Product managers are increasingly amplifying the customer value of their products by adding analytics-based features and experiences, a phenomenon that we call data wrapping. Wrapping can take the form of a data-fueled dashboard, report, alert, benchmark, suggested next step, or automated action. Product managers create these features and experiences to differentiate products and enhance their value propositions in ways that appeal to current customers and new markets. For example, a tractor may be “wrapped” with a dashboard that monitors operational performance, a bank account may be “wrapped” with a chart that communicates a breakdown of the account owner’s spending, a cab trip may be “wrapped” with a fare estimator, and freight delivery may be “wrapped” with notifications of expected delivery times.

Making Money from Data Wrapping: Insights from Product Managers

Abstract

Product managers increasingly amplify the value of their products by adding analytics-based features and experiences. This phenomenon, called data wrapping, represents one of three key approaches to data monetization. In 2018, MIT CISR collected information from 511 product managers to better understand how to execute lucrative data wrapping efforts. This briefing describes three key activities that distinguish top data wrapping performers: they please customers with useful and engaging wraps; they design features and experiences that anticipate, advise, adapt, and act; and they quantify and monitor financial returns.

Top performers in data wrapping please customers with useful and engaging wraps, design specifically tailored features and experiences, and measure the financial returns from their efforts.

MIT CISR defines data monetization as the conversion of data (directly or indirectly) into financial capital. Companies can monetize their data in three ways: by (1) selling information solutions, (2) improving business processes and decisions, and (3) wrapping products.[foot]For more on data monetization, see Barbara H. Wixom and Jeanne W. Ross, “How to Monetize Your Data,” MIT Sloan Management Review 58, no. 3 (Spring 2017): 10–13.[/foot]

What makes data wrapping unique?

- Data wrapping converts data indirectly into financial capital. Data wrapping generates value by influencing a lift in sales of a core product.

- Product owners control the wrap. Data wrapping decision rights reside not with IT but with a product role or unit that manages data wrapping as a component of the product’s overall feature and experience portfolio.

- Data wrapping is highly coupled with a core offering. Data wrapping must be delivered at service levels that meet quality standards similar to those for the underlying offering so as not to negatively impact the offering. Further, the costs and benefits of data wrapping must be evaluated within the context of the offering’s profit formula to ensure wrapping activities are lucrative.

On average, data wrapping represents 26 percent of the value a company creates from data monetization.[foot]The 2018 MIT CISR Data Monetization Survey (n=315) was administered to executives familiar with the company’s enterprise-level data activities and outcomes.[/foot] Companies urgently pursue data wrapping as they respond to competitive pressures and explore digital opportunities; however, their approaches are not equally fruitful. Companies that report wrapping more effectively than peers achieve an average return on investment of 122% from wrapping projects, versus 39% for those that report wrapping less effectively than peers.[foot]Ibid. Sample was split into low-performing (1 and 2, n=52) and high-per- forming (4 and 5, n=69) companies based on self-reports of how effective the respondent’s company is at increasing product prices, sales, and/or loyalty using data/analytics compared to peers. Mean scores for ROI on data wrapping projects were significantly different at p<.001 level.[/foot] It’s time for companies that want to maximize data monetization returns to get serious about becoming great at data wrapping.

In 2018, MIT CISR collected information from 511 product managers to better understand how to execute lucrative data wrapping efforts.[foot]The 2018 MIT CISR Data Wrapping Survey (n=511) was administered to product managers or someone responsible for generating revenues from products.[/foot] We found that three key activities distinguish top data wrapping performers:

- They please customers with useful and engaging wraps.

- They design features and experiences that anticipate, advise, adapt, and act.

- They quantify and monitor financial returns.

USEFUL AND ENGAGING WRAPS

Data wrapping can delight customers in a number of ways (such as making a product easier to acquire or use), but our research indicates that companies need to focus on making wraps useful and engaging. These two customer value out- comes are associated with top performance in every organizational value measure for product sales lift.[foot]Ibid. Launched wraps (n=242) were divided into low-performing and high-performing initiatives based on self-reports of seven sales lift measures. Means for usefulness and engagement were significantly different at p<.05 level. Also, high means for usefulness and engagement were significantly higher than high means for ease of use, help acquire/deliver, reduce time/effort, make customer money, and save customer money.[/foot]

A key reason that useful and engaging wraps have such impact is that they motivate customer attention and response to digital directives (e.g., schedule a repair; adjust spending habits; take a shared, cheaper ride; prepare to receive a shipment). These responses save or make the customer money, which creates value that the company then captures in the form of sales lift, such as by selling more of the product, raising the product’s price, or retaining a greater number of customers.

