Companies on the quest for new revenue streams are increasingly considering information businesses. Boards and executive committees have become progressively more aware of the value of data and are keen to profit from selling their data assets. In this briefing, we explore what operating an information business requires—and how to determine its suitability for your organization.

Six Sources of Value for Information Businesses

Abstract

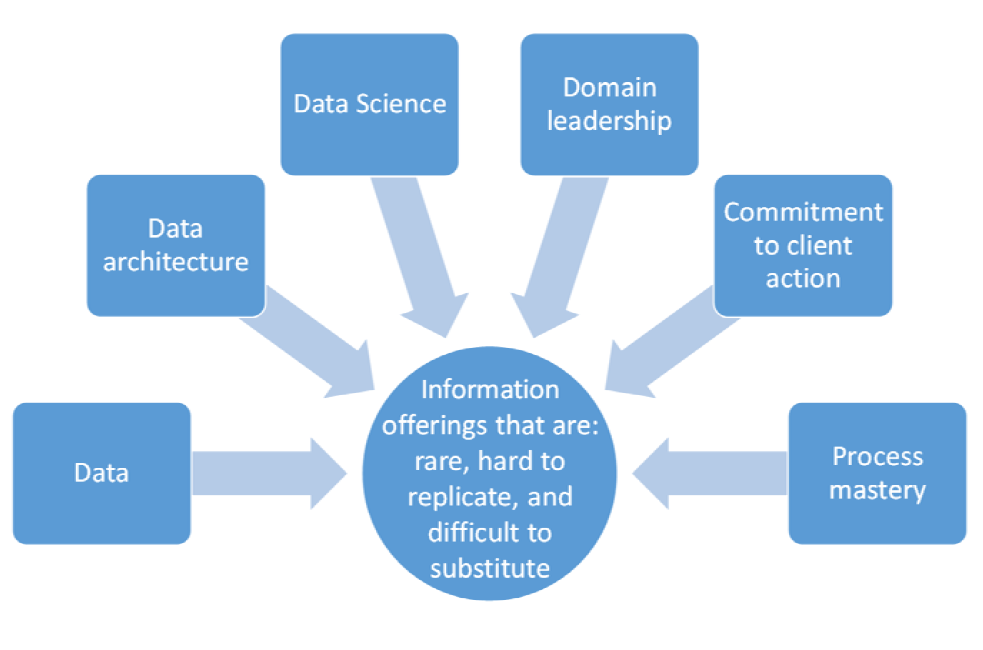

Companies on the quest for new revenue streams are increasingly monetizing data by selling information-based products and/or services. MIT CISR research found that information sellers compete by combining six sources of value—data, data architecture, data science, domain leadership, commitment to client action, and process mastery—into a business model that produces information offerings that are rare, hard to replicate, and difficult to substitute. Information sellers in our research relied greatly on other stakeholders to build and support these six sources of value.

Information sellers combine data, data architecture, data science, domain leadership, commitment to client action, and process mastery into a business model that creates competitive advantage.

