products or services introduced in the last three years vs. just 13% in bottom-performing firms. CIOs will need to spend more time on and be more effective at helping their firms innovate. In this briefing we explore an emerging new role for the CIO: acting as a venture capitalist (VC).

Approaches of the CIO Venture Capitalist

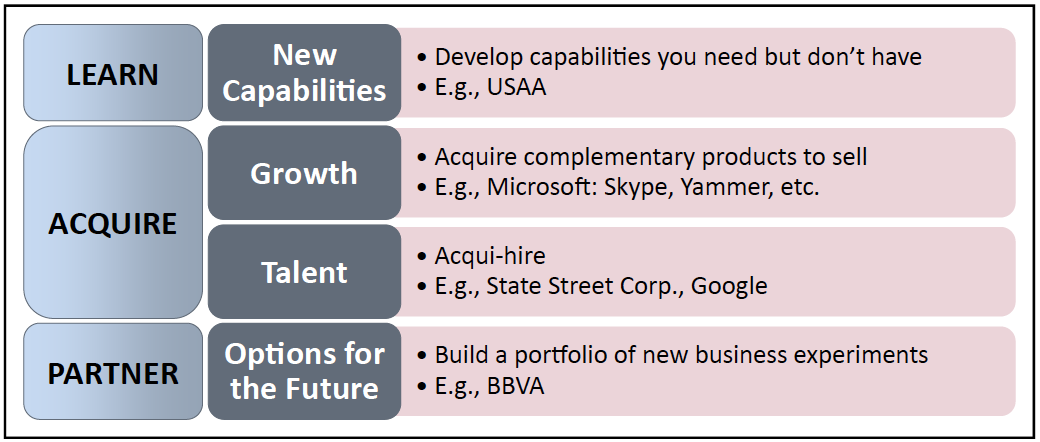

CIOs acting as VCs work with a broad range of companies, typically smaller ones, to bring innovations into the company and accelerate time to market. We found three approaches that the CIO Venture Capitalist takes to increase innovation are Learn, Acquire, and Partner (see figure 1).

Figure 1: The Goals of the CIO Venture Capitalist

Learn: Invest to Develop Capabilities You Don’t Have but Need

USAA, the Santa Antonio-based financial services company, was formed to serve the military and is famous for its outstanding customer experience.

About five years ago, USAA established an active strategic ventures group that makes investments typically in the range of $1 million to $10 million. The group’s goals are first strategic—to improve the lives of military families and enable USAA’s businesses—and second focused on investment return[foot]From MIT CISR interviews with USAA executives performed as part of this research.[/foot] The CIO does not directly oversee the venture group, but there is a strong link between the venture and enterprise architecture groups to ensure alignment. The venture group has closed over seventeen venture investments in the past few years, including a 22.6% stake in TrueCar at IPO. “TrueCar has saved more than $2 billion on the manufacturer's suggested retail price for our [USAA] car buying service, based on the infrastructure of TrueCar,” said Victor Pascucci, then head of USAA corporate development, in 2015.[foot]Toby Lewis, “USAA marches to investment success,” Global Corporate Venturing, July 20, 2015, http://www.globalcorporateventuring.com/ article.php/11532/usaa-marches-to-investmentsuccess[/foot] Establishing a strategic ventures group allows companies like USAA to learn new capabilities and test them out in their enterprise.

Acquire: Bring in Revenue Streams or Talent—or Both

We identified two types of acquisitions: those made to secure new technology or products for the enterprise, and those used as a recruiting strategy to bring in new talent. Microsoft’s acquisition of Skype was of the first type, and it “increase[d] the accessibility of real-time video and voice communications, bringing benefits to both consumers and enterprise users and generating significant new business and revenue opportunities.”[foot]“Microsoft to Acquire Skype,” Microsoft, May 10, 2011, https://news.microsoft.com/2011/05/10/ microsoft-to-acquire-skype/#sm.00001o38a1jr2ierjyh0vn91dtzgl[/foot] In the second type of acquisition, known as an acqui-hire, a company acquires a startup or small firm for its talent, often software engineers.[foot]Sarah E. Needleman, “Start-Ups Get Snapped Up for Their Talent,” The Wall Street Journal, September 12, 2012, http://online.wsj.com/news/articles/ SB10000872396390443696604577645972909149812?mod=WSJ_hpp_sections _smallbusiness&mg=reno64-wsj[/foot]Acqui-hiring has been practiced by newer tech firms such as Facebook, Google, and Salesforce, though this has declined recently. Now long-established corporations—including Walmart, GE, and Microsoft—are using the same approach. For example, evolving from a partnership with Zhejiang University, State Street established a tech center in China with the acquisition of UniverseSoft Technology Company in Hangzhou.

Partner: Build a Portfolio of New Business Experiments

Francisco González, Chairman and CEO of multinational Spanish banking group BBVA, declared in 2014, “We are building the best digital bank of the 21st century.”[foot] “Francisco González: ‘We are building the best digital bank of the 21st century,’” BBVA, 2015, https://www.bbva.com/en/francisco-gonzalez-we-are-building-the-best-digital-bank-of-the-21st-century/[/foot] Besides making acquisitions like Simple (a US online banking start-up for consumers) and Holvi (a Finnish online business banking service) to build a portfolio of digital services, BBVA is also creating partnerships in order to experiment. For example, it has partnered with Dwolla to offer a real-time payment service, and FutureAdvisor to offer automated investment advice capability to all of BBVA's digital channels.[foot]Penny Crosman, “BBVA’s Answer to the Call for Robo-Advisers: a Fintech Partnership,” American Banker, January 12, 2016, http://www.americanbanker.com /news/bank-technology/bbvas-answer-to-the-call-for-robo-advisers-a-fintechpartnership-1078785-1.html?zkPrintable =1&nopagination=1[/foot]

Orange fulfills a portfolio of Learn, Acquire, and Partner approaches by means of three venturing programs: Orange Fab, Orange Digital Ventures, and Orange Partners.

