Platforms provide the technological and organizational basis for developing digital offerings, but they are worthless if a company does not convert platform capabilities into offerings that customers find valuable. To understand what offerings customer will value, companies must build shared customer insights: organizational knowledge about what kinds of digital offerings customers will pay for. To solve customer problems, companies must invest in understanding such problems as well as potential solutions. Because that understanding will never be complete, companies must design processes for customer engagement and learning. Philips has designed HealthSuite Labs, an engagement designed to co-create digital offerings with customers (healthcare providers) as well as other external (e.g., insurance companies, patients, policy makers) and internal (e.g., customer account executives, product developers) stakeholders. In a series of workshops, multi-functional teams identify a problem and ways to address it that will work for all stakeholders. Shared customer insights result from customer co-creation, and from close internal collaboration between customer-facing and product development functions.

Organizational learning also requires experimentation, which is how companies test their hypotheses about what customers will value. Using experimentation, AUDI AG discovered that Audi unite—a service in which a group of people shared a car and split the cost based on its usage—did not work, in part because finding groups of compatible users (neighbors? friends?) was incredibly difficult. What might be most difficult for many executives of established companies: viewing this as an insight—part of a building block—and not a failure. Without experimentation, companies don’t develop shared insights; without shared insights, they can’t build valuable offerings and platforms.

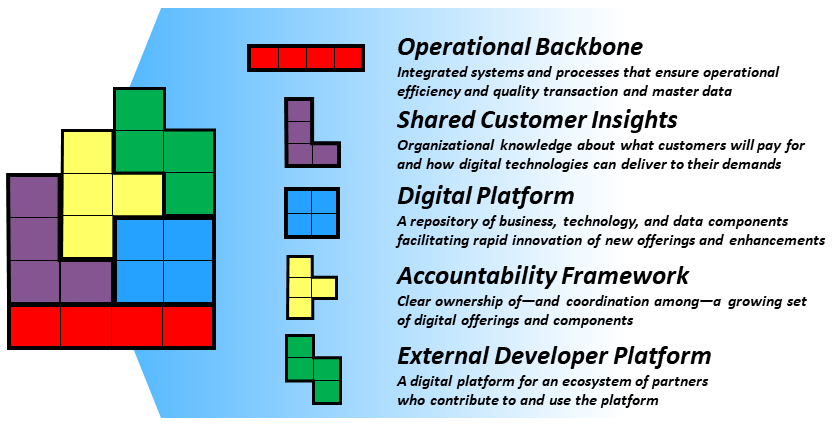

Hierarchy limits speed and innovation. Big companies cannot eliminate hierarchy, but they will need to build an entirely new accountability framework to rapidly deliver new and enhanced digital offerings. Traditionally, MIT CISR has referred to accountability frameworks as governance. In digital businesses, the thrust of the accountability framework is clear ownership of—and coordination among—a growing set of digital offerings and components. In short, digital businesses organize around offerings, not functions, assigning ownership for offerings and for the reusable business and technology components comprising them. The accountability framework empowers individuals and teams to make decisions related to the performance and cost effectiveness of their component.

Spotify maintains shared governance principles addressing the need for autonomy and coordination of offerings.[foot]A. Baiyere, J. W. Ross, and I. M. Sebastian, “Designing for Digital—Lessons from Spotify,” MIT Sloan CISR Research Briefing, Vol. XVII, No. 12, December 2017.[/foot] Such principles, if adopted, will lead to radical changes in organizational design. Philips, for example, is mapping out an organization divided into component and solutions businesses, the first delivering “Lego brick”-like components, and the second aggregating and integrating those components into solutions.[foot]Mocker and Ross, “Transforming Royal Philips to Reinvent Healthcare in the Digital Age.”[/foot]

Without a clear accountability framework that empowers and coordinates owners of components and offerings, companies will rely on hierarchical decision-making processes that will slow progress in becoming a digital business.