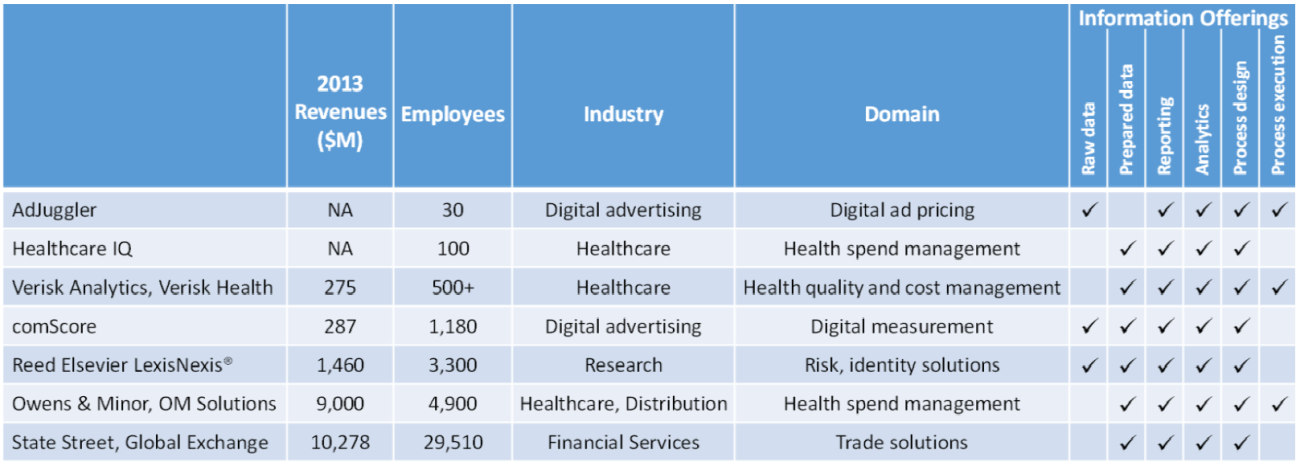

From 2013 through 2015, MIT CISR research investigated information sellers[foot]This MIT CISR research includes seven case studies and fifty-eight executive interviews representing thirty-four organizations involved in some form of data monetization. This research was conducted in 2013 and 2014 and will continue during our 2015 research cycle. Note that one researcher has studied Owens & Minor over time, beginning in 1998.[/foot]—information businesses that monetize data by selling information-based products and/or services. We conducted seven in-depth case studies on companies that varied by size and industry; all of the companies sold some combination of raw and prepared data, reporting, analytics, and process design and execution. (See table 1 for a complete list of cases.) The companies ranged from thirty-person AdJuggler, which helps publishers and networks automate and manage digital advertising campaigns and pricing via an analytics-enabled platform, to $9 billion Owens & Minor, which in 2004 created its OM Solutions Division to sell information-based health spend offerings to hospitals and trade partners.

Selling information requires a unique business model that draws upon six sources of value to create competitive advantage. This briefing describes these sources of value, and presents observations to guide companies that are considering an information business as a new stream of revenue.

Source of Value #1: Data

Information sellers possess unique data that has significant value in the marketplace. That value could be rooted in the data’s volume, comprehensiveness, accessibility, speed of ingestion, processing requirements, accuracy, or diversity of sources. Information sellers overcome hurdles regarding one or more of these dimensions so they can meet the needs of those that are unable or unwilling to provision the data themselves. For example, comScore recognized that marketing and advertising professionals need actual Internet behavior data to accurately measure digital ad campaign effectiveness. To address this need, comScore created a global two million person user panel and developed partnerships with more than 85% of North American digital media properties; together these were used to capture fourteen petabytes of digital behavior data that the company cleanses, organizes, and serves to clients.

Source of Value #2: Data Architecture

Information sellers create data architectures that allow superior data management and provisioning performance at costs significantly below average. Regarding his firm’s data architecture, the CEO of AdJuggler underscored the cost contrast: “You could probably duplicate this environment with three other architectures, but they might be ten times more expensive.” When you look under the hood of an information seller, you will not see mainstream data architecture—or at least, you won’t see one you might expect. Information sellers in our research created distinctive architectures by leveraging open source technologies, custom programs, innovative thinking, and thoughtful designs. A few companies had built their own hardware and software, or acquired companies that had. AdJuggler[foot]In 2014, AdJuggler was acquired by Zenovia Digital Exchange Corporation.[/foot] manipulates two to three terabytes of web log data every day in order to accurately price and bid digital media for billions of daily user ad requests, each to be fulfilled in fewer than 300 milliseconds. To do this, AdJuggler relies on open source products—Apache Storm for real-time streaming, and Vowpal Wabbit for online machine learning—as the basis for analytics capabilities. The company co-locates its data in a data center with other digital advertising partners to minimize communication delays. AdJuggler experiments with new technologies and designs in a nonstop quest for architectural improvements.

The business model that results from combining the six sources of value produces information offerings that are rare, hard to replicate, and difficult to substitute.

Source of Value #3: Data Science

Information sellers possess enviable data science arsenals. At LexisNexis®, the chief data scientist noted that he leads a team of data scientists that created a mathematical framework with more than twenty associated patents. The resulting capability enabled the company to associate records across thousands of data sources at accuracy levels that were considered to be extremely difficult for others to replicate. Much has been written about the dearth of data science skills in the marketplace. Information sellers, however, attract, train, and retain this rare breed of talent and place the hires within nurturing data science cultures that ultimately churn out analytics superior to the competition in speed, accuracy, and precision. The companies we studied did this by investing heavily in university partnerships, internal training programs that established a common company-wide data science language, and knowledge management platforms that identified and disseminated data science best practices across the firm.

