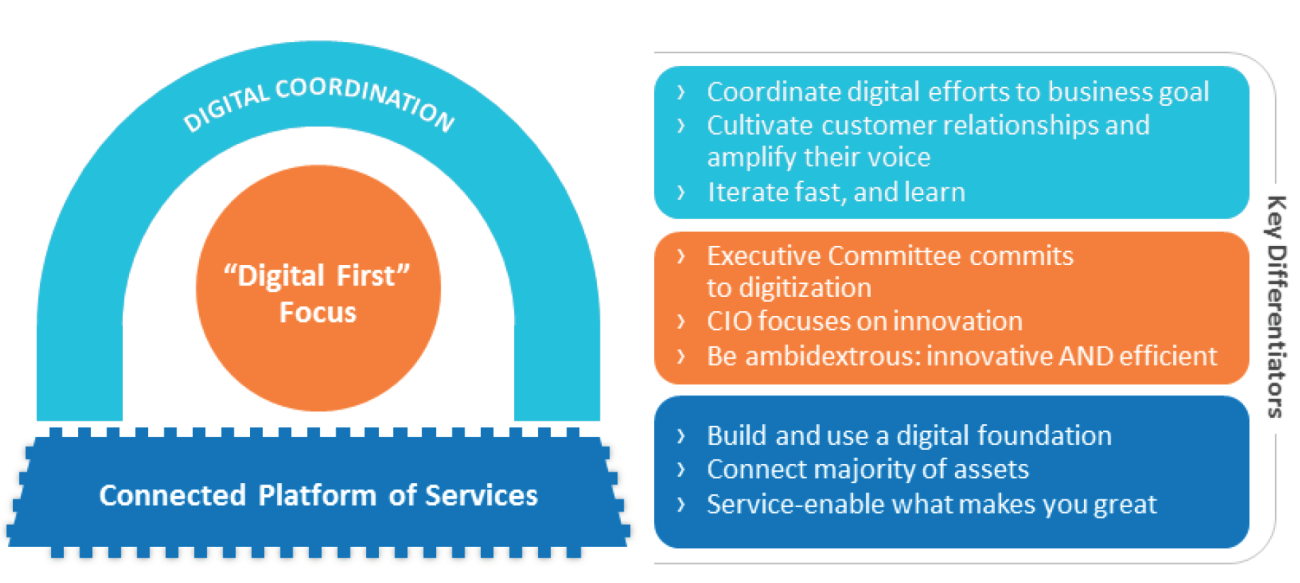

We define digital leaders as companies in the top quartile (relative to competitors) on a combination of profitability, innovation, and customer experience measures. In our survey of 413 companies globally, digital leaders exhibited seven times more innovation, three times greater profitability, and 38% better customer experience than the bottom quartile digital laggards.[foot]MIT CISR 2015 CIO Digital Disruption Survey, N=413. Profitability=% net margin, industry adjusted; Innovation=% of revenues from new products and services introduced in the last three years; Customer Experience=% customer experience effectiveness compared to competitors. Digital Leaders (Laggards) were top (bottom) quartile on the three measures. The “Key Differentiators” in figure 1 were significant in regression analysis against Digital Leaders (R²=0.42).[/foot]

What Differentiates Digital Leaders from Laggards

Digital leaders were statistically significantly different from digital laggards in three key ways that contribute to better performance (see figure 1):

1. Digital first focus: People at companies that are digital leaders think digital first—in all respects. They think every day about how digitization can improve their company’s customer experience, employee experience, and operations. It’s not just the CIO, CDO, or CMO focusing on digital, but everybody in the organization. And the contrast is stark: CIOs of digital leaders spend 52% of their time on innovation, while CIOs of digital laggards spend only 16% of their time. The result is that digital leaders are ambidextrous: they can innovate while cutting complexity, cost, and time to market.

2. Connected platform of services: Everything is connected in a digital world. Digital leaders build a digital platform, then identify their crown jewels—the specific capabilities that make their enterprise great—and service-enable them. For example, digital leaders API-enable 44% of their core capabilities so that external partners can connect to them. Digital laggards API-enable only 19% of core capabilities. Most of the digital leaders began by making their capabilities available via APIs internally. Digital leaders are now extending their platforms to include physical assets as part of the Internet of Things.

3. Digital coordination: Digital leaders coordinate all their digital efforts to meet a larger business goal—such as providing a multiproduct integrated customer experience—then iterate and learn from these efforts. In contrast, digital laggards—slow to invest or with a “let a thousand flowers bloom” mindset—struggle to monetize and coordinate their efforts.

In this fast-changing world, one important way to focus digital efforts is to amplify the customer voice inside the company. That’s everybody’s job. In digital leaders, the CIO/CDO spends 24% of their time engaging with and learning from external customers, while in laggards such spend is around 15%. Collaboration across silos within digital leaders allows them to offer customers a multiproduct, multichannel experience. And in digital leaders, the CIO/CDO coordinates with internal partners via budgets that locate 52% of enterprise digital spend in the IT budget (with its typically strong security and architecture requirements); laggards place only 35% of enterprise digital spend in the IT budget, and risk creating additional technical debt in the future.