FEATURES AND EXPERIENCES THAT ANTICIPATE, ADVISE, ADAPT, AND ACT

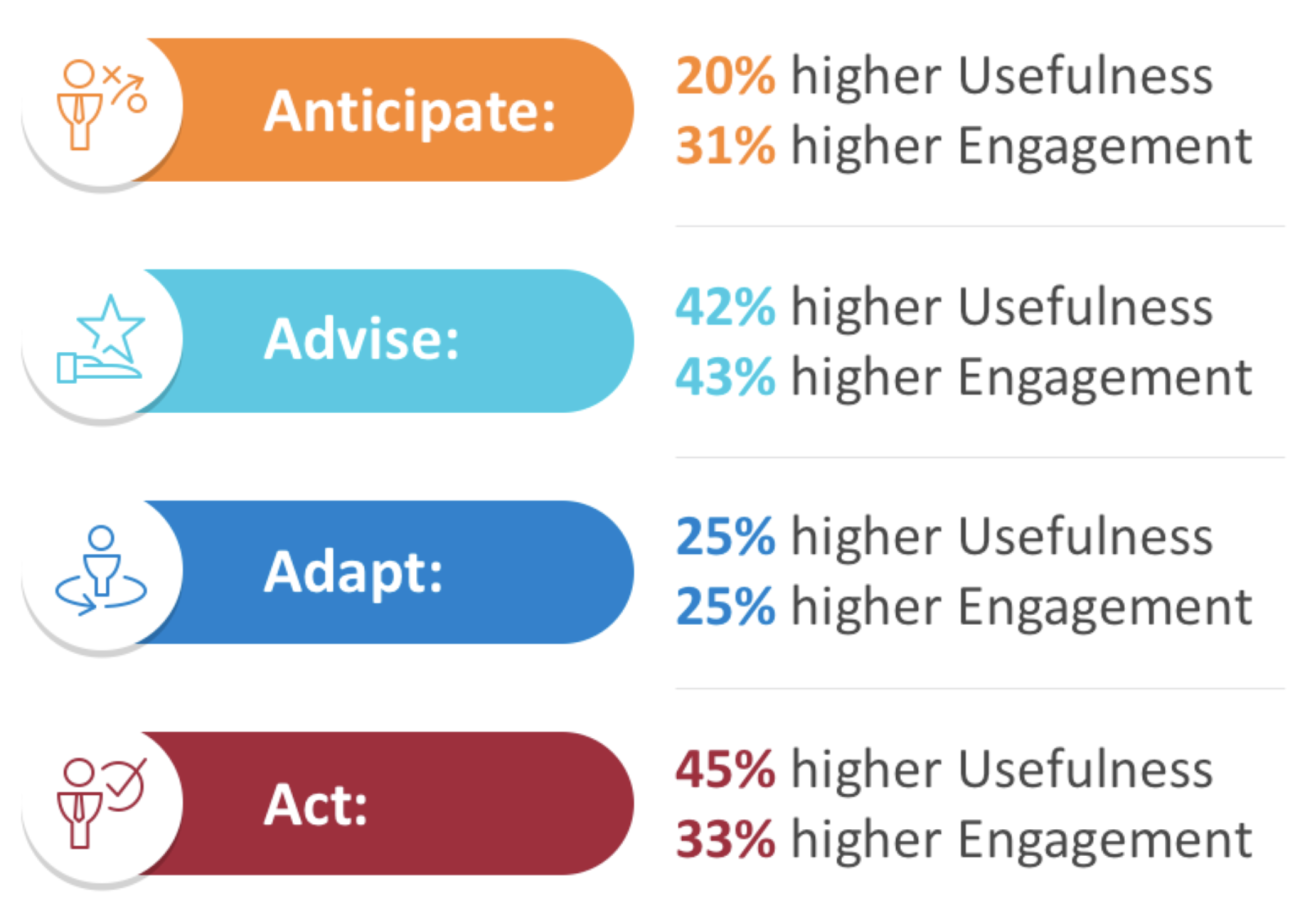

Our research found that useful, engaging wraps are associated with four design characteristics[foot]2018 MIT CISR Data Wrapping Survey. Launched wraps were divided into low-performing and high-performing groups on feature measures. Means for usefulness and engagement were significantly higher in high-performing groups, p<.05.[/foot] (see figure 1):

- Anticipate: The wrap intuits the customer’s need. Wraps that anticipate are predictive and proactive.

- Advise: The wrap supports evidence-based decision making. Wraps that advise provide data and insights that inform the customer.

- Adapt: The wrap meets the customer’s need in a tailored manner. Wraps that adapt are specific to an individual customer’s needs, environment, or context.