Key questions for CIOs and their companies are which one or more of these three approaches—learn, acquire, or partner—to focus on and what the role of the CIO and IT unit is in achieving success. Let’s explore how Orange has grown innovation through employing all three approaches.

CIO Venturing at Orange

Orange SA is a large telecommunications company with $44.7 billion in revenues and operating in twenty-seven countries. Although Orange has a long and successful tradition of using internal labs to develop new products, the company realized it needed to tap into the global market for innovation, particularly by targeting small companies. It’s hard to imagine an industry where startup talent will be more important than telecommunications—it’s tech driven, fast paced, and global. Three venturing programs at Orange—Orange Fab, Orange Digital Ventures, and Orange Partner— fulfill a portfolio of Learn, Acquire, and Partner approaches as described in figure 1. Together they help Orange grow; as CIO Pascal Viginier explains, “We want to develop new businesses in the fastest way to grow our ecosystem.”

Orange Fab[foot]Orange Fab, https://orangefab.com/[/foot] is a startup accelerator program operating in eight countries including France, the United States, Poland, Japan, Korea, and Ivory Coast. Each session of the Orange Fab program provides each of the six to fifteen startups accepted with twelve weeks of office space, more than twenty networking events and workshops with venture mentors, and up to $20,000 in funding. As importantly, Orange Fab offers access to partner corporations—there are sixteen in the Silicon Valley program, including AXA, LG, Hilton, and Visa—for distribution and other growth opportunities. Another goal of Orange Fab is contributing to local social and economic development. The Orange Fab program in Silicon Valley has completed five sessions, and of its forty-one startups, 95% are thriving (they have raised over $85 million in funding), and six have made deals or created pilots for Orange. Orange Fab is primarily focused on learning about new important technologies and business models, with partnering as a secondary goal.

One Orange Fab success is Edyn, a garden sensor system that monitors changes in weather and soil conditions. The device pushes notifications to the owner’s mobile phone app and can be combined with automatic watering and feeding devices to create self-managed systems for plant care. Available through The Home Depot, Edyn is a natural fit for Orange as it combines new sensor technology with cell phone use.

Orange Digital Ventures,[foot]Orange Digital Ventures, http://digitalventures.orange.com/[/foot] primarily focused on acquiring, is an investment fund that finds, strategically funds, and works with early-stage tech businesses. Orange wants both to earn a return on capital and to help companies in the early stages while expanding Orange’s ecosystem. The initial fund was $23 million; it provides up to $3.4 million per company in exchange for an equity stake. The target areas include networks, communication, data management, mobile payments, Internet of Things, cloud, enterprise systems, security, customer experience, and digital services for Africa and the Middle East. One funded business was Afrostream, a subscription video-on-demand service of African, African-American and African-Caribbean films and television series for Europe, Africa, Caribbean, and South America.

Orange Partner[foot]Orange Partner, https://developer.orange.com/[/foot] is the single publicly accessible source of Orange capabilities and online services for other companies to build on. The services include access to Orange APIs; a data service with a turnkey and scalable environment, predictive analytics, and data anonymization and security; an NFC toolbox; and access to Orange’s customer base in EMEA and partner opportunities in Orange’s promotion channels. There is a fascinating list of Orange APIs for activities such as identity confirmation, payment enablement, and location targeting. The goal of this program is partnering to accelerate time to market for innovation by other companies and to build the Orange ecosystem to generate revenue and other benefits.

The role of the CIO as VC at Orange has three major parts: (1) Viginier, with the input of the IT unit, participates in the final investment decisions for venturing and associated activity; (2) he and his IT colleagues develop connections between each investment and Orange’s corporate roadmap to help ensure synergies; and (3) he oversees the API strategy of the corporation. The API strategy at Orange is jointly owned by the

CIO and the head of digital products. According to Viginier, “APIs are like water and gas, and there will be APIs everywhere that will Lego-ize our capabilities.” Orange has three types of APIs: private (internal), restricted (for partners), and public. At the end of 2015, there were twelve standard APIs, including Check ID and WiFi locator. The plan for 2016 is to have thirty enterprise-wide APIs for internal consumption and several available to external companies.

Next Steps

Making a significant impact on the company’s ability to innovate will often require a CIO and his or her IT organization to act differently. Rather than act as a service organization or order taker, the IT unit has to become the first place to look in the enterprise for IT-based innovation. This change can’t happen overnight—the IT unit has to be perceived not only as being business focused but also possessing strong innovation and technology skills.

We see four skills that are key for the CIO and the IT unit as they take a more proactive role in innovation:

- Scanning the environment for new technology opportunities and then proactively helping the enterprise learn, acquire, and partner to produce benefits

- Investing and experimenting with a portfolio of high-potential technologies

- Working on teams with line-of-business executives to identify opportunities for value creation from new technologies

- Brokering, negotiating, funding, investing, joint venturing, and then integrating new technologies into the enterprise

In short, the CIO—and by extension, the IT unit—needs to become more of a venture capitalist, helping the rest of the company to incorporate and leverage the innovative capacity of new technologies created in startups and other enterprises.

© 2016 MIT Sloan CISR, Weill and Woerner. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.