Using Cloud to Accelerate Digitized Platform Maturity

Building and sustaining a mature digitized platform is a challenging longterm commitment. If a company can’t just implement cloud services to address its need for business agility, how can one with an immature platform respond to the demands of the digital economy? Case studies provide evidence that, while cloud services alone won’t make a company agile, they can be adopted in ways that accelerate platform maturity. Both Schneider Electric and Ferrovial implemented cloud-based solutions to quickly build platform capabilities, and ultimately, business agility.

Schneider Electric

In 2009, senior management at Schneider Electric, a global energy management company, sought to expand the firm’s strategic focus significantly beyond “manufacturer and distributor of electrical products” to a “provider of intelligent energy management solutions.”[foot]A. Karunakaran, J. Mooney, and J.W. Ross, “Accelerating Global Digital Platform Deployment Using the Cloud: A Case Study of Schneider Electric’s ‘bridge Front Office’ Program,” MIT Sloan CISR Working Paper No. 399, January 2015, https://cisr.mit.edu/blog/documents/2015/01/16/mit_cisrwp399_schneiderelectric_karunakaranmooneyross.pdf/[/foot]However, after doubling its size in six years through a combination of organic growth and over two hundred acquisitions, the firm had accumulated an immature digitized platform that included fragmented critical enterprise processes. For example, local IT units had installed more than three hundred independent CRM systems. This “spaghetti” constrained development of the kinds of capabilities the company needed for cross-selling and collaboration, enterprise-wide standardization of sales and service processes, and a 360° view of the customer. Schneider Electric started to mature its platform by consolidating myriad local IT units into a single global IT function called IPO (Information, Process, and Organization). The resulting centralization and streamlining of IT processes increased internal efficiencies and enhanced global project and program management capabilities.[foot]Schneider Electric was listed in the 2011 InformationWeek 500 because of the benefits from IPO.[/foot]

In 2011, once IPO was formed, Schneider Electric was in a stronger position to invest in cloud-based services to provide a global CRM platform for enterprise-wide opportunity management and sales support. Within eighteen months, Schneider Electric completed global deployment to its 25,000 field sales staff in over one hundred countries. After a year of using this platform, Schneider Electric was engaged in 20% more cross-selling across customer opportunities. For a company accustomed to operating in business silos, this demonstrated uncharacteristic business agility.

Schneider Electric management attributed its effective deployment of cloud to three practices. First, the company followed a lean/agile paradigm—“go fast, go good enough”—to configure and deploy limited functionality as quickly as possible, even if the functionality was far from perfect. This enabled IPO to obtain early feedback from users, which could then be used to improve the platform prior to the next iteration. Second, Schneider Electric deployed across the firm only the standard functionalities offered by Salesforce and severely limited customizations.

Third, management excluded real-time integration of Salesforce with local systems (e.g., ERPs) from the project’s critical path. Instead, they focused on global, rather than local, data integration requirements for identifying and managing enterprise-wide opportunities. For each customer, the core team created a unique global Customer ID and master customer data record. IPO decided to maintain these master records in the cloud, and to allow local business units to map them back to local records. In this way, Schneider Electric gradually built additional platform capabilities that supported integrated sales, and through reuse, facilitated local business agility.

Ferrovial

Ferrovial, the Spanish infrastructure group with approximately 57,000 employees and operations in more than twenty-five countries, is another example of a company that understood the importance of a mature digitized platform for competitive agility. IT is now so integral to agility at Ferrovial that its Chief Information Officer became its Chief Information and Innovation Officer.

In 2008, Ferrovial launched an ambitious strategy to increase the reliability and efficiency of IT operations and align IT with the rest of the business. Until then, due to a large number of historical acquisitions, Ferrovial’s IT needs were handled by a heterogeneous set of ten local IT departments, each working with its own systems and vendors and serving over five hundred internal companies. The business considered IT to be simply a cost center that provided bad service.

Ferrovial appointed its first CIO and tasked him to simplify, align, and integrate all the IT functions into one coherent central business unit. In the process, several functions—such as infrastructure and communications—were externalized, resulting in savings of up to 20%.[foot]The European Outsourcing Association (EOA) distinguished Ferrovial with the IT Outsourcing Project of the Year award for 2011./foot] With greater control and oversight of IT, Ferrovial increased the quality of IT services. It also centralized all the IT purchases at group level to reduce duplication and fully leverage the buying power of Ferrovial. This resulted in more standardized technologies and cost savings of 25%.

Having developed and successfully demonstrated its capacity to standardize, integrate, and outsource key aspects of IT, Ferrovial tasked the IT Group to improve Human Resources and Purchasing across the enterprise. After considering various options, the IT Group decided to transfer both to the cloud.