- Act: The wrap performs an action that benefits the customer. Wraps that act are integrated into customer processes or behaviors, or they trigger behavior automatically on the customer’s behalf.

Figure 1: Four Design Characteristics Associated with Useful, Engaging Data Wrapping

2018 MIT CISR Data Wrapping Survey (n=511). Launched wraps (n=242) were divided into low-performing and high-performing groups on feature measures. Means for usefulness and engagement were significantly higher in high-performing groups at the p<.05 level. The percentages reported in the figure reflect the striking differences between the low- and high-performing groups.

These four design characteristics are reflected in the wrapping of the CochlearTM Nucleus® 7 Sound Processor. This behind-the-ear sound processor was launched in 2017 by Cochlear, an Australia-based company that designs, manufactures, and provides implantable hearing solutions to customers globally.[foot]B. H. Wixom and R. Schüritz, “Creating Customer Value Using Analytics,” MIT Sloan CISR Research Briefing, Vol. XVII, No. 11, November 2017.[/foot] The sound processor’s SCAN Scene Classifier feature anticipates that an end-user’s hearing needs will require adjustments as the person changes environments through the day, and adapts to contexts, such as to a crowded street corner or quiet room. The feature advises the end-user of optimal settings through an app, and acts by automatically adjusting the sound processor’s settings to deliver the best hearing for the conditions. Cochlear had to establish new analytics and customer intimacy capabilities to enable all this functionality.

