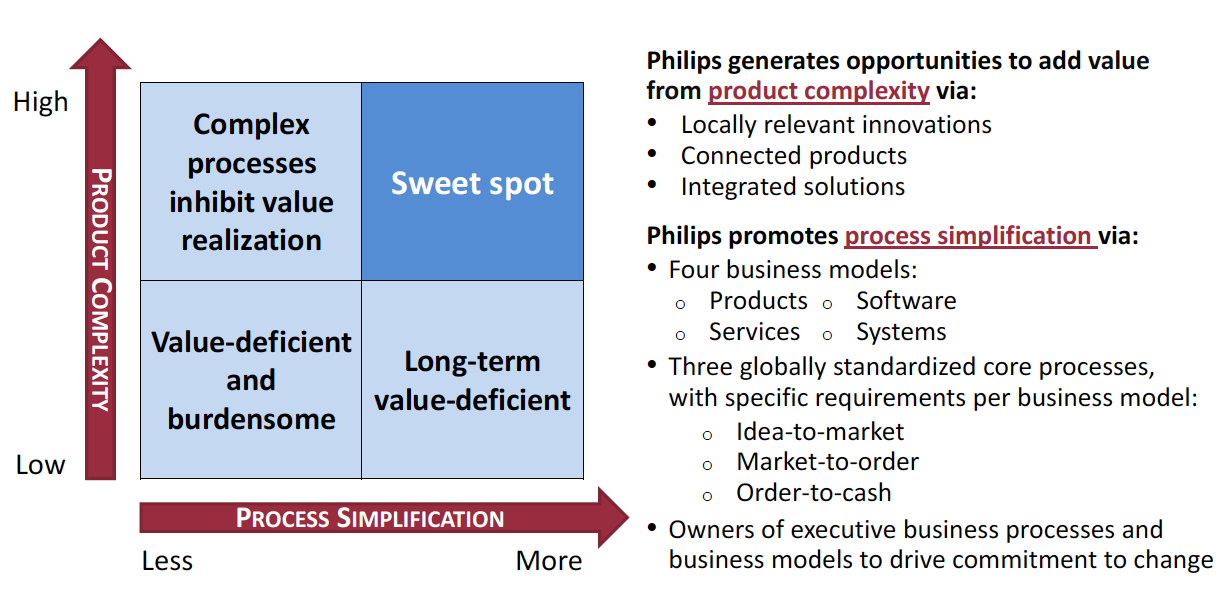

Philips addressed that challenge in part by identifying three end-to-end core processes: idea-to-market, market-to-order, and order-to-cash. In idea-to-market (I2M), an idea is turned into a product and brought to market, and the product’s lifecycle is managed. Market-to-order (M2O) concerns product marketing and the generation of sales orders. Order-to-cash (O2C) involves the processing of orders and includes fulfillment, distribution, invoicing, and payment handling. The intention was to standardize these processes plus supporting systems; accordingly, M2O processes were built to operate on a Salesforce.com foundation, and Philips had selected technology platforms for the other two processes.

It was clear, however, that selling an integrated healthcare solution to hospitals was not the same process as selling an electric toothbrush. So Philips defined four different business models: products, i.e., off-the-shelf products like shavers and MRI scanners; services such as providing training or maintenance; software, e.g., a web portal for doctors; and systems, or integrated solutions such as uniquely customized municipal lighting. Management distinguished the unique process requirements of each business model and assigned each of Philips’ sixty business categories to these business models.

Philips was building modular technology platforms to limit systems complexity while accommodating the differences in core processes across the four business models. A key element of the systems architecture was the “information factory” data platform, which would provide a central repository of master data apart from applications. Philips IT would then “plug and play” application modules from the public cloud, purchased packages, and custom systems. To avoid creating unnecessary variety in systems going forward, Philips adopted a “configuration instead of customization” principle.

Implementing the Change

Given Philips’ long history of independent process design, process standardization represented a significant change to people throughout the company. To win commitment to this change, the entire management team of each business participated in workshops to better understand its business model. Working from a generic list of around one hundred high-level processes used by companies with similar business models, workshop participants identified those few high-level processes that differentiated Philips from its competitors. The understanding was that all other processes would be standardized in accordance with common industry practices, with exceptions for local legal and regulatory requirements.

To anchor standardized processes organizationally, Philips added several roles. Each of the three sector leaders also served as Business Model Owner for at least one business model across all sectors. Business Model Owners were responsible for the design and implementation of all the processes associated with their business model. In addition, Philips also assigned Executive Business Process Owners (BPOs) for the I2M, M2O, and O2C processes to help define, govern, and enforce process standards across markets and business models. While Philips previously had BPOs, they were relatively low in the organization. Now, Executive BPOs were part of the Executive Committee, making end-to-end process improvement a leadership task.

Two years into Accelerate!, Royal Philips had turned around performance, but management was still in the throes of helping 115,000 employees understand the journey and change their behavior accordingly.