Transferring HR—and at the time, 70,000 employees—to the cloud took six months instead of the eighteen originally anticipated, saving the company a year’s worth of both time and internal and external resources. Ferrovial achieved these savings in part by conforming to the standards set by cloud service providers. As Florez put it, “We adapted ourselves to the services in the cloud, and not the other way around.”[foot]According to Florez, while Ferrovial could have transferred HR and Purchasing to the cloud before centralizing IT, it would have been significantly more difficult and risky and would have consumed more resources. [/foot]

Ferrovial realized multiple benefits from transferring HR and Purchasing to the cloud. First, as a result of greater platform maturity (and consequently, less operational complexity), two core services were provisioned better and cheaper. Second, the flexibility of cloud-based services enabled Ferrovial to adjust the scale of those services much more quickly in response to acquisitions and divestitures.

Finally, Ferrovial was also able to refocus resources towards developing innovation capabilities. The IT group now works more closely with business units throughout the organization to leverage new technologies, such as Internet of Things, to develop new product and service offerings. The company established an innovation function, a new culture, and a new process of innovation, leading to five hundred new ideas every two years. In 2014, thirty-five of those ideas became new projects with impact on the P&L.

Cloud‐Based Digitized Platform Maturity

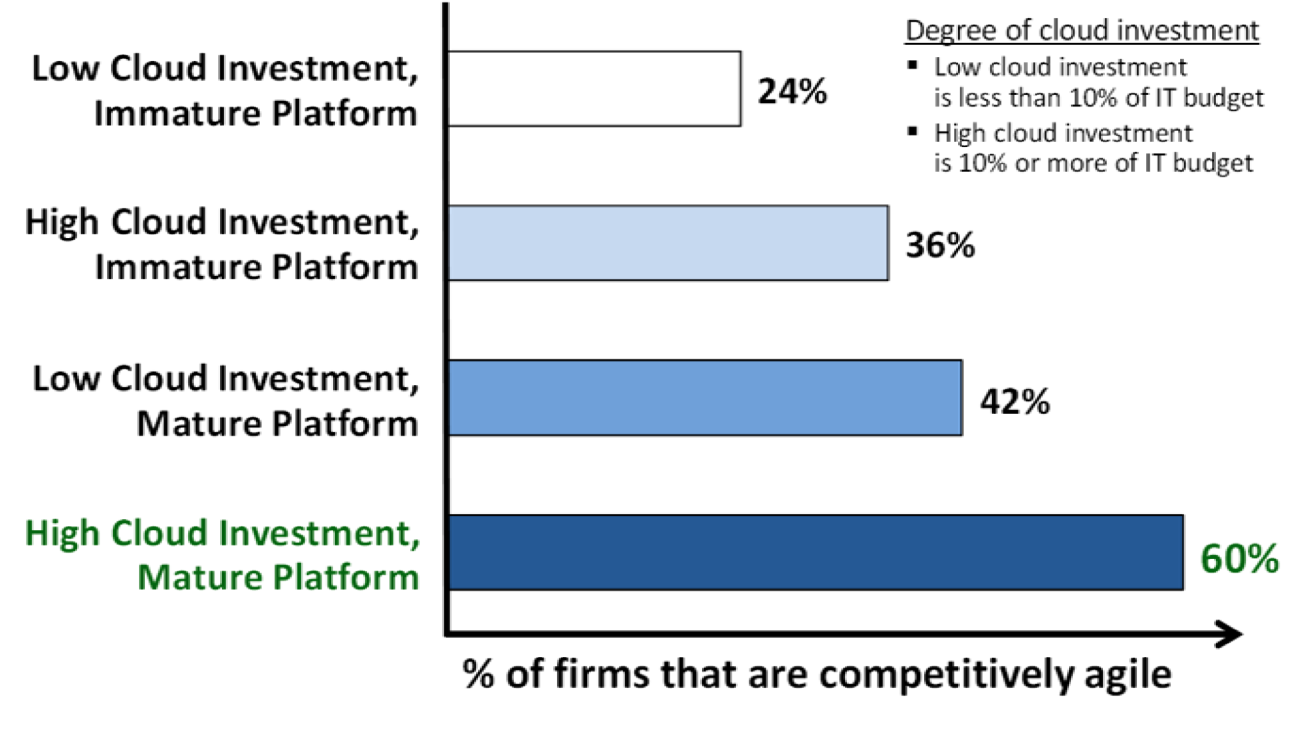

Most senior leaders agree that a mature digitized platform is fundamental to efficient and reliable operations. However, in the rush not to be disrupted by competitors, many lose sight of the fact that platform maturity is also essential for competitive agility. IT leaders in companies with immature platforms are under even greater pressure to respond quickly to business opportunities and threats rather than to build platforms. The easy availability of cloud services can aggravate the inclination to address immediate needs with short-term solutions. But as Schneider Electric and Ferrovial demonstrate, an IT group that has already started the process of maturing its digitized platform is in a stronger position to adopt cloud services in a way that simultaneously addresses immediate business needs and further matures a digitized platform. This is an approach that will benefit many companies attempting to make up for lost time.