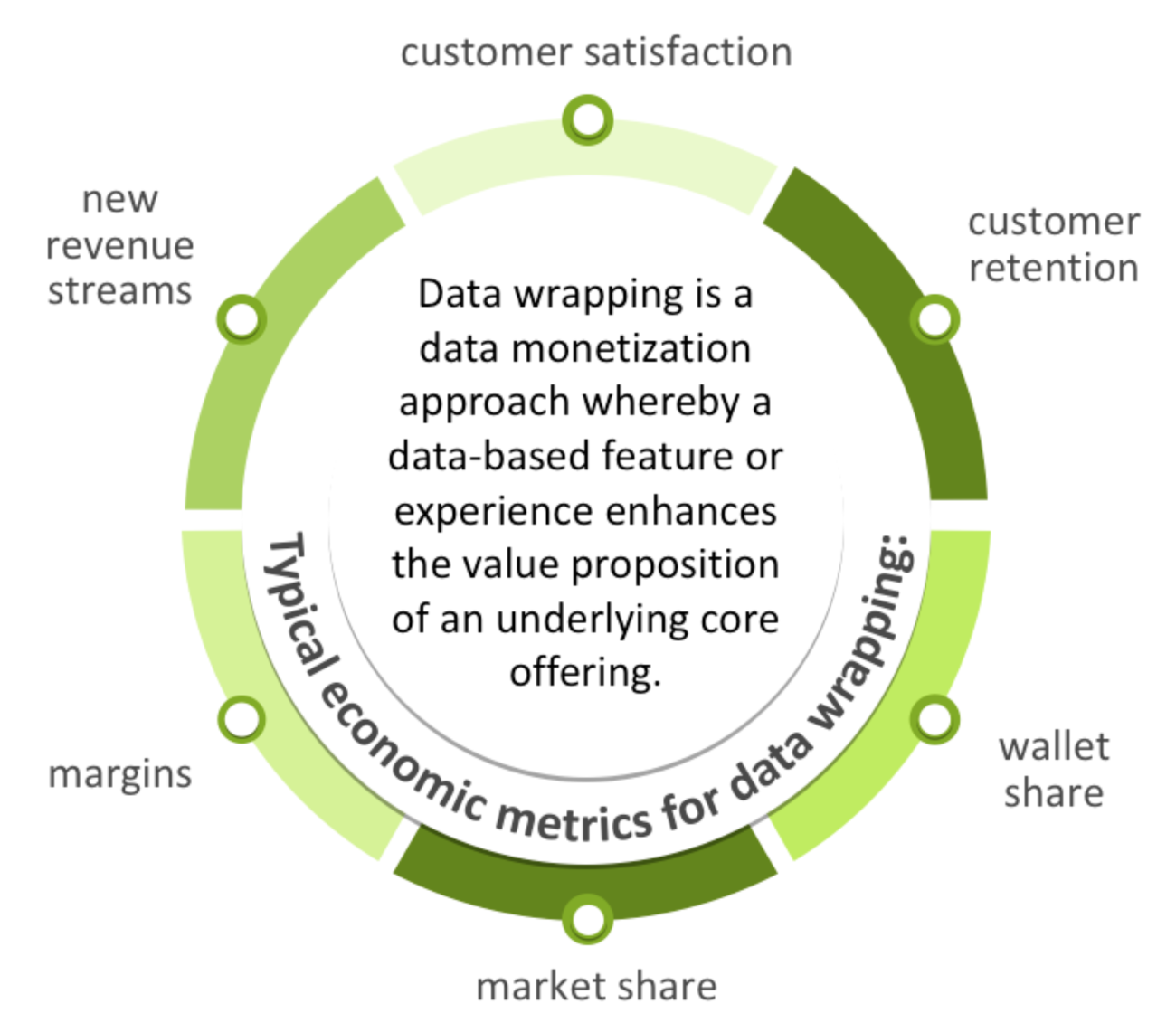

MEASUREMENT OF FINANCIAL RETURNS

Product managers generate data wrapping returns by increasing customer retention, wallet share, market share, core product margin, new revenue streams, and/or customer satisfaction (when customer satisfaction is quantified using NPS[foot]For more information on Net Promoter Score (NPS) see “What Is Net Promoter?” NICE Satmetrix.[/foot] or similar methodologies); see figure 2. However, because data wrapping’s impact on sales lift is indirect, measuring wrapping returns can be tricky.[foot]Our research indicates that in some cases, such as when a wrap is highly distinguishable from its product, a product manager may choose to charge directly for the wrap and then measure the fees the wrap generates. According to the analysis of sixteen interviews with professionals engaged in data wrapping as part of the 2017 MIT CISR Data Wrapping Study, this approach is not always desired, particularly when product managers want the end customer to view the product and its wrap as a holistic solution.[/foot] Our research discovered that top-performing product managers measure (and can report back on) how much value the wrap generates for customers—and for the company.[foot]2018 MIT CISR Data Wrapping Survey. Launched wraps were divided into low-performing and high-performing groups for charging directly, raising the price of the core product, selling more. High-performing groups reported significantly higher scores in measuring customer and company value, p<.05.[/foot] To do this, these product managers draw upon a portfolio of techniques, such as usage tracking, AB testing and controlled experiments, customer surveys, and pilot studies.

Product managers at one financial services company[foot]Source of company detail is one of the authors’ years of research with the company and anecdotes from classroom discussions of the case. The company described permits use of name in verbal discussion of the case but prefers anonymity in publications.[/foot] are great at this—they know what their top customers want and use data wrapping to please them in relevant ways. The product manager for one of the company’s affinity credit cards, for example, prioritizes wraps related to fraud management, which is a top concern for customers of that offering. In recent years, fraud management wraps for this card have included digital transaction statements that contain merchant logos and geospatial maps that reduce the time and effort it takes a customer to review their purchases; and email and text alerts when transactions suggest unusual activity, such as a tip amount that is disproportionate to the cost of a meal.

Figure 2: Common Metrics that Reflect Data Wrapping Returns

For more information about data wrapping, watch for the publication in Q1 2019 of an MIT CISR research report that will feature results from the 2018 MIT CISR Data Wrapping Survey.

The company’s product managers monitor how customers react to new wraps by conducting experiments that compare the recipients with control groups of customers that did not receive the new features, collecting attitudes from surveys (sometimes in the form of a quick sentiment poll offered via email or administered along with the wrap), and analyzing usage data from customers who use (or ignore) features on the website or mobile app. The company’s product managers further translate these customer reactions into impact on product sales; for example, the product manager of the aforementioned affinity credit card can report on how a wrap feature increases usage of the credit card (i.e., customer wallet share).

Companies that report wrapping more effectively than peers achieve an average return on investment of 122% from wrapping projects, versus 39% for those reporting that they wrap less effectively than peers.

THE BOTTOM LINE FOR FRUITFUL WRAPPING

It’s time to get serious about data wrapping. The first step is to recognize and appreciate data wrapping as a key source of your company’s data monetization returns. Then we suggest you evaluate the rigor of your processes for data wrapping design and value measurement. Companies that invest in and purposefully shape these processes to meet customer needs and be measured—activities that distinguish top performers—are more likely to generate fruitful data wrapping efforts that represent a win-win value proposition for the customer and the company.

© 2018 MIT Sloan Center for Information Systems Research, Wixom and Schüritz. MIT CISR Research Briefings are published monthly to update the center's patrons and sponsors on current research projects.

About the Authors

MIT CENTER FOR INFORMATION SYSTEMS RESEARCH (CISR)

Founded in 1974 and grounded in MIT's tradition of combining academic knowledge and practical purpose, MIT CISR helps executives meet the challenge of leading increasingly digital and data-driven organizations. We work directly with digital leaders, executives, and boards to develop our insights. Our consortium forms a global community that comprises more than seventy-five organizations.

MIT CISR Associate Members

MIT CISR wishes to thank all of our associate members for their support and contributions.