Source of Value #4: Domain Leadership

Information sellers often understand domain areas better than their clients. Their deep domain expertise allows them to identify the most pressing business problems and how to effectively solve them. We observed across information sellers a variety of practices that foster deep domain expertise. These companies hired employees that had previously worked in client or partner organizations; partnered with clients to develop solutions; and offered professional services, which enabled them to learn best practices across clients. The companies also were highly engaged in their industries: their representatives spoke at conferences, served on standards boards, and were published in trade magazines and journals. These practices benefited the companies’ public relations and kept them close to industry thought leadership.

Source of Value #5: Commitment to Client Action

Information sellers recognize that their clients must act upon the seller’s information products and services in ways that generate business value; otherwise, the information seller’s business model is not sustainable. This knowledge creates an urgency in driving client action. Companies in our research offered extensive customer support and training, tracked client usage of products and services, created intuitive toolsets, measured client value generation, and offered value-sharing or low-risk pricing structures to encourage clients to use their solutions. Healthcare IQ, for example, developed a state-of-the-art call center called the IQ Center, which was designed to support staff as they guide clients that have complicated project requests. Healthcare IQ offers technology with an interface similar to Google Earth, which it believes helps clients answer any question about the data they are analyzing in fewer than seven mouse clicks. Healthcare IQ hired a professional production company to shoot instructional videos that illustrate use cases of their offerings. The recent development of the Healthcare IQ Informatics MBA with the University of South Florida St. Petersburg permits working healthcare professionals to analyze their employers’ data using the Healthcare IQ toolset as they learn how to solve real business problems—and while earning an MBA.

Source of Value #6: Process Mastery

Information sellers become masters of the business processes that their offerings inform. Organizations in our research cited accolades in the form of industry or association awards, high rankings on respected industry lists, impressive returns from client process outcomes, or the status of industry or partner standard. One company described itself as the “currency” of measurement for its clients; another referred to itself as the “holy grail metric” for scoring in its industry. At some organizations, process mastery—combined with established trust and credibility—created opportunities for the information seller to execute processes on behalf of clients, either through an outsourcing arrangement or by automating a client business process. For example, in 2004 a health system approached OM Solutions to manage its medical supply procurement processes—and became OM Solutions’ first of many materials management outsourcing clients.

Competing as an Information Business

Information sellers compete by combining data, data architecture, data science, domain leadership, commitment to client action, and process mastery into a business model that produces information offerings that are rare, hard to replicate, and difficult to substitute (see figure 1). Although an information business may begin with a focus on one or two sources of value, we hypothesize that all six areas are important to develop at some level so that a company can sustain competitive advantage over time.

Figure 1: Six Sources of Value for Information Businesses

The requirements for building an information business may appear steep, but you can get help to fill capability gaps. Information sellers in our research relied greatly on other stakeholders to build and support value sources. The information sellers partnered with customers, data owners, academia, hardware and software vendors, crowds, and industry, governmental, and regulatory bodies to understand what problems to solve and how to solve them—and to gain access to requisite resources and capabilities. For example, a financial trade solutions firm invested heavily in university research centers, and leveraged these academic partnerships to help develop next-generation algorithms. At times these partnerships took the form of M&A, such as when one analytics firm acquired a technology vendor to own the patented technology underlying its core offering, or when a healthcare analytics firm acquired a services firm that specialized in manually collecting essential data from patients.

Is information selling in your future? To determine the answer, we suggest you ask yourself the following questions. Is your organization prepared:

- To accumulate and manage unique data?

- To build and maintain innovative data architecture at a low cost?

- To attract, develop, and retain data scientists—and to leverage their talent via a data science culture?

- To understand its domain area better than clients do?

- To help clients act upon insights gleaned from your information offerings?

- To master business processes to the extent that clients may ask you to execute the processes?

Information businesses present exciting opportunities for some companies, but our data shows that information selling is a journey that requires a thoughtful strategy and serious commitment.

Table 1: Information Business Case Studies

© 2015 MIT Sloan CISR and SAS Institute Inc., Wixom, Buff, and Tallon. This work was jointly created by MIT’s Sloan Center for Information Systems Research (CISR) and SAS Institute Inc. CISR Research Briefings are published monthly to update MIT CISR patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our research is funded by member organizations that support our work and participate in our consortium.