Designing a Digital (Integrated) Business

The concept of business services as applied at BNY Mellon is not new. For example, the financial services industry has established a capability architecture called the Banking Industry Architecture Network (BIAN). Other companies are defining their own capability architectures. The consistent idea is that a company’s capabilities (e.g., onboarding a client, launching a product, creating a dashboard) will increasingly be captured in one or more standardized components.

We define a component—which BNY Mellon refers to as a service—as a set of steps that processes business data to produce a predetermined business outcome (e.g., summary of customer transactions, product history, data analysis, alert). Although the concept of components is not new, the growing availability of cloud services, API development, sophisticated data management, and storage technologies, as well as the growing adoption of agile methodologies and DevOps, is making componentization a realistic approach to building and reusing capabilities for integration.

Delivering and managing components, however, requires fundamental redesign of the IT unit and ultimately the rest of a company. A reliance on a capability architecture and component design shifts the role of an IT unit from delivering projects to managing living assets. This is a huge change in how IT delivers business value. IT must abandon the model of developing software that is put into production by one project team and periodically maintained and upgraded by another. Instead, a standing team in IT designs and implements components and constantly adapts them to the needs of the company. Each component must have an owner who ensures its cost effectiveness, functionality, quality, and availability. The owner commands the resources needed to sustain and improve the component. This accountability structure is essential to successful reuse.

Because component owners ensure the quality of the data their component processes, client relationship and product owners can call upon components they need to deliver their value propositions, and integrate the components as needed. When necessary, client relationship and product owners can create unique components (code) to supplement shared components and customize their products and processes.

Digital Transformation Is a Walk, Not a Run

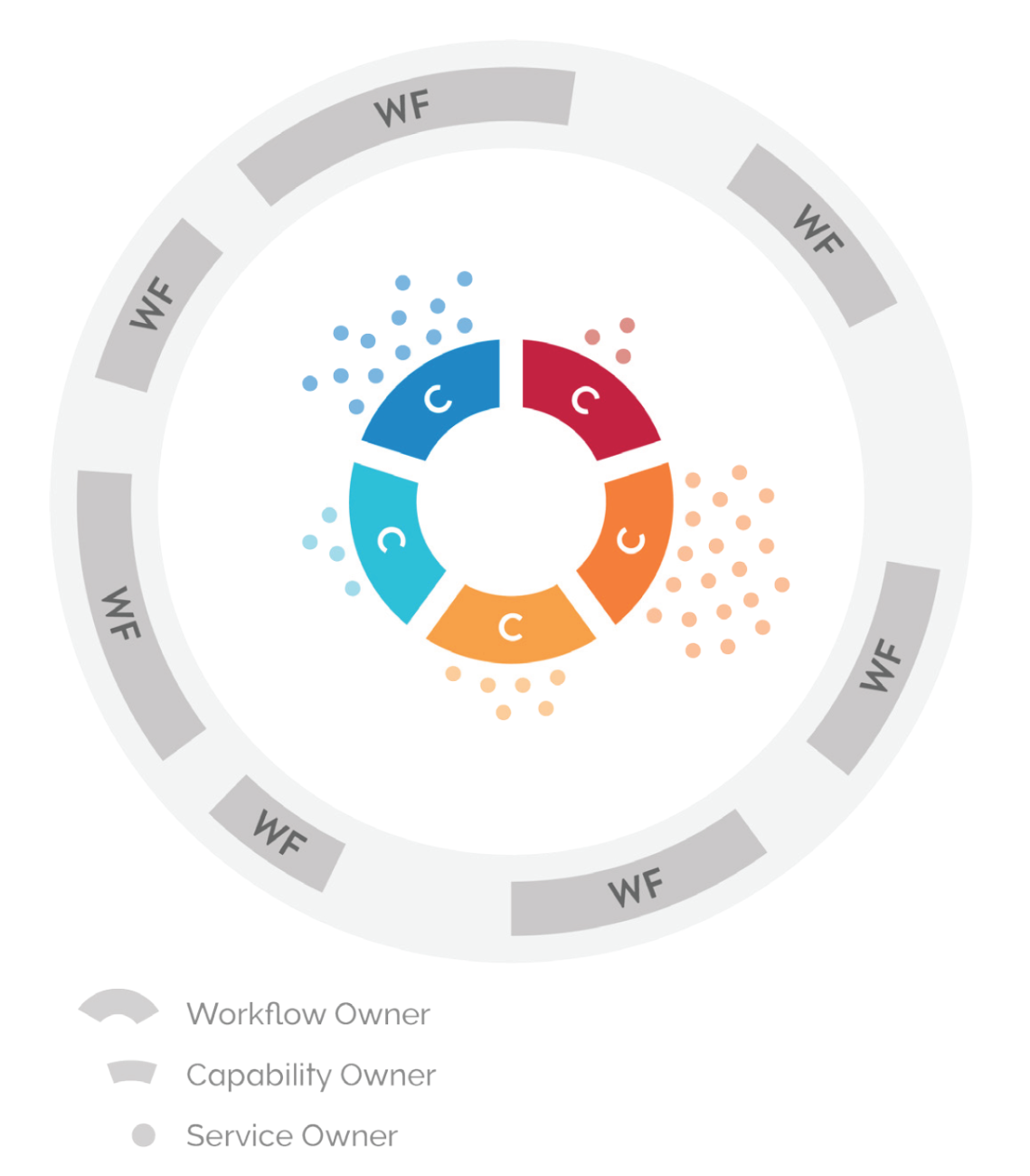

We anticipate that as companies adopt capability architectures and build components, they will reimagine their entire organizations. Figure 1 depicts the design of a company that organizes around services. There are three key roles. Workflow (product and process) owners are accountable for accessing services to complete all processes that ensure delivery of the company’s value proposition. Supplying those workflow owners are service (component) owners, who manage access to their components. They are responsible for the quality of their output. The service owners are organized under capability owners, who are responsible for providing oversight and development of related service owners. Capability owners also authorize development of unique services to supplement common services. These three roles replace traditional development and operations teams in IT with teams that support critical business capabilities—living assets.

The transformation from project management to living asset management necessarily proceeds incrementally. A company identifies a shared business need and then makes an owner accountable for developing, improving, and providing access to a common component. It repeats that process—often. In doing so, the company gradually transforms into an integrated digital company.